Interesting video … amazing lesson.

Did you download my Little Free Book? Did you like it? Did you pass this link on ( www.littlefreebook.com )? Hmmm ….

I love YouTube 🙂

Interesting video … amazing lesson.

Did you download my Little Free Book? Did you like it? Did you pass this link on ( www.littlefreebook.com )? Hmmm ….

I love YouTube 🙂

Not many people are rich, so following COMMON financial wisdom can’t be all that it’s cracked up to be, can it?

Not many people are rich, so following COMMON financial wisdom can’t be all that it’s cracked up to be, can it?

Case in point: paying down your mortgage is a subject that always gets a rise out of my readers.

I see it very simply:

If mortgage rates are currently 5%, what investments can give you 5% + whatever margin you feel you need to compensate you for risk?

How ‘risky’ is that risk? And, what do you stand to lose?

Some people, like Executioner, look at the 100% risk/loss scenario:

Although I’ll concede that it is unlikely that a broad index fund would ever drop to zero, it’s not outside the realm of possibility.

Sure, it’s not outside the realms of possibility, but has it EVER happened?

What’s the worst 30 year return that the stock market (as represented by, say, the entire S&P500), a basket of ‘blue chips’ (say, Coke + Berkshire Hathaway + GE + IBM etc.) have returned, or any solid piece of real-estate (be it residential or commercial)?

I’m betting that it’s not zero … not, by a long-shot!

But, maybe the rules have suddenly changed?

Neil thinks so, at least when it comes to house values:

House appreciation used to be a sure bet, but it isn’t any more.

But, I can’t help wondering … we used to say: “the market is going UP, blue sky everywhere … the rules have changed, it’s going to keep going UP”.

And, that thinking, of course, lead to ridiculously high valuations of both stocks and RE … and, a correction had to come.

And, it did. Big time!

Now, we seem to be saying: “no 8% returns for next 30 years [Executioner]” or “House appreciation used to be a sure bet, but it isn’t any more [Neil]” … “the risk/reward balance is different now [I made this one up]”.

So, I can’t help wondering:

If this is really the case … if things really weren’t different BEFORE (i.e. the market couldn’t keep climbing) are they really different NOW (or, can the market really keep falling?) …

… or, are we just guilty of doing more ‘rear mirror’ personal financial management?

I can’t give you the answer … only 30 years of ‘future history’ can do that!

But, if things haven’t suddenly changed PERMANENTLY – if the fundamental principles really haven’t changed – then, isn’t a ‘down market’ a GOOD time to buy?

Or, is that just the way that Warren Buffett thinks?

And, I know one which side of this coin I’ll be betting on 😉

6 million+ views, now that’s how to build a brand … here’s a lesson in viral-marketing for you: http://www.hoax-slayer.com/walking-on-water.shtml

I don’t think that I ever mentioned it at the time, but I went to Warren Buffett’s Annual General Meeting in Omaha in 2008.

I don’t think that I ever mentioned it at the time, but I went to Warren Buffett’s Annual General Meeting in Omaha in 2008.

It was like going to a rock concert … without the music.

It was held at some football stadium, which was packed with 30,000 (maybe more?!) people and Warren Buffett and his long-time business partner, Charlie Munger sitting at a table with three large video screens behind them (just showing Warren and Charlie sitting at the table … only MUCH larger!).

They basically spent the day munching on Sees Candy (peanut brittle, I believe) and sipping on Coke …

Warren invites all the ‘international visitors’ [AJC: That’s anybody who registers with a foreign passport as their ID … I have a US driver’s license, of course, but I heard that there were ‘extra benefits” to registering using international ID] to a meet and greet.

This meant bringing anything that you bought from his trade show in the huge conference hall attached to the stadium (he has stands from a number of the 70+ businesses that he owns) and he and Charlie will shake your hand and sign it one item that you bought.

But, he stopped doing that – after 2008 – because there was a line of 1,000+ people waiting to shake his hand and get their signature. I know this, because when I got to him, the World’s Greatest Investor spoke to me!

He said (looking visibly paled): “Are there many more people in this line”. Sadly, I had to say there were …

Still, I got my $5 T-shirt signed, and had it framed with a couple of Warren Buffett and Charlie Munger playing cards (!), a couple of pictures that I printed from a web-site after googling “warren buffett”, and my round official entry badge.

Still, I got my $5 T-shirt signed, and had it framed with a couple of Warren Buffett and Charlie Munger playing cards (!), a couple of pictures that I printed from a web-site after googling “warren buffett”, and my round official entry badge.

Which has nothing to do with anything other than Bill McNabb – who replaced the famous founder of Vanguard (with their famous, low-cost Index Funds), John Bogle, who also seems to afford ‘rock star status’ with fans of his investing philosophy (which, naturally centers around buying and holding Index Funds) calling themselves Bogleheads and acting more like rockstar groupies than investing disciples – recently said that one “essential ingredient” in the investing and advice business, is:

Simplicity, which is exemplified by the “Five-Minute Rule” first coined by Richard Ennis of the pension consulting firm Ennis, Knupp: “If you don’t understand the thesis underlying an investment in five minutes or less, take a pass.”

This equally reminds me of a recent story of a company that a friend of mine was CEO of that existed solely to build, manage, and sell tax-advantaged agricultural ‘investments’:

Basically, this company did complex deals with rural land-owners, farmers, and so on to plant certain crops and sell shares to private investors; the advantage to the investors being (a) immediate and attractive tax-deductions, and (b) future (i.e. 10 to 30 year) capital returns … trees take a LONG time to grow!

Given that one friend was their CEO, another one of their key operations directors, and a third an enthusiastic ‘professional’ (counting, amongst others, my wife as his client) who positively represented the project to a number of my affluent friends who were also his clients, you may ask how much I invested in the company.

The answer is ZERO.

You see, I don’t invest in anything:

1. That eats or grows (because eventually it will stop eating, stop growing, and will die),

2. Uses tax-advantages as one of its key features (because I don’t mind paying my fair share of tax and governments have a sneaky habit of changing the tax rules),

3. Because of the 5-minute rule (if I don’t IMMEDIATELY understand it, I don’t buy it … and, truth be told, I don’t IMMEDIATELY understand much).

Postscript: because of the Australian drought, many of the trees did die, and the government did change the tax rules, and the company did go broke … and, many of my friends did lose 100% of their investment.

And, I still don’t understand the business 5,000,000 minutes later 😉

It occurs to me that, at the age of 49+, that I still like Vegemite, that quintessential Australian curiosity very loosely labeled as ‘food’.

It occurs to me that, at the age of 49+, that I still like Vegemite, that quintessential Australian curiosity very loosely labeled as ‘food’.

If you don’t know what Vegemite is, let me give you a few brief ‘highlights’:

– Vegemite is a salty black spread that is best used VERY sparingly on toast or dry crackers;

– Aussie children are almost weaned on it … it’s the only way to learn how to like it!

– It’s predecessor is Marmite, an English product derived from animal fats;

– Vegemite, on the other hand, is made from the sludge left over from pouring beer out of its vats (really!)

– It used to be fed to pigs, because of its very high Vitamin B content, until an Australian Food Scientist discovered how to refine it slightly and feed it to children [kids = pigs?]

Even though I actually LIKE Vegemite, I can understand that to most people it is totally inedible:

I met a food scientist who was working on a project to create Vegemite cookies to help feed the less-fortunate in Africa (again, because of its super-high Vitamin B content); this came on the back of the very successful Milk Cookie project which helped to bring Calcium to places (like Africa) where the shipping and transport of dairy products would be just too difficult.

Unfortunately, they had to cancel the project … there was just no way to make the Vegemite cookies taste good!

Now, I can actually relate to how bad this stuff must taste to others (yet tastes so good to me … in moderation!) because I was traveling to Amsterdam and in the clothing store (that I stopped by to buy a hat and scarf for the bitterly cold winter weather) there was a jar of candy on the counter …

… actually, it was liquorish – so, I took one and almost spat it straight out … it was THAT horribly salty! Apparently, it’s a delicacy in Holland on par with Vegemite (and, as bad tasting to the uninitiated).

One man’s food it definitely another man’s poison.

But, to get an idea as to how popular Vegemite really is – despite the taste (!) – here are three anecdotes for you:

1. Kraft bought the rights to Vegemite at some point, and if you visit their offices in Northbrook, Illinois (as I have) you will see its logo displayed very prominently on the wall above the receptionist’s desk. Not bad for a product only sold in a country of 20 million people (and, stocked in the USA almost purely for visiting Aussies).

2. Vegemite is inherently kosher (apparently pig food isn’t as unkosher as pigs-as-food) , but when Kraft decided to cut costs and take it off the kosher list (meaning that religious Jews in Australia could no longer buy it … a very small minority, in a very sparsely populated country), there was such an outcry that Kraft had to certify Vegemite as kosher again.

3. When we came to America, we brought 6 huge jars with us (and, brought more back on every trip home); this is not just us: my wife accidentally met a girl who was also relocating to Chicago … they were both at the supermarket checkout with a few of these large jars and (naturally) got talking.

So, what?

Well, there is a personal finance message and it’s this: one size doesn’t necessarily fit all … what one person likes may not suit the other at all.

That’s why when Steve asked me why I recommend that you put aside 2 year’s living expenses in retirement (as opposed to zero dollars before retirement) in your ’emergency fund’, I can’t really disagree when he says:

Adrian, what you said makes sense in most cases I suppose, but ,each case /person will have different circumstances ,even after retirement.Some sort of funds set aside seems a wise move.You cannot fore see very situation that might arise,especially at an advanced age.

So, yes I agree that there is no magic in the 2 years’ number: put aside 1 year, 18 months, 2 years, or more …. I don’t really care!

And, does it really matter whether you meet the 20% Rule or make it, say, 15% or 25%?

Probably not …

BUT, the principles behind these rules – indeed, the whole methodology that I am slowly unfolding in these posts (in the random, shambly way that bloggers like to follow) – is One Size Fits All.

Why?

Because the principle is simple: Find out how much you need to make (and why and by when), then work out how hard you need to work (financially) and how much risk you need to take to get there, then go for it!

But, if you stray too far from the the guidelines that I provide, the chances are that you will not be investing enough to make any sort of meaningfully large Number by any reasonably soon Date.

Second guess the Been-There-Done-That Multi-Millionaire who has a passion for sharing his hard-won personal/financial experience at your peril 😉

–

It’s true, I am the ultimate Secret Blogger …

It’s true, I am the ultimate Secret Blogger …

… only two of my closest friends even know that I do blog – about personal finance – but, I won’t even tell them the name of my blog or my ‘pen name’!

[AJC: By now, you probably know that Adrian John Cartwood isn’t my real name – only the Adrian part is. For no reason that I can understand, my daughter started calling me ‘Adrian John Cartwood” when she was 7 … well, when the idea to write this blog sprang to mind in 2008, AJC was the natural choice!]

It’s not comfortable to talk about money: but, I resolved from Day 1 that this blog would need to be authentic and I would have to share the most gruesome details of my financial life.

So, when Bob asked:

From your “I’m a money hacker” post:

What is some financial advice you could give our readers?

Most people don’t really know how much house they can afford, so let me give your readers some very specific advice that will help them through every stage of their own financial journey: never have more than 20% of your Net Worth invested in your own house…

Do I understand from this post that $5M of your $7M net worth is in your own house?

… I can, from a position ‘protected’ by semi-anonymity, remind our readers that my $7 million journey represents a 7 year ‘slice’ of my financial life from when I started $30k in debt in 1998 and ended up with $7 million in the bank in 2004.

My recent ‘bad beat‘ post talks about what happened between 2008 and now 🙁

But, the years in-between (i.e. 2004 to 2008) were very kind to me: dominated by a series of sales of my Australian, New Zealand, and US businesses to a UK public company … it was almost literally raining money for those years.

But, this is a personal finance blog, not a business blog, so I concentrate on the $7m7y because I believe that is repeatable by almost any of my readers.

Even so, my $5 million (cash) house certainly breaks the 20% Rule (my net worth would need to be $25m+) but, it doesn’t matter!

You see, the 20% Rule only applies when you are still chasing your Number!

When you have reached your Number (Making Money 301), THE RULES CHANGE:

Remember when you calculated your Number?

You:

1. Took your required annual living expenses (of course, adjusted for future inflation until your chose ‘retirement’ Date) and multiplied that by 20, and

2. ADDED in the value of your house (plus any additional cash required to pay off the mortgage), initial cars, and any other one-time purchases.

Once you reach your Number, you no longer require 75% of your Net Worth to be in investments: you ‘only’ require the amount that you came up with in Step 1.

So, you can buy as much ‘stuff’ (houses, vacation homes, cars, etc.) as you like with any extra cash that you happen to have!

For me, it doesn’t really matter how much house I bought, as long as I still have >$5m in investments, generating my annual living requirements.

So, Bob, you don’t have to worry about me … yet … I just like to complain 🙂

The current state of American financial thinking is terrible, if this is the best advice that “a senior editor with Money Magazine” can come up with:

Question: I’m 28 and would like to have $1 million by the time I retire at 65. What are some of the investing options I should consider? –Joshua Sin, Fresno, Calif.

Answer: I’m all for savvy investing, and I’ll get to what I think you should do on that front in a minute. But let’s not forget that when it comes to building wealth, investing alone won’t do it. –Walter Updegrave, Senior Editor, Money Magazine.

Walter Updegrave, the author, then goes on to provide a very interesting analysis of how to come up with the $1 mill by 65 – basically saying that it can’t be done:

If you begin putting away $100 a month starting now and continue doing so until 2047, the year you’ll turn 65, you would need an annual return of roughly 13.5% a year to turn that monthly hundred dollars into a million bucks.

What investment options can deliver a 13.5% annual return for almost 40 years? None that I know of.

True. Correct. Perhaps, Insightful.

But, I’ve said it before and I’ll say it again: who in their right mind cares?

Hasn’t Walt forgotten to ask the key question … why???!!!

Joshua is to be commended for thinking so far ahead, at the age of 28, towards retirement. But, shouldn’t our financial expert’s first step be to examine if the objective is reasonable?

Let’s give it a shot:

Choosing a much more reasonable go-forward inflation rate of 3.5% …

[AJC: The author assumed “a modest 2.5% inflation rate”; that’s just UNDER the current outlook for the next 5 years, pulling out of a major global recession … but, I wouldn’t bet FOR a 40 year recession, if I were planning my own retirement!]

… by the time Joshua turns 65 that $1 million will only be worth $268k.

What does that mean?

It depends on what Joshua does with the money; however, given that his 37 year financial strategy has been simply to ‘save’ (presumably via CD’s, Bonds, Mutual Funds, and the like), I guess we need to assume that he will continue that strategy in retirement.

Therefore, Joshua will have little choice but to abide by the ‘advice’ of the financial planning community, which will be centered around finding a ‘safe withdrawal rate’; a great way to find out what that might be for Joshua, is to plug his $268,000 nest-egg into the T. Rowe Price Retirement Calculator:

Now, what annual income would be reasonable for somebody like Josh to aim for in retirement? $150k a year? $75k a year?

Let’s just say that he aims for $30,000 a year or $2,500 (before tax!) per month in today’s dollars; how well does he do with his $1,000,000?

Not very:

[AJC: PLUS whatever social security there may happen to be in 37 years time … how optimistic are you?!]

Do you think that Josh would have been more surprised to learn that:

a) he would need to average 13% p.a. on his savings to reach $1 mill, or

b) even if he made it all the way to his $1 mill. target, he would only have $871 per month to spend?!

Our readers represent a small but keen-to-learn cross-section of people interested in the subject of personal finance; let’s tell the financial services, advice, and publishing industries:

What sort of financial advice are you looking for?

Go ahead, leave a comment – especially if you’ve never done so before – and, we’ll challenge them to respond!

PAY CLOSE ATTENTION TO THE NARRATOR’S INSTRUCTIONS!

After you’ve seen the video, read on:

I said that if I found a video that was a real cracker, I would do one of my famous-in-my-own-lunchtime Videos on Sundays …

… well, I found this one on Youtube.

In fact, it’s the exact same video that I used to show students of our training division (before I gave it away to my ex-business-partner).

If you want to learn about WHY this works and HOW you can use these concepts in your own marketing, read Ramit Sethi’s spot-on post:

But, first be sure to let me know what you thought of this video!

I have to admit that it’s very exciting seeing my two real-estate development projects coming to fruition [AJC: this is the architect’s rendition of just one of my two condo projects … click on the image to enlarge it … go ahead … do it … I’ll love you for it].

I have to admit that it’s very exciting seeing my two real-estate development projects coming to fruition [AJC: this is the architect’s rendition of just one of my two condo projects … click on the image to enlarge it … go ahead … do it … I’ll love you for it].

I’ll get back to that in a sec’ …

… first, let me tell you about a conversation that I just had with a friend, while we were playing poker today:

FRIEND: Do you find any parallels between business and poker?

AJC: It’s uncanny, but yes I do … and, it’s caused me to totally rethink the way that I think about money

Well, not so much ‘totally rethink’ as remind me about some important Making Money 301 lessons that I seem to have forgotten …

…. but, I keep getting side-tracked; back to the poker:

Case in point: I had quickly tripled my starting stack in a cash game but, just as quickly lost it on a series of bad beats; bad calls (by them, not me); and bad luck.

When you’re running hot, you feel invincible.

When you’re running cold, nothing that you do turns out right.

… and, your poker bankroll quickly slips away.

Well, it’s pretty much the same thing in business and personal finance:

Your investments and/or businesses are ‘on fire’ … the market’s running hot, and – if you’re smart – you cash out at the peak, building up quite a bankroll.

Maybe you even reach your Number.

What should you do then? STOP and smell the roses!

But, the trouble is, greed and the adrenalin kicks in … you believe that you’ve got the Midas Touch. And, you push for the next project.

… and, that’s the one that gets you.

You know, market downturn, bad luck, bad advisers, etc., etc. sob, sob, sob.

Which is, perhaps, why Ill Liquidity asked me:

I don’t get it. You make a tidy sum and retire from the rat race, paying yourself a salary… why go forth and try new money making ventures?

Given my own ‘stop and smell the roses’ advice in that regard, I agree, it’s hard to understand. Sometimes, it’s even hard for me to understand 😉

So, let me take a stab at explaining it; the story so far:

I made my $7 million in 7 years (mainly through reinvesting the profits of my businesses into buy/hold real-estate), and then made a heap more (by selling those businesses just before the 2008 crash), but ….

… then the crash hit, and here’s where my money went:

1. $1.5 million cash into my house in the US (you know I can’t sell that, right?)

2. $5 million cash into my house in Australia

3. 25% of what I sold the businesses for in taxes [AJC: sheesh!]

4. Lost 100% of my $3 million bonus on company stock price crash + taxes paid on the full $3 million [AJC: double sheesh! … but, it’s nice to know that I have a heap of capital gains tax credits to use for the rest of my life]

5. Gave my accountant $1 million to invest in the Aussie stock market for me … he promptly lost 75% in about 6 weeks. My fault for trying to time the market, not his 🙁

Don’t feel too sorry for me: when others try to get to sleep by counting sheep, I count millions!

Don’t feel too sorry for me: when others try to get to sleep by counting sheep, I count millions!

My problem is this:

All of this bad luck and bad management has left me with assets – not including my $5 million primary residence – that I consider just enough to live my Life’s Purpose.

But, I am an über-pessimist and I really want a large margin for error.

Now, in my rational moments, I realize that my house provides me that i.e. as soon as the kids move out, in approx. 10 to 15 years, we will sell down into a, say, $2 million apartment, which would free up another $3 million (all in today’s dollars, but the price differential should still hold true).

But, even that’s not good enough for me.

So the question that I am wresting with – and, have decided to put off answering until I have building permits for both projects in my hands:

Will I take my own advice and sell both development sites (with permits) for a tidy profit (if all goes well), or will I pull the trigger and dump most of my net worth into these developments to get the Really Big Bucks?

Only time will tell … but, you will be amongst the first to know 🙂

In the meantime, have you suffered any ‘bad beats’ lately?

Take a look at the chart on the left … yes, the one that I’m busy drawing for you 😉

Take a look at the chart on the left … yes, the one that I’m busy drawing for you 😉

… because, if you’re in business – or aspire to be – whether online or offline, this is a lesson that you simply have to ‘get’ … and, early:

For those of you who have been to business school, there is a space between the sales [blue] and expense [red] lines called PROFIT.

Profit is for growing the business and returning value to the shareholders.

But, in a small business it’s mostly known as OWNERS’ SALARY, because the owners live off this instead of taking a wage … and, it’s usually (barely) enough to fund their ever-growing (assuming the business is becoming more and more successful) lifestyle.

Instead, it should be known as CAPITAL.

You see, large businesses (particularly publicly listed ones) find it easy to raise capital: they simply issue stock.

They trade bits of paper (stock) for more bits of paper (cash) to go ahead and do all the things they need to do in order to expand their businesses (e.g. buy new machinery, open new branches, fund acquisitions).

But, small business owners can’t do that … it’s very hard to raise money as a small business owner, for anything … including expansion.

So, my advice is to fund your own expansion, by retaining profits (instead of spending them on yourself) and using those retained profits to grow the business.

There’s your capital!

Fellow Aussie and business/success coach, Jon Giaan (knowledgesource.com.au) similarly advises aspiring business owners:

When starting a business, most people focus on generating income and lose sight of their long-term goal of having a successful and ‘sustainable’ business that will provide freedom, independence, wealth and support many years into the future. Keep focused on building a long-term asset.

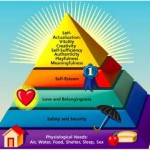

No doubt this is true; Maslow’s Hierarchy puts food/shelter/clothing right at the top …

No doubt this is true; Maslow’s Hierarchy puts food/shelter/clothing right at the top …

But, once your business has grown to supporting those needs, your mind starts to look at wants, and before you know it, you NEED your business just to survive mortgage payments, expensive car leases, private school/coach/country club fees, and the list goes on.

Right from the beginning, we had a different view, one that saw the owners of an [eventually] profitable business jointly deciding that the partner not working in the business – my wife – still needed to work her $60k – $90k per year ‘day job’ (as an IT Project Manager with a major telco).

The reason was exactly as Jon says: we wanted to keep “focused on building a long-term asset”.

We knew that it was only by reinvesting the cashflow produced by the business – both within (reinvesting in the business) and without (buying good quality buy/hold real-estate and other investments) that we would eventually reach our Number.

[AJC: Right there, in a nutshell is how we reached $7m7y: use the cashflow from the business to invest instead of spend. A side benefit being that we didn’t need to rely on the ongoing success and/or sale of the business to reach our Number. Too easy, huh?]

In fact, we eventually blew our first $7m7y out of the water … but, that’s a whole, other story 🙂