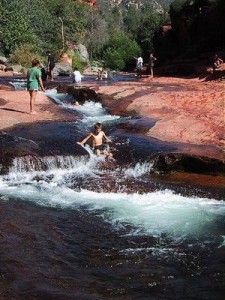

We were driving through Sedona and stopped into some sort of Big Box Store to pick up some rubber beach shoes so that we could take the kids to Slide Rock.

We were driving through Sedona and stopped into some sort of Big Box Store to pick up some rubber beach shoes so that we could take the kids to Slide Rock.

We met a nice, older lady at the checkout and – as I tend to do with anybody and everybody – we got chatting.

Then she said something that took me totally by surprise:

She said that she moved to Sedona now that she is retired!

Retired?! Hang about, I thought, isn’t she standing at the cash register swiping my credit card?

Perhaps, reading my mind (more likely, the expression on my face), she clarified: she moved to Sedona when she retired from full-time work, and now that she is ‘retired’ (there it is again!) she only works part-time.

Why is that when you are studying – or perhaps slowly returning to the workforce post-parenthood – you are happy to tell your friends that you are “working part-time”.

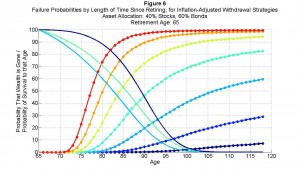

But, when you reach 65 and suddenly find that you still need to work (perhaps with reduced hours, or in some sort of micro-business that you set up for yourself) you are “retired” or you are in that even less definable state of “semi-retirement”?

In fact, there are whole websites and books devoted to the subject of semi-retirement. One of those books is “Work Less, Live More” by Bob Clyatt; I bought it on the recommendation of Jacob from Early Retirement Extreme (he left a comment on this post) … I’ll be commenting on one specific aspect of this book (in fact, the very aspect that prompted Jacob to recommend it to me ) in an upcoming post.

In the meantime, Bob did confirm that I am not retired … I am semi-retired.

According to Bob, I am semi-retired because I do various income-earning activities: I still own a business; I own two development sites (and, am going though the process of having development plans approved by council); I have started an angel investing incubator (or, at least, started to put the foundations in place); have a web 2.0 startup and a book well under development.

But, if I am doing these things because I am a hobbyist, am I any different from the guy who is game fishing every other day as a hobby?

But, if I am game fishing every other day because I need the income (e.g. I take some paying clients out on my boat, or I sell the fish), am I any different to the guy who needs to have a part-time business – or blogs – because he needs the money?

In other words, isn’t the difference between working part-time and being semi-retired the need to bring in income from the activities that you undertake?

Doesn’t that change the dynamic just a little?

Even though he may enjoy the core activity, isn’t the part-time game fisherman who needs the money a little bit more upset when a trip is canceled due to bad weather (or customer cancelation) than the guy who is doing it purely because of his love of the sport?

Whether you agree or not, let’s at least agree on something … at least for the purposes of this blog:

1. If you are retired, you don’t need the money – you just do stuff for fun.

2. If you need the money, you aren’t retired, you are [insert activity of choice: writing a book; blogging; game fishing; real-estate developing; etc.] part-time.

The day that I need to consult to top up the income from my investments is the day that I am no longer just having fun: I’m working part-time.

Maybe we can coin a new term: flexi-working? Semi-working? Whatever you call it, there ain’t no retirement happening …

How about you? Where do you draw the line between work and retirement? And, does it even matter?