How do you put a price on security?

How do you put a price on security?

Well, in this post I’m going to try and do exactly that but, first MoneyMonk asks the question that all people have at the back of their minds:

As a woman, I just want to say that “to each it’s own” Women love security.

If you are not a person that love investing, and you have the cash to pay off your mortgage (considering that you plan to live their forever)

Adrian- not everyone is business oriented. Some just don’t have the business acumen to run a business. Therefore, that group SHOULD pay off the mortgage

This is the dream of home ownership: own your home outright and you have nothing to worry about.

But, do you?

Let’s say that you own a $150,000 home today … what will it be worth in 30 year’s time?

About the same as a $150,000 home today, but in future dollars!

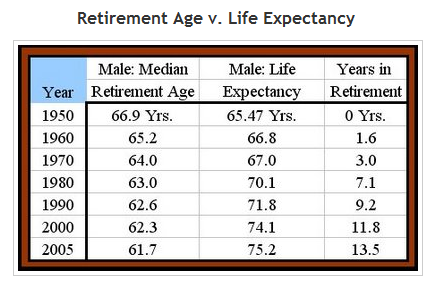

So, let me ask you; when your kids grow up, move out, and you retire, what are you going to move into?

Probably the same, or another $150,000 home … a smaller condo or newer townhouse that will probably not give you too much change, if any, from $150,000, a retirement home that (with fees) will cost you far more than $150,000.

Your home is not your financial security; your realizable net worth is. Put it another way: you can’t live off your home, but you can live off your cash and investments.

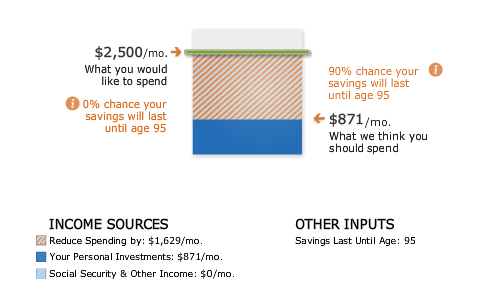

True security comes from knowing that you can pay your monthly bills for the rest of your life, without needing to work or get handouts from friends, relatives, or the government, through up markets and down (war, pestilence, and other Acts of God aside).

I hope that you see my point …

So, let’s look at two scenarios for a $150,000 house that you just bought and locked in a 30 year fixed rate loan at 6% (a bit higher than today’s actual rates, which are still between 5% and 5.5%):

1. You pay off your mortgage early

Note: We will assume that you are allowed to pay off as little / much as you like on your loan (not the case with some fixed rate loans in the USA, and certainly not the case with most fixed rate loans in most other countries!) because it makes the math simpler.

This is great, because you ‘earn’ 6% on your money [AJC: remember, a dollar saved – in interest – is the same as a dollar earned], better yet:

– The amount you ‘earn’ is guaranteed; every year that you are no longer paying that 6% loan, you are in effect earning 6% … simple and guaranteed!

– Unlike an investment that pays you 6%, there is no tax to be paid on the 6% mortgage that you save (although, there can be a negative benefit of losing the tax deduction on your home loan interest … but, I’m trying to keep this simple), so it’s more like earning 7.5% – 8.5% (depending on your tax rate) in any other investment.

– Let’s say that you plonk the entire $150k down in one hit, you save the entire $175k INTEREST (yes, a house that you buy for $150k in 2010 will have cost you $325k, just in principal and interest, by the time you have paid off the 30 year loan in 2040).

2. You do not pay off your mortgage early

Note: Paying the loan off slower will, naturally, save you something greater than $0 and less than $175,000 … but, is too hard to calculate, here, so we will continue to use the assumption that somehow, you were able to pay that entire $150k loan off in one hit.

Well, it’s a fairly simple calculation then, isn’t it: what can you invest $150,000 in that will return more than $175,000? Let’s run some numbers and see:

Business: If Michael Masterson is right, and we gain 50% (or more) from our own business, then after 30 years you would have earned $29 Billion on your $150k ‘seed capital’.

But, MoneyMonk is right: there is extreme risk and skill involved in being successful in business … just a shame the potential reward is so low 😉

[AJC: just a tad more than the $175k interest that you would have saved if you used the money to pay off your mortgage instead of starting a business]

Real-Estate and Stocks: Again, if Michael Masterson is right, and we gain 30% by investing in a mixture of buy/hold real-estate and stocks (naturally, continually reinvesting the rents and dividends), then after 30 years you would have $392 million …

… if that sounds a lot, remember that Warren Buffett built up a $40 Billion+ fortune over 40 years at not much more than 21% compounded.

Stocks: I agree with Michael Masterson, that if you buy stock in just a few good businesses when they are are going cheap (as the market does from time to time) and wait 30 years, you should have no trouble getting a 15% compounded (pre-tax) return so, after 30 years you would have nearly 10 million.

But, all of this has some risk / skill associated with it … so, maybe paying off the mortgage and snaffling that $175k is still the way to go for all of those risk averse people [AJC: Like me. True!] out there?

But, wait, what if we just do the ‘no brainer’ thing and plonk that entire $150k in a set-and-forget-low-cost-Index-Fund?

Here’s the good news: paying off your mortgage is a 30 year investment (you have forgone 30 years of being locked in to a loan and paying 6% interest year in, year out), so it’s only fair that we buy $150k of Index Fund units and don’t even look at our portfolio for 30 years, right?

Well, that’s an ideal strategy – THE ideal strategy – for Boglehead set-and-forget investors! So …

Index Funds: Over 30 years, the markets (hence the lowest cost Index Funds) have averaged something more than 12% – set and forget (!) – so, after 30 years you would still gain close to $3.5 million!

But, wait … we’re all about security here: you can’t live off averages, right? What happens if there’s another crash like 1929 and 2008 the day after I plonk my entire $150k into an Index Fund?

Well, you lose half your money immediately 🙁

But, we don’t care what happens immediately, this is a 30 year set-and-forget plan … and, there has been NO 30 year period where the stock market hasn’t returned AT LEAST 8%.

Now, isn’t 8% (since we have to pay tax on it) exactly the same as the equivalent after-tax 6% mortgage (give or take 0.5%)?

Yes!

The lowest possible return that we can get with any reasonable investment strategy that we can come up with is exactly the same as the best possible return that we can get by paying off our mortgage early.

Now, isn’t that interesting?