$1 million? Pleeezze … even Dr Evil knows you need (a LOT) more than that these days 😛

Tag Archives: Starting Out

You gotta know your customer …

If you’re in business, then you had better get to know your customer. I’m sure that you’ve heard that before, but what does it really mean?

The true meaning hit home for me not long after I received this unsolicited e-mail promoting a new rating service for bloggers:

For the first time, publicists will be able to research, connect and manage Social Media relations in a single integrated platform. MyMediaInfo has scored thousands of blogs based on key metrics creating the MMI score. A trial is available at http://mymediainfo.com/register.jsp or give us a call at (888) 901-3332 to speak to a product specialist.

Excellent!

Point 1 of getting to know your customer:

Bloggers are vain/curious … they want to know that their blog is being read, and how it rates against other blogs [AJC: c’mon … if you’re a blogger, you can’t tell me that you aren’t checking your site stats quite often!].

I’m no exception, so I click through to their web-site and am sent a confirmation message:

Thank you for registering for a free trial of MyMediaInfo. A product expert will call you within 1 business day to activate your account and provide a brief tutorial.

Bummer!

Point 2 of getting to know your customer:

Bloggers are shy; no way does a blogger want to hand over their personal contact details and phone number to anybody [AJC: except maybe the publisher of the New York Times].

Here’s what I said:

Uh, this is the internet and the world of bloggers … we stay semi-anonymous, so don’t expect a big take-up on providing phone numbers!

I recommend that you provide a trial link that speaks for itself and only requires an e-mail address to register … bloggers will only be interested in seeing how their own site ranks, anyway 🙂

You gotta know your customer 😉

If you’re also a blogger, would you have registered and given your phone number? Maybe you’re not as shy as me?

Do the rules need to change?

Please keep sending your questions and comments either via e-mail [ ajc @ 7million7 . com ] or via the comments; I answer as many personally and/or here as I can …

… for example, Mike asks:

Are your rules of thumb like making 15% year on year in the stock market still true in an environment when treasuries and inflation is so low?

One of the reasons pension funds are blowing up left and right is that there are assumptions on portfolio rises of 8% per year… so should you be pulling down those numbers of expected returns?

This is a great question … so much so, I’m wondering why anybody hasn’t challenged them before, considering the current market.

Yet, my answer would be – and was – and is:

We’re not concerned, here, with what stock markets are doing now, [not] like pension fund managers and traders are …

The reason is simple: we’re not trying to invest to achieve the greatest possible returns now, as traders and pension fund managers hope to achieve …

… we’re here simply to reach our [large] Numbers by our [soon] dates.

By ‘large’, we’re talking $7 million (give or take a few million) and by ‘soon’, we’re talking 7 years (give or take a few years).

We’re not talking this year, or even the next, or the next, or …. we’re totally focussed on that end result.

Besides, traders and fund managers who chase the market fail … and, fail miserably 🙁

Here’s what happens to ordinary folk who try and time the market, because they are worried about [temporarily] low returns or are chasing [temporary] high returns:

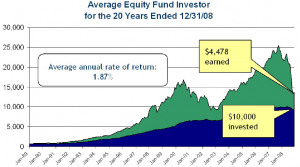

This shows that no matter what gyrations the market had over the last 10 years – as shown by the green area – the typical investor never managed to keep up – as shown by the blue area – not by a small margin, but by a HUGE CHASM, managing a return of only 1.87%

Think about it: the average investor (that’s you and me) only managed less than a 2% return, over the 10 year period 1998 to 2008, when the market returned over 8%.

That’s worse than simply sticking your money in the bank!

[AJC: to show it’s not just a function of the current market, this huge discrepancy also held true for Dalbar’s earlier study]

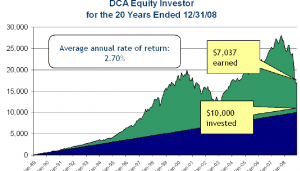

And, if you think that’s because the average investor is a know-nothing dolt and you can do better; here’s what professional fund managers managed to achieve:

2.7% … that’s the best that even the professionals could manage.

Why?

Because both professional fund managers and investors (yep, even those who BELIEVE that they are buy/hold long-term investors) switch in and out of the market, altering their strategy [AJC: a nicer phrase than greed and panic] as markets rise / and fall … obviously, timing things terribly.

That’s why when I talk about investing – and, the associated rules of thumb – I look at the average returns over a long period. I sometimes even advocate looking at the lowest average returns over a similar period.

Yes, if your Number is soon, then you will need to look up my references (they are sprinkled thoughout my posts) and choose more appropriate estimates and take your chances along with the rest of the speculating masses …

… but, for planning your Number and then acting out your strategy you can – and, probably will – do much worse than simply following my ‘rules of thumb’.

After all, I have made $7 million in 7 years – and, this blog is all about helping you do the same – using these exact, same strategies that I teach here.

* Footnote: in the interests of full disclosure, here’s what I told a reader on Monday:

I hope that everything here rings true; I try and give all stories from personal experience. But, not everything happened for me in a nice, clean order: for example, I only found out about the 20% Rule a couple of years ago.

Sometimes, I simply have no choice but to talk from personal experience about ‘rules’ that I found out about a little too late 😉

Is there enough profit in it?

Here’s a story about increasing your profit margin from 17% to 117% to 1,017% …

… I want his “Irish friend” working for me!

AJC’s Secret Strategy?

Every financial ‘expert’ has a secret strategy …

Every financial ‘expert’ has a secret strategy …

… you know, the one that made them $1,000,000 simply by doing [insert: strategy of choice]; just try googling “how I made million” and you’ll come up with listings like:

How I Made $77 Million In Two Years & You Can Too by Vincent James

How This Kid Made $60 Million In 18 Months

How I made a million in 3 months.

How I made over $2 million with this blog

How I made my first million: Schoolboy entrepreneur…

7million7years- How to make 7 million in 7 years …

How I made a million dollars investing in real-estate

One link is about making millions in real-estate; another through marketing your business; another through online businesses; another through promoting yourself via your blog, and so on …

In fact, you’ll find one guy talking about how to make $7 million in 7 years through commercial real-estate and business 😉

At least that is the vibe that I am picking up, if Ryan at Planting Dollars (who kindly mentioned my blog in this post about personal finance outliers) is representative of my readers:

There are two blogs in the personal finance arena that are obviously outliers.

Adrian at 7 Million 7 Years… How many people do you know that are worth 7 million? Adrian did it in 7 years and writes about his strategies that are, of course, not common sense and not mainstream. He advocates starting businesses and investing in commercial real estate.

Jacob at Early Retirement Extreme… He retired in 5 years via traditional work, lots of traditional work, and cutting his living expenses to the bare minimum.

I may have used real-estate (both commercial and residential) – fueled by very modest (at the time) business-generated cashflow – to make my first $7 million, and then actually selling the businesses to make my next … but, I also used stocks, negotiating, options, gold, and relationships to make a few more million, as well.

Starting a business and/or investing in commercial real-estate may be the exact wrong – or right – strategy for you to make your $7 million in 7 years, too.

It all depends …

First, though, if there’s any ‘secret’ to making millions, it’s to truly understand the game of financial roshambo:

Stocks have no intrinsic advantage over Real-Estate; Real-Estate has no intrinsic advantage over Business; Business has no instrinsic advantage over Stocks.

This applies equally to how you choose to earn your money, as well as how you choose to invest it.

In fact …

It’s the combination of what you earn (income) and what you do with it (invest) that provides the compounding that you need in order to reach your Number.

For example, if you put a little extra salt-and-pepper into your income-producing strategy, you may be able to back-off the gas a little with your investing strategy (as long as you have cultivated excellent MM101 habits, so that you don’t just piss it all away).

On the other hand, if you are subsisting on a meagre office-job salary, you may need to ramp up your income with a little side business and you may need to seriously ramp up your investment strategy with some RE and/or stocks.

Three examples:

– I pursued a high risk / high reward business strategy to generate the cash that I then invested in real-estate and stocks to allow me to reach my Number; to ensure my success, I chose to push the risk throttle by expanding my businesses internationally.

– Josh has chosen an even higher risk / higher reward income-producing strategy by trading ‘penny’ pharma stocks with ever larger portions of his Networth going into one or two ‘trading positions’; I advised him to put a portion of his ‘winnings’ into lower risk / lower reward investments such as buy/hold RE, Value stocks, Index Funds, or (dare I say it), Bonds or CD’s to ensure that he reaches his Number.

– Mike has chosen a high-income-employment path to producing the income required to fuel his investment strategy, but has chosen to ‘invest’ his Net Worth mainly in cash. I advised him to maintain his current earning capability, but ‘up’ his investment risk profile up the scale to, say, Index Funds so that he can then pretty much cruise to his Number.

It’s different for everybody …

In neither Josh’s nor Mike’s case does commercial real-estate or business need to figure greatly in their journey towards their Number.

And, it may not figure in yours 🙂

Hypothetical Mike … and, Beyond!

The story so far:

The story so far:

Hypothetical Mike (the hero of our story) has super income-earning powers (ranging between $250k and $350k p.a.) … his powers also extend to corporate high flying, not to mention having a super-strong handshake 😛

His mission: to amass $10 million within 14 years.

But, like every superhero, he has a weakness: he keeps too much of his current $1.7 million networth in cash … $1.3 million of it to be precise.

Cash is kryptonite to financial superheroes like Hypothetical Mike!

Does HypeMike – as he is known in superhero and rapper circles – need to fly higher and higher in order to fulfil his mission? Or, can he simply destroy that stash of kryptonite and let the natural laws of investing wisely take over?

In an unusual twist, we let the readers decide the outcome of this story …

For example, here is what Steve said:

What are Hypothetical Mike’s Talents and hobbies? Based on what he likes to do in his spare time. I might recommend starting a business, that could bring in an income and later be sold for a nice return. This could help him reach that goal quite well. It would be less like running a business cause it would be something he enjoys anyway.

If HypeMike were a mere mortal, I would agree with Steve: you and I should ramp up our Making Money 201 activities in an attempt to accelerate our income …

… but, HypeMike already has his MM201 ‘money tree’ (i.e. his relatively high-paying job); coupled with his $1.7 million starting bank and his 14 year timeframe, he need leap no tall buildings to reach his Number.

A relatively mere 13.5% compound growth rate will do the job … PROVIDED that HypeMike doesn’t lose his main ‘super power’ i.e. his ability to keep earning superhero-like salaries.

Hypothetical Mike shouldn’t do ANYTHING to jeopardize his job, hence his income stream (e.g. moonlighting might be against company rules, or might distract him, tire him out, etc., etc.).

On the other hand, a number of readers commented that HypeMike’s money – merely sitting in cash – is his real problem. For example, Brad said:

If you are successful at running this business (you said you turned it profitable) then you should be in a position to negotiate larger and larger bonuses or equity ownership. Seems like THAT is what you are talented in. Don’t feel like you need to start investing in real estate or small biz because that is how OTHER people might have gotten rich.

I do agree that you should keep some cash positions if that makes you feel secure, but also to keep the bulk of your invest-able assets in at least an S&P500 index fund.

In my [AJC: emminently unqualified] opinion, Brad is 100% correct.

Hypothetical Mike should take a close look at Brad’s advice and follow it!

[Disclaimer: Brad is likely just as unqualified as I am to offer personal financial advice … always seek professional advice!].

A hidden risk of reward …

I have postulated before on the $5m5y Phenomenon: why is it that 80% of lottery winners, winning absolutely life-changing amounts such as $5 million (all the way up to $150 million) lose 100% of their winnings within 5 years?

I have postulated before on the $5m5y Phenomenon: why is it that 80% of lottery winners, winning absolutely life-changing amounts such as $5 million (all the way up to $150 million) lose 100% of their winnings within 5 years?

Think about it, it’s a staggering amount of money: how would you even go about spending $1m+ a year for 5 years, starting from an almost zero spending base?

Jake hits the nail on the head for at least one of those reasons:

When you hit your number or are well on your way toward it, how do you deal with family that are not making progress to their number (or likely ever will get there).

Specifically, how do you keep a cordial relationship – i.e avoiding acting like a heartless a-hole but also avoiding being the family patsy / sucker who pays for everything.

If you are making good progress toward your number, you are likely very hard working, talented and lucky. Chances are that family members lagging behind are lacking one or more of those traits, often the one associated with hard work.

Yes, after the houses, boats, vacations, girl/boy friends, and Ferraris come the financial-vacuum-cleaning carpet snakes:

Your friends and relatives 😉

Having had [AJC: too much] personal experience dealing with exactly this type of issue, let me try and give you some random pointers, which you will need as your journey progresses:

Stage 1 – When you are still on your journey towards your Number

– Lie about your financial circumstances; the corollary is to keep your spending under control, which has the side benefit of actually helping you to reach your Number

– Complain about everything: business is bad, your investments aren’t doing as well as you hoped, and so on

– Take a preemptive step: actually try and borrow money from those most likely to put the hard word on you [AJC: don’t try too hard though, you don’t actually want to owe your relatives anything]

Stage 2 – Just as you reach Number

– OK, it might be difficult to hide behind a veil of poverty (unless you are some sort of miser); so, you will need to rely on the old “can’t confirm/deny anything” … this is best done by attitude rather than words: in other words, when one of your friends says “Frank’s really loaded now”, just smile wryly or – if you have to say something – try “don’t believe everything you hear”

– You could still try and borrow money from your relatives to “help pay some back taxes that I owe … nothing serious”; this works best if you also put a For Sale sign on your Ferrari.

– At least try and keep your post-windfall spending spree in check; and, it’s likely – if you’ve been following the advice on this blog – that your Lifestyle isn’t going to to take a big jump, rather you will not have to work to maintain it.

Stage 3 – Making Money 301

You have your Number, but you forgot to build into your chosen lifestyle a certain amount for ‘paying off the friends and relatives’ [AJC: if you’re still calculating your Number, now’s your chance to put something in there], what to do?

– You will have no choice but to do certain ‘good deeds of kindness’; for example, we paid for two tickets for family members to fly to the US to see us. We flew them coach, provided no spending money, looked after them generously while they were with us (we paid for all meals, etc.), but they were grateful.

– Keep these ‘acts of generosity’ few and far between, or they will be soon seen as ‘rights’ and you will end up wearing all the cost with none of the benefit.

– Simply accept it as a ‘cost of doing [family] business’ that you will be the one footing the bill at all family events; we find ‘prior engagements’ for as many of those family functions as possible: out of sight, out of our pocket.

– Give 30% to 50% (only for family … friends get no more from you than anybody else) more generously for gifts than others; it will be expected and there’s not much you can do.

– Ditto for tips; if they know who you are, you had better be a little more generous if you want to avoid your food being spat in.

– Listen politely but offer little when friends and relatives come asking you for ‘advice’ … they are really sounding you out to ask you for money (they will call it a ‘loan’, but you know it for what it really is); your only protection is preemptive (see above).

– You are far better off to be seen doing ‘good works’ and giving to charity; the aim is to be seen as a good role model and something that your good-for-nothing-freeloading-ex-friends-and-still-relatives can aspire to when they make their own money.

Just remember, unless you built a huge Charity Case Buffer into the calculation of your Number, you have no choice but to let your friends/relatives do the right thing and work on their own Numbers … unless, you no longer want to be able to live your own Life Purpose?! 😉

You are already wealthy!

This guy actually talks a lot of sense … the subtext being that – in historical and/or Third World Country terms – we are already wealthy …

… so, don’t make your life about making money, make ‘making money’ about supporting your Life.

No more, no less 😉

Risk is in the eye of the beholder …

Our Philip Brewer Confest is almost over, and it’s time to thank him for his articles and inspiration for a series of posts exploring the concepts of safe withdrawal rates [AJC: which has more to do with financial planning than family planning 😉 ], however I did want to wind up by exploring one of his comments:

Our Philip Brewer Confest is almost over, and it’s time to thank him for his articles and inspiration for a series of posts exploring the concepts of safe withdrawal rates [AJC: which has more to do with financial planning than family planning 😉 ], however I did want to wind up by exploring one of his comments:

I think your step 1 is the most important: Decide what you want to do with your life.

I wanted to write fiction. That doesn’t take much money, but it does require time (and high-quality time at that). So, for me, getting free of a regular job as soon as possible was a much higher priority than accumulating a vast amount of wealth.

For me, too, the turning point for my financial life – indeed my whole life – came in Step 1: finding my Life’s Purpose then using that to calculate my Number. For me, though, it happened to turn up a Large Number / Soon Date … that may not be the case for everybody.

Just remember that Time = Money and if you are desperate to achieve that financial freedom (e.g. in Phil’s case, so that he can write that book) you may need a lot of both …

… IF so, then I have a hypothesis [AJC: tested on a subject of one i.e. me] that goes like this:

When you find your Life’s Purpose, you will most likely find that you will come up with a Large Number / Soon Date [AJC: remember, this is just my hypothesis albeit, now, supported by a little research] and you will not stop until you get it …

… your priorities (including your financial priorities) will drastically change.

But, what about Philip’s thoughts about risk?

I would like to suggest, though, that your ideas on which assets are secure and which aren’t could use some fine tuning.

It’s true that you may not be able to work during your retirement, but most people will be able to earn at least some money if they need to. It’s also true that government pensions can be taken away—but so can anything else.

And don’t forget all the other ways that things can be lost or taken away—declining market can sap your portfolio, a lawsuit can seize your assets, a natural disaster can destroy your house.

My point is not that it’s hopeless, but rather that while racking up assets may increase your standard of living, at a certain point it no longer increases your security. (A flood can destroy a house worth $1 million as completely as it can destroy a house worth $100,000.).

At some point—and to my mind the point is well before you have $7 million—you don’t get as much security from adding another million to your portfolio.

I beg to differ: until I made my $7 million Number, my thoughts were EXACTLY about ” adding another million to my portfolio” … but, that’s only because I calculated that I needed it – not want, not desire, but need – to live my Life’s Purpose.

But, that may not be you; like Phil, you might just need a little extra time to write your book or to support huminitarian projects like backpacking to hotspots like Haiti, so your Number may be $100k, $1 mill., or … ?

And, unlike me, your assessment of your Number may include allowances for earning extra income through part time work, income producing projects, pensions, inheritences, or even handouts.

In that case, I challenge you to substiute your Number where, in my blog, I use the $7m7y illustration … the principles won’t change much.

[AJC: unless, you have a “<$1 million in >20 years”-type Number, in which case this blog is NOT for you 🙂 ]

So, substituting your Number for mine, here is the second part of my hypothesis:

– While you are trying to reach [insert your Number] so that you can achieve your Life’s Purpose, ‘hold back’ concepts such as risk take a backfoot to ‘push forward’ concepts such as REWARD, suddenly opening your eyes to the ‘benefits’ of burning the candle at both ends, starting a business or three, trying to become a stock market and/or real-estate mogul, etc.

BUT

– Once you reach [insert your Number], somehow your brain resets such that RISK (i.e. protecting your nest-egg) seems to become much more important than reward (i.e. growing the nest-egg) and all of a sudden CD’s, bond laddering, (dare I say it!?), index funds, 100%-paid-for-by-cash real-estate, etc. becomes much more attractive.

At least, that’s how it happened for me …

This doesn’t mean that risk isn’t important (after all, we spend a lot of time on this blog covering strategies to manage risk), it’s just that in some respects, it’s in the eye of the beholder 🙂

The Ideal Perpetual Money Machine …

So, it seems that creating a mix of bonds and stocks and then picking some magic withdrawal rate (e.g. 4%) is not the ideal way to plan our retirement (a.k.a. life after work) after all …

… instead, it seems that we need to create our own Perpetual Money Machine: a renewable resource of cash 😉

The ideal Perpetual Money Machine – at least, according to my liking – is Real-Estate (more wealthy people build their own Perpetual Money Machines using real-estate that any other investment, even more so than cash, CD’s, bonds, mutual funds, or stocks):

1. Real-Estate (particularly commercial real-estate, when purchased well) protects your capital and keeps pace with inflation; it will last as long as you do, and then some!

2. Real-Estate (when managed well -and, this is something that you CAN confidently outsource) protects your income (i.e. net rents; they will grow with inflation).

3. The bumps in your real-estate road can be managed with insurance and provisions: you can insure against most catastrophic losses (and, you can spead your RE investments to minimize even those risks), and you can keep a % of your rents (and, starting capital) aside to help smooth your income stream (against vacancies, repairs and maintenance, etc.).

For example, with $7 million (aiming for a $350k per year gross income – indexed for inflation – which should net $200k – $250k after tax), you could:

1. Keep $500,000 as a two years of living expenses cash buffer (one year to allow for the rents to start coming in, another year “just in case”),

2. Invest $6.5 million CASH into 5 x $1.0 million to $1.25 million dollar properties (allowing for closing costs, etc.),

3. Which should provide 5 x 7.5% x $1.0 million to $1.25 million = $400,000 gross rental income

4. Of which you would pay tax of 30% (say) and divert another 25% of the remainder to your ’emergency / provision fund’ leaving $215k (PLUS, tax benefits such as depreciation, tax deductions of cars, certain travel and other business expenses etc.).

After every few ‘good years’, you can trim your provision fund back to two years of living expenses, allowing you to buy some more real-estate (therefore, providing the basis for another future pay rise!).

If you don’t like real-estate, then you can always lower your spending expectations and dust off your bond-laddering books 🙂