All this talk of ‘safe withdrawal rates’ begs the question: can you build a perpetual money machine from stocks and bonds?

I’m going to go out on a limb, here, and say NO.

To help us find out why, let’s try and answer Rick’s question:

I agree if you can live on what your investments produce over inflation you’ll never run out of money.

Does it still make sense to plan using the rule of 20 when you don’t think you will be able to reliably pull out 5%?

It seems to me use a more conservative rule say 25 or 30.

Also, you could still use stocks- you would need some other income sources too- bonds or cash to draw upon in down years.

Rick raises a three part question:

1. Why base the Rule of 20 on a 5% withdrawal rate, when that doesn’t appear to be safe?

Well, given that I don’t think ANY withdrawal rate is safe, for me at least, the Rule of 20 should only be used as a PLANNING figure i.e. to help you convert your required annual income into your Number.

As a planning figure, I think the Rule of 20 underestimates your Number; the chances are that you will overachieve it rather than underachieve it.

Given that it’s extremely unlikely that you will exactly achieve your Number, you will either undershoot or overshoot it … if you wait until your Number is a virtual gimme before selling your [Insert Number Reaching System Of Choice: business, real-estate, stocks, horses, etc., etc.] you will probably find that it takes time to decide what/how/when to sell and in that time, your assets have appreciated even more.

If you don’t think that’s the case for you, use a higher multiplier … I just don’t think it’s necessary to stress over it 🙂

2. Why can’t you use stocks to create your ‘perpetual money machine’?

It is a rare stock that provides the kind of income that we need without compromising the underlying business, but they certainly do exist: you would need to find a business (that you can buy stock in) that generates at least a 4% dividend, yet still grows the stock price at least according to inflation … consistently, over 30 to 50 years after you stop work!

However, using “bonds or cash to draw upon in down years” is a losing proposition (it’s not income … you are spending your capital!); I think that a two year emergency fund is a great idea … but, is there a reasonable chance of a stock downswing that will deplete that fund?

If so, I would not like this stock+bonds+cash retirement strategy one little bit … which brings me to the final – and, key – question:

3. Can’t we use a more conservative rule say 25 or 30?

Here’s the crux; the Trinity Study (for example) says that we have a small chance of running out of money, even if we choose a “safe” 4% withdrawal rate …

… the longer we expect to live – hence have our money last – the larger the failure rate (which can be as low as 2%).

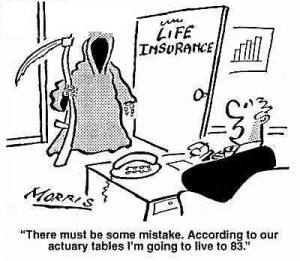

Here’s my question to you: if you are facing even a 2% failure rate, what are the chances that your money will last as long as you do?

98%?

Well, you would think so, but I once asked a doctor friend a similar question when – in a moment of rare weakness (thankfully now passed) – I actually thought about getting a vasectomy.

I told him that I heard that the operation was quite reversible. I asked him what the reversal success rate was.

“In your case” he said ” exactly 50/50 …

… either it will work, or it won’t!”

So, Rick, find an actuary to help you choose any multiplier that you like and the chance is still 50/50 for you: either your Number will be enough to last as long as you do, or it won’t 😉

2. If the business grows at 4% per year, then, regardless of the dividend payment, the equivalent monetary value of the company could be sold off to keep the invested equity constant. It is better if a company doesn’t pay a dividend if it means growing the business faster. Some companies even increase dividend payments knowing that growth options are limited.

Adrian,

I suspect you believe that the perpetual money machine can be created with real estate? However, if you can’t ever dip into principal you can’t use real estate either because there may be some years where occupancy is low and costs are high enough that you have negative cash flow forcing you to sell a property to cover expenses. The only asset you could use would be TIPs as you know the real return rate.

It strikes me that dipping into principal is not fatal as long as it is done infrequently and by a small enough amount. That suggests a large cash buffer. We could also look for real world examples- say trust funds or endowments that have been managed for many years. What distribution rates do they sustain and what assets to they own?

-Rick Francis

@ Rick – TIPS are a great alternative … they protect your capital and allow it to keep up with inflation. But, you would need to use the Rule of 40 to 100, as returns are so low 🙁

Pingback: The Ideal Perpetual Money Machine …- 7million7years