As you have no doubt worked out for yourself paying yourself twice is in itself just a stepping stone to financial success.

Let’s just quickly recap for new readers:

The likes of David Bach (The Automatic Millionaire) like to tell you that you needn’t do much more than ‘pay yourself first’ (i.e. save) 10% – 12.5% of your gross salary in order to live an idyllic life (well, at least retire well) … going so far as to call this “A Powerful One-Step Plan to Live and Finish Rich”.

The reality is that this is actually a dangerous financial strategy to pin your financial future on.

Whilst the idea of saving money is to be commended – in fact, saving is absolutely necessary – the sad reality is that you would need to pay yourself first 75% of your gross income, starting now and continuing for the next 20 years, just to maintain your current standard of living in retirement.

Clearly, my solution – which is to Pay Yourself Twice 15% of your gross salary – does little to bridge the gap.

Of course, it’s what you do with the money that counts:

I assume that your current ‘pay yourself first’ savings are going into some sort of employer sponsored, tax-advanatged retirement plan …

… which we already know cannot possibly be enough to support your current lifestyle in retirement, let alone set you up for that hammock in the Bahamas with free flowing Pina Coladas that you crave 😉

However, I do want you to keep your retirement fund going – and growing – because it is insurance, if all else fails.

But, it’s the “all else’s” that will make the difference between an austere retirement in 20 – 40 years or a certainly more memorable (and, very early) retirement with $7 million in 7 years … or a happy medium, if that’s more your speed.

And, that’s why you need to Pay Yourself Twice:

– Once to maintain this insurance policy, and

– The second time to build your investing war-chest.

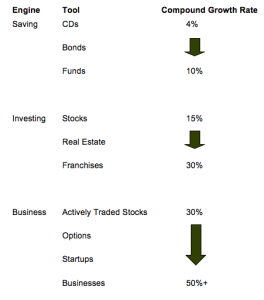

If the power of compounding at bank to mutual fund rates of return (i.e. 4% – 10%) is not sufficient, then it stands to reason that you need to start investing at (much) higher compound returns.

This means building up a modest starting capital amount and ‘rolling the dice’ with higher risk / higher reward investments e.g.

A few minutes with a good compound growth rate calculator will (a) confirm how well your current strategy is doing against your desired retirement needs, and (b) tell you how deep into the above table you need to dive to bridge the gap.

It goes without saying – so, I’ll say it anyway (!) – that I hope that you all succeed with your investments, be they in stocks, real-estate and/or businesses. However, if you should fail … well, by continuing to Pay Yourself Twice, it won’t take too long to build up enough starting capital to have another go.

And, it might take one, two, five times before you are successful …

All the while, you have a 20 year backup plan (by also continuing to pay yourself first) just in case 😉

I am sorry but the returns I see on businesses and franchises and active trading seem too high.

Are these best case scenarios? Because you know 80% of new businesses fail in the first 3-5 years of establishment. Also, 95% of active traders lose money over a similar time period, if not shorter.

We all hear about startups like LNKD making their founders millionaires. But what about the startups that fail – and there’s plenty of those around.

However, I do agree that ownership of businesses, whether through direct investment/management or by buying stocks, is the main way to generate wealth in the US.

@ Blogging – None of these returns account for failures. We have all just lived through periods where stocks and even CD’s and bonds returned zero-to-negative returns.

The numbers seem high, but – as you move down the table – you are able to utilize the power of leverage more and more e.g. margin lending your stocks, the built in 10x leverage of options, the leverage of staff for businesses, and so on.

So, yes, a 50%+ compound growth rate for a SUCCESSFUL business (one that can be scaled and sold) is certainly reasonable.

Pingback: If you were interviewing me …- 7million7years

Pingback: Another reader question …- 7million7years

I also am a multimillionaire and stumbled on this blog tonight, does anyone here actually OWN a franchize like a taco bell, Dunkin donuts, or Panera Bread? Are they any good? I have a lot of capital to invest but i need a place to park it that is NO investment of my time, my time is strapped out on other things right now. please comment?

Pingback: Pay Yourself Twice « Wealthymatters

Pingback: 7 Million 7 Years – Best of the Best Blogger Series