This used to be me … it sucked! 🙂

Tag Archives: money

Home Business Success?

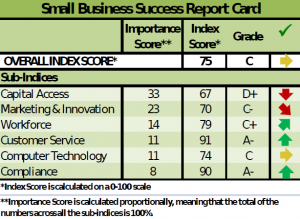

Andee Sellman, friend and occasional $7million7years contributor, refers to the Small Business Success Index study saying:

There are about 6.6 million home based businesses that generate at least 50% of the owner’s household income.

Now, assuming that home based businesses have either no – or very few – staff, I think that means that there are about 18 million home based businesses that are generating less then half the owner’s household income.

Now, think about this: the chances are that the whole household has a maximum of two full-time salaries – IF the owner of the small business runs it purely after hours …

… so, most home based businesses are making less than one full-time salary.

Let’s look at the most successful 6 million of these businesses: what are the chances that many of them are doing much better than “50% of the owner’s household income” – or, a maximum of one full-time wage (but, probably, much less!)?

Not much, I would think.

Now, there are exceptions: if you say that Facebook was a home-based business when it started … or, Apple … or, Google. But, most are just small online/offline concerns … low cost, low revenue, low return.

Chances are, you aren’t going to earn a lot from it, or sell it for a lot.

So, what’s the value of starting a home based business?

Well, unless you’re one of the very lucky ones, it’s in what you do with:

1. What you earn: this is extra income (assuming that you just haven’t thrown your old job in until it replaces your income … plus more) that you SHOULD be investing 100% of (some back into the business … some into outside investments, RE is ideal because the extra business cashflow can help fund any shortfall in the first few years), and

2. What you learn: there is no better way to learn about business than by running a business (preferably, with the resources of sites like Andee’s to help you); sure, my son made a couple of grand between the ages of 12 and 14 running his little eBay business from home … but, the lessons that he learned – not just business lessons, but Life lessons – will become priceless!

No, Michael Masterson’s 50%+ compound growth rate is reserved for businesses that can grow rapidly, have intellectual property that is both desired and protected, and have owners who are inspired by their Life’s Purpose to reach extraordinary heights …

… but, even the most humble home-based business can be a huge turning point in your financial life.

I highly recommend that you give it a go … and, keep trying until you find The One that helps you reach your Number 🙂

When is cheap debt expensive?

Dave Ramsey says to use Gazelle Intensity to pay down all debt, before even thinking about investing. Yet, would he consider running his (rather large) business without an overdraft, or leased cars, equipment, and/or furniture?

Dave Ramsey says to use Gazelle Intensity to pay down all debt, before even thinking about investing. Yet, would he consider running his (rather large) business without an overdraft, or leased cars, equipment, and/or furniture?

I doubt it … he needs to preserve his capital, and put it to better use by growing his business investment (more stock; better marketing; more staff; more training; etc.; etc.)

So, why should personal finance be any different?!

But, Dave Ramsey would argue to pay off all debt, whether it is ‘good’ (e.g. produces income) or ‘bad’ (e.g. credit card loans for consumer goods, like that LCD TV that you just bought).

If you are a regular reader of this blog, by now you will know that my view differs markedly; I say:

Once the debt is incurred, it is no longer ‘good’ or ‘bad’ … it becomes either ‘cheap’ or ‘expensive’.

And, as I mentioned in a previous post …

You should only pay off your ‘expensive’ debt!

What makes a debt ‘cheap’ or ‘expensive’? What is the yardstick interest rate? 2%? 5%? 11%? 19%?

Any, all, or none of the above. You see, it’s relative:

– Debt only becomes ‘cheap’ when you have something that produces a better after-tax return [AJC: probably, a MUCH better return to account for the fact that paying off the debt is a GUARANTEED return].

– Otherwise, by default, all debt becomes ‘expensive’ and you should do as Dave Ramsey suggests.

Fortunately, finding suitable investments to offset the need to pay off relatively low-cost debts such as student loans and home mortgages is as easy as finding some great value stocks, a cashflow positive real-estate investment or three, or a small business to buy or begin …

… provided that these are things that you are:

1. Passionate about,

2. Educated in, and

3. Convinced are needed in order to achieve your Required Annual Compound Growth Rate to reach your Number.

I recommend that – if you are pursuing a Large Number / Soon Date – you must pursue your investments with Cheetah Focus … a great example is provided by Eric [AJC: emphasis added]:

I graduated college 2008 from the University of Texas. worked at an oil and gas company in Houston named Flour Daniels. they had massive lay offs in 2009. I worked for a year and managed to save well over 50% of my pay. I reinvested it all into the stock market. I set up a regular investment account and a Roth IRA.

To date my Reg. Stock account is up 30%+ and my Roth IRA is up over 60%. and I still have another month to increase my yearly gains for it

I have had no prior experience with investing/trading. I played safer stocks/ETFs .. Bought on dips and sold when it would pop.

Oh and I also took out a loan from Citi bank.. who sent me a 10,000 loan offer in the mail with a 2% interest for the life of the loan. LOL.. I had to take it. I threw that into stocks also.

Any how my point is. If i had focused on paying off my $28,000 college debt I would have missed all of last year gains. I just made it a goal to beat my debt interest. and I did!

Currently I have enough money to pay off all my debt. but of course i’m not going to do it. I took out 2K from my portfolio to invest in an online woman’s clothing site. We have great style at affordable prices. we are not making huge profits.. but we are selling and that is encouraging.

Did you notice in the image (above) why the gazelle has such intensity?

It’s because the cheetah is coming up fast and furious on his tail 😉

Punch Buggy Blue!

Let’s say that you do agree that real-estate is one of the best MM301 (wealth preservation) strategies … although, many of my readers would disagree …

Let’s say that you do agree that real-estate is one of the best MM301 (wealth preservation) strategies … although, many of my readers would disagree …

[AJC: I’m happy to meet all the dissenters in, say, 50 years – at a very cheap restaurant, as they won’t be able to afford much more – to discuss how they went with their TIPS, bonds, cash and stocks-based retirement strategies. Then I’ll meet Scott, Ryan and all the other RE and business-based retirees on their private golf-course in Palm Beach for a second debrief 😉 ]

… but, what type of RE would fit the bill?

After all, many of my readers, Evan included, have had mixed experiences with RE:

I have watched my dad deal with C R A P for years. He owns 2 properties:

1) CASH COW – 2 family residential unit income exceeds mortgage payments. They always pay on time and there mostly are no problems2) 2 family unit with a bar attached. I have listened to him say for YEARS, that if the bar paid its rent things would be different. I feel like the stress associated with this property is going to kill him eventually, and that is the commercial part.

In NY it takes 9 to 18 months to get someone out, so even if you try to evict you are looking at legal and time costs that could literally eat 6 months profit.

As I said to Evan:

That’s why we keep TWO YEARS’ buffer 😉

But, we all have a Reticular Activating System (RAS) that attracts us to whatever it is that has caught our attention … for example, have you ever played the Punch Buggy / Slug Bug game with your friends and / or kids?

If not, it’s a bundle of fun – and, pain. Actually, mainly pain 🙁

It works like this: who ever sees a VW ‘bug’ first calls out “Punch Buggy [insert color of choice: yellow, green, red, etc.] !!” and gets to whack the other person on the arm … as hard as they like [AJC: usually me. ouch!] …

It’s amazing how many VW Beetles there are on the roads, these days!

We used to play a similar game – many, many years ago – when I was on the school bus: we used to look for Chrysler Chargers, and whomever saw one first would yell out “Hey, Charger!” and hold up their hand with a Richard Nixonesque V-For-Victory sign.

We used to play a similar game – many, many years ago – when I was on the school bus: we used to look for Chrysler Chargers, and whomever saw one first would yell out “Hey, Charger!” and hold up their hand with a Richard Nixonesque V-For-Victory sign.

The winner for the day was the one who scored the most ‘victories’ …

It’s amazing how many Chrysler Chargers there were on the roads, in those days 🙂

Of course, what’s happening is that our RAS is simply filtering IN Chargers (or VW Beeltes) and filtering OUT other types of vehicles, making it SEEM as though Chargers / Beetles are everywhere … of course, there are no more / less than there were before we started looking out for them.

Similarly, with RE – or other – investments:

Our view tends towards our first direct – or, even indirect – experiences; which helps to explain why my generation is more conservative (we went through some down cycles in the late 80’s and early 90’s) and younger folk were more bullish, having had 15 to 20 good years … until resetting their RAS’ in the current cycle.

Similarly, Evan’s views may be colored by his Dad’s experiences albeit mixed.

But, Evan’s Dad could have avoided many of his RE problems by buying well … now, for MM301, buying well is NOT the same as buying well for MM201:

While we are still building towards our Number, we need to buy RE that will appreciate strongly, with rents just covering cashflow (of course, we wouldn’t say “no” to more!) …

… but, when we have reached our Number, we need to generate INCOME, so buying well really means that we need to:

Buy to protect our future income / rental stream

As I have shown you, it’s easy to get a positive cashflow from RE; just pay cash!

And, live happily from 75% of the rents (less taxes), knowing that the other 25% will cover all of your ‘normal’ costs (management fees, vacancies, repairs and maintenance, etc.), and will keep up with inflation.

It’s the last part that is key: since we are never selling these properties [AJC: lucky kids!], we don’t really care how much/little the RE itself appreciates, we just care how much the rents appreciate, and our benchmark for this is:

The rents must appreciate at least as much as inflation

That is through both UP and DOWN markets …

… so, I would keep away from bars and other retail EXCEPT for counter-cycle retailers such as dollar stores, groceries / food stores (food staples only), and – of course – Walmart and Walgreens [AJC: if I could get my hands on the freehold!].

Remember, we’re not looking for extraordinary capital growth (any more), but protection in down-cycles.

[AJC: oh, and if you were going to buy stocks (again, for retirement capital protection and dividends); these types of retailers and food businesses would be great ‘protection stocks’ to own, as well]

And, moving away from retail, I would also happily buy small offices, say, housing a number of separate professionals (e.g. doctors, attorneys, etc.), as these professions are required in all markets and my risks are well spread.

But, I would avoid large offices – or industrial showrooms and warehouses – housing SME’s, as these are prime candidates for simply shutting shop in a down cycle, and I may only have one tenant per property (even though buying 6 or 7 of these would certainly help to insulate the ‘shock’)

And, you might be surprised to find that I am not all that excited about residential (even multi-family) for MM301, simply because the rental returns are usually not that great (but, they can make a fantastic MM201 strategy).

Remember, RE isn’t the only MM301 Wealth Protection strategy that you can base your retirement (or, life after work) around, it’s just that I am struggling to find another one that has both income and capital that can keep up with inflation, fairly consistently, through at least the 30 to 50 years that I still plan to be around …

… can you?

What would you do with $5 million … or $50 million?!

Even if you are NOT a poker fan, scroll forward to exactly the 5 minute mark (once the video has had a chance to buffer) to hear Kara Scott ask some poker young – and, old – guns what they would do with $5 million (or, $50 million) …

… you might be surprised how little it seems to mean.

But, if I asked you the same question, you would [AJC: I hope by now] instantly answer:

That’s easy, I would [insert: Your Life’s Purpose]!

But, if you want to understand why these guys are seemingly so relaxed/flippant about $5 million (or, even $50 million for a couple of them) you first need to realize that the question actually means: “what would you do with another $5 million?”

So, it shouldn’t surprise you that my answer would equally be:

Nothing special …

… it would simply make me a little more comfortable that I could live my Life’s Purpose, since I’ll just buy another $5 million of [insert Perpetual Money Machine of choice: 100% paid for by cash real-estate; annuities; TIPS; bonds; etc.; etc.] and live off 75% of the net proceeds.

The Formula For Wealth!

Oops, I made a couple of mistakes, and one of the millionaire ‘success factors’ that I believe in is to admit your mistakes, make restitution as best you can, and then move on.

My first mistake was taking a hot chilli from one of the tradesmen working on my house; I told him it was fine, but a minute or so later (when I was already in my car on the way home) it really hit and I was suffering for another 10 or 20 minutes. I decided that appropriate Restitution for this one was simply the embarrasment of ‘coming clean’, so I had to go back and tell him I’m not a real man, after all 😉

My second mistake was making a promise to the 7million7years who applied (and, were accepted) for my new 70 Millionaires … In Training! program that resulted in me (a) reducing the number of Foundation Members to 40 (was meant to be all 70) and (b) charging them $1 a year (it was meant to be totally free for life). We agreed that appropriate restitution was to donate $5 to a worthy charity for each Foundation Member ($5 x $40); I decided to do it for all 70 charter members (Foundation Members, plus full paying Premium Members) hence the receipt, above.

You gotta admit your mistakes and keep your promises …

__________________________________

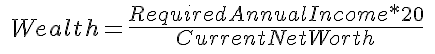

The 7million7year approach is not to measure wealth by the amount of money that we have, or some arbitrary sum that we might wish to have, or even some really complicated ‘secret formula’, but to measure wealth by this simple formula:

Where RequiredAnnualIncome = f { LifePurpose }

[AJC: which simply means that your Required Annual Income is some Function of Your Life’s Purpose i.e. they are -or, at least, should be – totally related!]

You are wealthy, in 7million7year terms, when:

“Wealth Factor” Wealth < 1

Or, you can just go by Ill Liquidity’s formula:

Let E be earn and S be spending. If E E QED. The latter part of the statement is redundant. What about “if you can finance it you can own it?”

I finance therefore I can? 😛

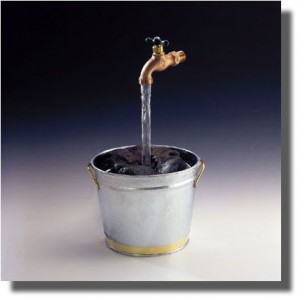

The Golden Faucet

Ordinary folk don’t plan their finances during their working life, so what chance do they have in retirement?

Ordinary folk don’t plan their finances during their working life, so what chance do they have in retirement?

None.

But, that doesn’t apply to us smart folk who read personal finance blogs …

… WE plan our retirement according to either Poor Man methods, or Rich Man methods known only to a few i.e. The Rich!

By the end of this post, you will know the difference; whether you choose to believe me and what you choose to do with this information is entirely up to you 😉

So, here goes:

Conventional Personal Finance wisdom – clearly ascribed to by the majority of my readers – says that you pick a so-called ‘Safe Withdrawal Rate’ …

…. that is, the percentage of your retirement Nest Egg that you can withdraw to live off each year that you feel will be small enough that your money will last as long as you do.

A sensible objective, wouldn’t you think?

You can pick any % between 2% and 7% (even up to 10%, if you believe all of those Get Rich Quick books) and find some expert or study that supports your choice.

You then have a choice to

a) make that % a fixed amount of your initial retirement portfolio (e.g. let’s say that you retire with $1,000,000 and choose 4%, giving you an initial retirement salary of $40k p.a.), then increase that salary by c.p.i each year regardless of how your portfolio rises or falls [AJC: it’s called the “close your eyes and hang on tight” approach to retirement living], or

b) choose your preferred ‘safe’ withdrawal % and let that rise and fall according to the rise and fall of your your portfolio’s value … so, if you happen to retire a year before the next stock market crash, you could be withdrawing 4% of $1 mill. in one year, then 4% of $500k the next year [AJC: no problem, as long as you can stifle the urge to jump off a ledge when your income halves, as well]

Optimists will choose a withdrawal rate in the 5% to 7% range and pessimists will choose a withdrawal rate in the 3% to 5% range …

… Rich people will do neither!

Why?

Well, before you retire (i.e. now, while you are still working) you could draw a curve of your likely salary moves between now and retirement and you could pick a living standard that corresponds to that curve, using actuarial tables to basically create an inflation indexed annuity for yourself throughout your working life.

But you don’t.

Instead, you live according to your means – and, adjust as necessary – and, build up various safety nets (via cash reserves and insurances) as you deem prudent and necessary.

Why would you do any different after you retire?

Poor people who retire put their money in a bucket and a little trickles in (interest, dividends, capital appreciation) and a lot gushes out (inflation, taxes, expenses, disasters).

You have a bad year or three, overspend a little, a couple of health issues, and you’re screwed [AJC: it even happens to retired sports stars, movie stars, and musicians. Ever heard of MC Hammer?].

But it doesn’t happen to smart Rich people, because they don’t drink from a bucket … they drink from a golden faucet:

They create – then live from – an income, both before retirement and after!

Think about our energy crisis past, present and future … all resolvable (we hope!) by switching to an abundant source of clean, green, renewable energy.

Now, think about all of your spending crisis past, present and future … all resolvable (you hope!) by living within your means a.k.a. creating an abundant source of renewable income!

That income can come from a family business that you retire from but retain “passive” part-ownership of; from venture capital activities; from real-estate investments; and, so on … in fact, from any investment that produces a reliable income stream that tends to grow at least in line with inflation.

Here is how I planned it:

1. I used the Rule of 20 strictly for planning purposes [AJC: this sounds like a 5% withdrawal rate, but who said that I’m actually going to withdraw the 5% each year?!]

2. I started creating a Perpetual Money Machine: something that will produce income that I can live off; in my case, it was RE bought with (or, for which I already have built up) plenty of equity or cash to ensure a healthy positive cash flow.

3. To cover ‘bad years’ and other contingencies, I retain at least 25% of the income stream until I have built up enough for TWO YEARS of living expenses and then I reinvest whatever is left over (i.e. buy another property every few years).

So, what if something goes wrong as it did for me when the GFC hit leaving me with too much house, another house I can’t get rid of, and $2.5 million of unavoidable stock losses [AJC: part payment for my business came in UK stock … yuk!], resulting in not enough income?

You go back to MM201 and start again (hence, my commercial property development activities) …

… after all, history has shown that your first fortune is by far the hardest 🙂

I’m diversified …

Applications for the new $7 Million 7 Year Wealth System Guided Learning Experience are now closed. Thanks to all of those who applied … and, congratulations to those 30 who made it!

Applications for the new $7 Million 7 Year Wealth System Guided Learning Experience are now closed. Thanks to all of those who applied … and, congratulations to those 30 who made it!

I’m not going to encourage my other readers to join, as I can’t see the point of paying $97/year for something that you could have got for free (well, for $1 a year). Anyhow, no advertising allowed on this blog … and, that even applies to me!

Instead, I hope that you will keep reading this blog, and that it will inspire and help you to make millions the good, ol’ fashioned way 🙂

_____________________________________

Yes, I am well and truly diversified …

Yes, I am well and truly diversified …

… and, it sucks!

Here are my current holdings, roughly:

$5.0 million – House in Australia

$1.5 million – House in USA (soon to be a rental)

$2.5 million – Cash in Bank/s

$1.0 Stock in UK (actually, 70% has just been converted to cash)

$1.0 million – Equity in 5 condos

$1.0 million – Equity in two development sites (could be up to $3 million – $6 million once permits are issued)

$1.0 million – Value of business (I still have a finance company running on ‘auto-pilot’)

… aside from the fact that I’ve over-invested in my Aussie house [AJC: see this post for the problem and how I intend to fix it], you can see why I am not happy:

– Too much in cash,

– Too much overseas, in chunks too small to be meaningful

– Too many ‘small’ chunks of $1 million

Ideally, I would like to bring some of those small chunks together, merge them with my cash (like so many drops of mercury) and do something useful with them …

…. by ‘useful’, I mean plonk as much as the bank requires into my two development projects, then use the proceeds to buy as many investment properties in the $1 million to $3 million price range that I can find, as long as the net result is free cashflow of $500k+ p.a.

Nowhere here do you see me saying:

– 30% in cash,

– 30% in real-estate,

– 30% in stocks

– 10% in venture capital

Mine will look more like:

– 80% – 90% real-estate (albeit, over a number of properties, rather than just one big’un),

– 5% – 10% cash for contingencies (up to approx. 2 year’s living expenses or $500k to $1 million, whichever is the lesser)

– 5% – 10% for ‘fun projects’ (e.g. venture capital investments).

Why so much in RE?

[AJC: It doesn’t have to be RE; how I invest my money is not how you should invest yours … but, the principle of NON-diversification is what’s important, here. And, I should clarify that, too: for you, non-diversification could be 95% in TIPS; 80% in AN index fund; 90% in just 4 or 5 stocks … in other words: it means, avoiding spreading across asset classes]

I can’t find the online reference, but Warren Buffett was asked at the 2008 Berkshire Hathaway AGM (which I attended, so I am paraphrasing exactly what I heard, here) how much of his net worth he would place into one position (Berkshire Hathaway doesn’t count, because it’s really a conglomerate).

Warren said that his biggest problem right now is that his investment war chest is so large that he is forced to buy many investments, however, he did point out that he was very happy in days long gone, when his investment in AMEX comprised nearly 60% of his net worth.

Charlie Munger (Warren’s long-time business partner) said that he would be equally happy to have close to 100% of his net worth in just one outstanding investment.

BTW: Charlie is a real ‘character’; short on words … long on wisdom!

Having sat on both sides, I can tell you that – right now – I am NOT happy being so ‘diversified’ … it annoys me, and I feel hamstrung in that I can’t bring my full financial weight to bear on any project.

But, each to their own … it’s just that certain rich peoples’ “own” = non-diversification 🙂

_______________________________________

Adrian J Cartwood is on FaceBook … come and be friends!

_______________________________________

A manifest error?

Last days for ‘pre-applications’ to become one of my 70 Millionaires … In Training!

I am offering the first 70 – and, 70 only – of qualified readers free lifetime access to all of the Premium Content on the site.

First, though, you’ll complete a short application form, so that I can see whether you will be a contributor to the program, or just a freeloader 😉

Better hurry, free is a pretty good incentive and I reckon you’ll be fighting for your place …

Click here to find out more …

_________________________________________

In an interesting experiment in the ‘dark arts’ of using visualization and other techniques a la The Secret, Steve Pavlina challenged his readers to attempt to ‘manifest’ $1,000,000 each:

This experiment is based on the intention-manifestation model of reality, where the goal is to generate $1 million of additional wealth for each person who chooses to participate.If you wish to participate, all you need to do is to decide to put forth the following intention:

In an easy and relaxed manner, in a healthy and positive way, in its own perfect time, for the highest good of all, I intend $1,000,000 to come into my life and into the lives of everyone who holds this intention.

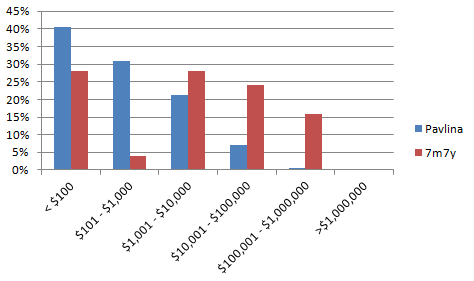

The experiment claims $5.5 million that participants would not have received in ordinary earnings, and Steve Pavlina achieved over $100k in 18 months all on his own.

But – and, this is a big BUT – Steve did set the bar at $1 million dollar each, but NONE of the participants achieved that target.

More importantly, as the graph shows, our readers (most of whom, presumably, did not use creative visualization, chants, or the suchlike) actually achieved a much greater average result!

In fact, as I pointed out in my last post:

In that 18 month period, nearly 1,600 participants [in Steve Pavlina’s Million Dollar Experiment] reported ‘manifesting’ anywhere from $504,873.56 (in just one day; if you choose to believe him) down to just one cent.

The average was closer to $3,500 in less than a year, with the median being just $180.

Our response to this challenge ‘produced’ more than an average of $18.5k for each $7m7y participant (!) …

… I don’t know how the Universe really works – or whether there is any Power in Intention – but, can I at least claim the Power of Reading the $7 Million in 7 Years blog as the key to manifesting your own millions? 😉

Casting Call: 70 Future Millionaires Wanted!

So far, this blog has covered – in a random way – perhaps 10% – 20% of what I have to offer, and over the next 2 years you can expect that to double again … so, if you can wait 4 or 5 years (and, can unscramble the order that I deliver this content in) you will know at least half of what I have to offer.

IF you can wait …

But, now I am offering another way to learn what you need to learn – quickly and in a totally ordered/guided way – AT NO COST TO YOU … NOT NOW … NEVER … EVER … really 🙂

Why?

It’s another way for me to share my ideas … and, more fuel for my next book [AJC: my first one is finished and is being hawked to publishers and agents as we speak] 😉

So, what’s this all about?

If you have been around – reading this blog – for the past two years, you will already know about my Other Site, which was host to a unique online experiment where a real multi-millionare (that would be me) offered to mentor just 7 people to make their own fortune.

Scott, Ryan, Josh, Debbie (who volunteered to leave the program to help me write a book about their experiences with this experiment), Jeff (who replaced Debbie), Diane, Mark and Lee (a retired Police Chaplan!) all participated and you can read about their experiences on that site.

Scott, Ryan, Josh, Debbie (who volunteered to leave the program to help me write a book about their experiences with this experiment), Jeff (who replaced Debbie), Diane, Mark and Lee (a retired Police Chaplan!) all participated and you can read about their experiences on that site.

If you are a regular reader of this blog, and meet a couple of very small criteria, ALL of this content is – and, will always remain – free to you!

But, I am offering you even more .. also for free / for ever …

You see, I am opening up this site to just 70 more Millionaires … in Training! and, will be offering memberships to qualified applicants for a small monthly fee … but, not for you – as a reader of this blog, I feel morally obligated (seriously!) to keep my promise that I would NEVER ask you to pay a dime for my online services.

This won’t stop me from advertising the hell out of this re-launched site elsewhere, looking for paying customers … but, NOT HERE.

[AJC: This is about as good an offer as you will ever receive in this life, so maybe you should take advantage of it]

Foundation Membership (this is exclusive for the first 70 QUALIFYING $7million7years readers) is just like the Premium Mmbership that others will need to pay for – but, you get it for LIFE and for FREE.

Joining will enable you to find:

![]() EXACTLY how much money YOU need in order to be rich [hint: this will be different for everybody]

EXACTLY how much money YOU need in order to be rich [hint: this will be different for everybody]

![]() WHEN you need to stop working full-time and WHAT you will be doing with your new-found freedom

WHEN you need to stop working full-time and WHAT you will be doing with your new-found freedom

![]() WHAT steps you need to take in order to amass the fortune that you need

WHAT steps you need to take in order to amass the fortune that you need

![]() HOW to find your passion and turn that into cash

HOW to find your passion and turn that into cash

Most importantly, you will find THE ONE THING – more than any other – that helped me move from $30k in debt to $7 million in the bank in just 7 years … and, how it is virtually guaranteed to work for you.

This is no scam or Get Rich Quick system that tells you how to invest in real-estate, stocks, online businesses, or any other method that made the author rich [or, was it just selling you the information that made the author rich?!] …

… no, this is a NEW and UNIQUE Guided Learning Experience that will show you how to get as rich as you need to be, doing whatever it is that you are most passionate about.

Haven’t found your passion?

Don’t worry, that’s one of the first things that we will cover 😉

If you want to become one of the 70 Millionaires … In Training! click here now, before 70 others jump in ahead of you!

Still reading?

There’s nothing more to know!

Just click the button … I’m offering you – just 70 of you – the Keys To Willy Wonka’s Chocolate Factory, perhaps you shouldn’t look a gift horse in the mouth? 🙂

Good Luck!

Adrian.