As we bask in the sun, a couple of interesting financial questions popped up, both voiced by my 15 y.o. son.

As we bask in the sun, a couple of interesting financial questions popped up, both voiced by my 15 y.o. son.

The first was as we picked up our rental car and were offered the choice between the ‘standard insurance’ with its $3,300 deductible (regardless of fault!) to which I said “yes please” just as the guy next to me (receiving the similar offer for his rental car) just as immediately said “yes please” to the alternative offer of ‘reduced deductible’ insurance for an additional $29 per day.

“Why is it that two people can immediately make opposing financial decisions” was the gist of my son’s question (actually, it was “why didn’t you pay the extra $29 a day, too, Dad?”).

Well, it isn’t because I know that car rental companies rake in approx. 25% of their profits from their insurance scams … I mean, schemes … it’s because he is thinking MM101 and I am thinking MM201.

If you don’t have the $3,300 (actually, an extra $3,000 because the ‘reduced deductible insurance’ still leaves you to pay the first $300 of any incident) then the decision is reasonably simple:

Can I afford to pay the daily rental INCLUDING the extra $29?

– If YES then rent the vehicle WITH the reduced deductible coverage.

– If NO, then you can’t afford to rent the vehicle, so you had better look at the bus/train option.

Now, the other guy probably would have had a heart attack if he had to fork over an unbudgeted $3k all of a sudden – as would my son, with his limited eBay-plus-allowance income – but, not me: $3k is a figurative drop in the 7m7y financial ocean.

So, I have a different set of questions because I CAN afford to pay the $3,300 deductible … easily, even though I wouldn’t like to pay it:

What is the daily cost of the waiver? How many days will I be renting for? What is the likelihood that I will have an accident in that period? How much will I be ‘saving’ in deductible if I do have an accident?

Now, three out of the four questions are trivial, and I was able to simply explain to my son that over a three day rental, the extra daily charge would cost me close to $100 and ‘save’ me $3k if I happen to have an accident.

But, what about the likelihood of having the accident? In my son’s (and, perhaps the other renter’s) eyes, the answer was “very likely” … but, the truth is that I don’t know for sure, making this potentially a very hard ‘actuarial’ problem to solve.

[AJC: in fact, I do know that the chances of a policy holder making a claim on their insurance policy is about 14% 😉 ]

But, there is another – more financial – way of looking at this situation … one that works for most complicated financial problems where a critical piece of information may be missing: find the break-even point.

In this case the break even point is trivial to calculate: it’s simply to calculate how many days of additional charges it would take to ‘pay off’ the additional $3,000 of the deductible.

The answer is: $3,000 / $29 per day = 104 days (rounding up a little).

So, my thought process was simple:

– Can I afford the $3k deductible? No doubt about it!

– How likely is it that I will have an accident in less than 1/3 of a year? Not very likely, considering that my last ‘bingle’ was so long ago that I can’t remember it.

Clearly it’s a bad bet … and, obviously so otherwise the rental companies wouldn’t offer it 🙂

Now, this obviously applies to all insurance situations, so you don’t need to be an actuary. Instead, and as I told my son, think about the worst case scenario:

– If you could afford to cover it in the event that it came up, don’t sweat it,

– But, if you can’t afford to cover the cost, then you have no choice but to insure it or risk your financial health.

Until you reach 7 million, insure it or don’t do it …

… a financial lesson to warm the cockles of many an insurance brokers’ heart 😉

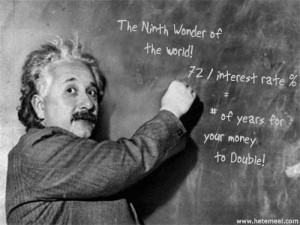

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ … You’re probably attracted to this blog because you want to get wealthy … and, if you’re anything like I was (and, now still am for ‘professional interest’) you probably read any and all decent books on personal finance in the hopes of finding those very ‘keys to wealth’.

You’re probably attracted to this blog because you want to get wealthy … and, if you’re anything like I was (and, now still am for ‘professional interest’) you probably read any and all decent books on personal finance in the hopes of finding those very ‘keys to wealth’.