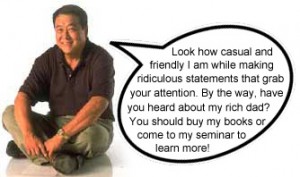

Where I fear to tread, Bargaineering boldly ventures; proudly proclaiming The Billionaire Secret: Avoid Ordinary Income, Acquire Capital Gains.

Where I fear to tread, Bargaineering boldly ventures; proudly proclaiming The Billionaire Secret: Avoid Ordinary Income, Acquire Capital Gains.

I won’t presume to tell you anything about being a bil-yun-air until I are one, but that doesn’t stop others from trying; Bargaineering says:

The key to building wealth is to build or buy an asset that can appreciate in value and/or generates passive income. The key to building or buying an asset that can do that is to convert your labor into capital (money). This is why saving for retirement, saving for a home, and saving in general is such an important piece of your personal finance plan. This is the billionaire secret because this idea is well understood by people who are wealthy. They see that capital gains taxes are much lower than ordinary income, that’s why Warren Buffet pays lower tax rates than his secretary. Capital gains are taxed at 15% for 2010 while the 15% tax bracket is the second lowest federal tax bracket (for those earning up to $34,000). It’s a no brainer, you want to transition, as quickly as possible, from ordinary income to long term capital gains and dividend income.

Have you ever seen those magic shows where the magician pulls some random guy out of the audience and gets him to try and copy what the magician is doing?

Presto!

The magician accomplishes some amazing feat and the other guy (gal?) ends up looking like a shmuck …

Well, that’s kind’a like what’s happening here – in fact, with most PF authors who write ‘get rich’ stuff. They are working by what they THINK they see other (real millionaires and billionaires) doing.

And, they see Warren Buffett playing with capital and saving on taxes and … presto!

“Convert your labor into capital (money)” and “capital gains taxes are much lower than ordinary income”, so “it’s a no brainer, you want to transition, as quickly as possible, from ordinary income to long term capital gains and dividend income”.

So, it’s a no brainer that you do all this (because the Billionaires DO do all of this, I think) and you’ll be standing there in 5 to 10 years as a poor shmuck.

Why?

You’ve missed the point entirely: how the trick is done, because it’s done behind the scenes … Bargaineering can’t really see it and neither can you.

Not because these billionaires are hiding anything (well, they probably are hiding at least a little) – unlike the magician who can’t afford to tell, not even once – but, because they have much more important things to do than write books and blogs.

So, from a multimillionaire’s perspective rather than a billionaire’s, let me share what I think is going on:

1. While you are trading hours for $$$ you lose

This is why I chose NOT to become a highly paid consultant, way back when I was a world expert (speaking tours and all) in my little niche. Don’t trade a limited commodity (time) for an unlimited one (money); you only have 40 to 60 hours a week to trade, no matter how much per hour you think you can pull, yet money is just bits of paper that Uncle Sam prints by the trillions.

Fortunately this one is simple: start a business; start investing … make your little bit of time and money work as hard as possible, until the money – on its own – starts to make more money for you. I think you can extrapolate?

2. Capital is better than income

But, it’s not for the tax-advantages … I don’t do anything BECAUSE of the tax advantages (for one, Uncle Sam loves to change those rules at the drop of a policy change); I simply take ’em when they come.

But capital is a tool for creating income; it’s a little like that time/money thing. The best you can do is create your perpetual money machine: use your income to buy a little capital (real-estate is nice) which generates more income (from rents, after mortgage and other costs) which you pump back into buying more ‘capital’; repeat until rich!

Finally, Bargaineering says:

While the 2% you can get at a high interest savings account isn’t going to set you for retirement, that income represents your money working for you. The problem with this approach, at least for the long term, is that interest income is considered ordinary income. It’s taxed at the higher rate, which makes it a bad idea.

Do I really need to explain why the problem here is the 2%, not the taxation rate?

None of this get rich(er) quick(er) stuff works, if you don’t get your annual compound growth rate to infinity and beyond … well, at least to 15%+++ 😉

This is the view from my tennis court (taken just as the house was almost ready to move into). Which neatly brings me to Budgets are Sexy, who asks: “do you you still want to live in a mansion?”

This is the view from my tennis court (taken just as the house was almost ready to move into). Which neatly brings me to Budgets are Sexy, who asks: “do you you still want to live in a mansion?”