Yes. Before you can find the right answer, you need to know the right question.

Yes. Before you can find the right answer, you need to know the right question.

So it is with personal finance: most pf bloggers will answer a whole variety of questions:

– How can I become debt free?

– How can I pay off my credit cards?

– How can I save for retirement?

– How can I be more frugal?

BUT, these are not the questions that you need to be asking … at least, not at first.

No, there are only TWO questions that you need to ask. The first is in two parts, and it simply asks:

a) How much money do I need to support the life that I truly want to live? And, b) when do I want to begin?

I have a hypothesis about the typical answer to these questions, but the truth is that for every human being on this planet there is a different answer:

For some, it may be that they are happy doing what they are doing today, and are happy to keep doing it until they drop. For, them personal finance begins with maintaining their current lifestyle (which probably revolves around maintaining their employment) and staying healthy.

It probably also means learning all the lessons about personal finance that the blogosphere has to share: living below your means, eliminating debt, cutting up your credit cards, paying off your home, setting aside an emergency fund …

My second question – which I’ll come to in a moment – is moot for these lucky, satisfied, job-secure, working-class few.

But, my hypothesis is that most people are not satisfied with their current lifestyle … that you are not satisfied with your current lifestyle … that you:

– Want more time with your family,

– Want to indulge your hobbies and interests,

– Want to travel more,

– Want to be more relaxed and healthier,

… and, the list goes on.

And, I’ll wager that the limiting factor for you, right now, is money.

But, I’ll also bet that with a little thinking, you could come up with a salary that if a rich uncle were to pay it to you, would allow you to stop working full-time (or, altogether) and fund your ideal lifestyle.

I’ll also take a stab that ‘salary’ would bear little resemblance to your current salary.

But, if you can take an educated guess at what that ‘salary’ would need to be, I can tell you what your Number is (the answer to the first half of my first question) simply by telling you to multiply that amount by 20.

Let’s now assume that you have no rich uncle and have to amass this amount yourself …

How long will you give yourself to reach your goal so that you can begin to live the life you really want to live before you are too old to enjoy it?

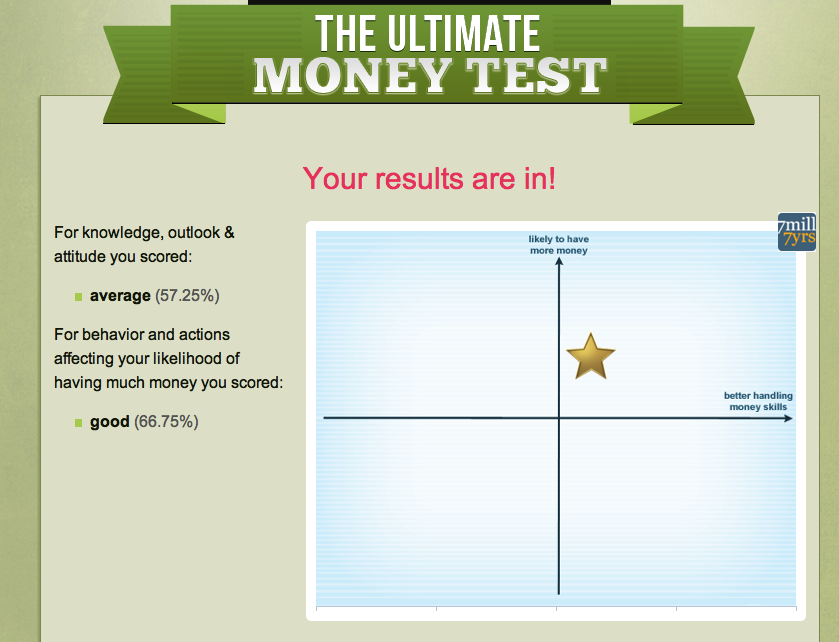

I gave myself just 5 years to reach my Number of $5 million; in the end, I made $7 million in 7 years, starting $30k in debt.

[AJC: keep in mind that the longer you allow to reach your Number, the larger it will need to be because of the effects of inflation. For example, whatever Number you come up with today, you will need to add 50% if you aim to reach it in 10 years, and you will need to double it if you are prepared to wait 20 years … just to keep up with inflation.]

Which brings us to the second most important question in personal finance:

How am I going to get there?

For example, in order for me to reach a $5 million target in 5 years from a virtual standing start:

– I had to learn how to invest (I had no investments and no idea HOW to invest or WHAT to invest in)

– I had to turn my business around (it was breaking even, at best)

– I (more importantly, my family) had to sacrifice our existing life: we had to move overseas, my wife gave up her career, my children their friends, we all gave up our families for the 5 years we were away from home.

But, we all agreed that it would be worth it, because we had already answered the first question (both parts).

How about you?