I spend a LOT of time on this blog talking about your home, and rightly so; your home is often regarded as your single largest asset.

I spend a LOT of time on this blog talking about your home, and rightly so; your home is often regarded as your single largest asset.

Or, is it?

TraineeInvestor reopens the debate with what I think is a really interesting – seemingly ‘throwaway’ – line in his comment to this post:

The overwhelming consensus of opinion on internet forums and blogs is that your home is not an investment. (There are even people who think it is a liability rather than an asset!!!).

The “overwhelming consesus” hasn’t made $7 million in 7 years, and probably never will 😛

But there is grounding to the home-not-an-asset way of thinking; for example, in this post I quoted Robert Kiyosaki who first told me that a home is NOT an asset [AJC: Unlike many others, I am not a Robert Kiyosaki detractor … Rich Dad Poor Dad was the first book that I ever read on personal finance and, at the time, it really opened my eyes to the value of financial education].

Here’s what RK said:

My Poor Dad Says My Rich Dad Says “My house is an asset.” “My house is a liability.” Rich dad says, “If you stop working today, an asset puts money in your pocket and a liability takes money from your pocket. Too often people call liabilities assets. It’s important to know the difference between the two.

Yet, paradoxically, TraineeInvestor also pointed to the exact opposite: study after study has shown that the wealthy own their own homes and the ‘poor’ do not!

So, what do I think?

Well – and, this may also SEEM paradoxical – I actually agree that a home is not an asset in the sense that it doesn’t earn an income.

Of course, you could rent to yourself.

Tell me then, though, when do you – could you – ever realize the value in that ‘asset’?

Only if you sell (you never will); or, pass it on (it’s not an asset for YOU).

Yet, there is one way to realize at least part of the value of your asset (while you still need a place to live), and that is to release some equity by refinancing.

So, technically, I agree with the ‘non-asset’ thinking, which is why I ask you to at least minimize the equity in your own home to a mere (by Dave Ramsey standards) 20% or less of your current Net Worth (and, review annually).

I also advocate buying your first home – more for some ‘human nature’ reasons rather than strict financial reasons – but, nowhere in this blog have I ever said: “… then, upgrade it”! 😉

Why bother keeping up an esoteric “is your home an asset or a liability?” debate at all, when the only real question that you need ask yourself is:

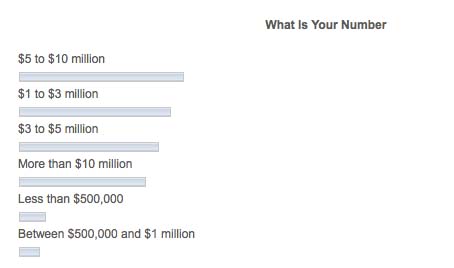

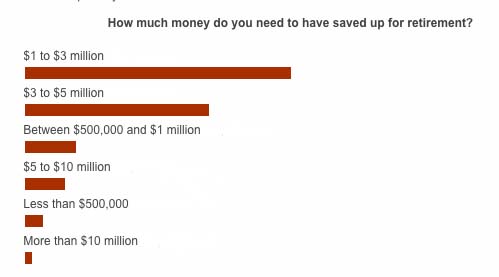

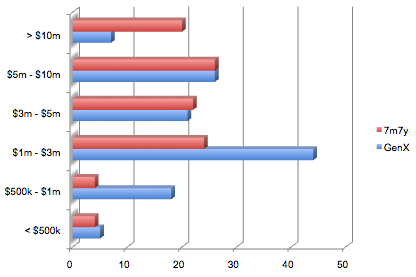

Can I reach my Number if I buy my own home, then keep [insert ‘% of current home value’ of choice: 0%; 10%; 20%; 50%; 100%; other] tied up as home equity?

My standard advice is, YES … if:

a) I buy my first home (with whatever starting equity that my bank and I can agree on), then

b) [as soon as reasonably possible, start to] maintain no more than 20% of my net worth in that – or, any future – home as equity

c) and, reassess b) annually (against both my home’s and my own net worth’s current value)

Ultimately, the equity that you choose to keep in your home either helps you to reach your Number, or it doesn’t.

For most people, “reaching their Number” means amasssing ‘real’ assets in the range of millions of dollars. Logically, tying up valuable equity in something that can’t possible reach ‘millions of dollars’ in value is wrong, so why do it?

What does this all mean for you?

My ‘rules’ of home ownership are designed to give you the best chance to reach your Number by your Date.

Depending on how YOU choose to look at it, your home is either your single largest asset or single largest liability …

… the real point of this blog is to make sure that it doesn’t stay that way 🙂