Not strictly about personal finance, but building a startup is one (highly risky) way of making $7 million in 7 years!

It also happens to be one of my twin passions (the other, obviously, being personal finance) … and, one of the key components of my Number was a $500k ‘startup fund’.

I realized – before I even made my 7m7y – that I wanted (amongst other things) to become a ‘venture capitalist’, but I was well aware of the 7-2-1 formula, which goes something like this; for every 10 startups that a VC funds:

7 will lose money (probably the VC’s entire investment)

2 will break-even (maybe even returning the VC’s initial investment, but not much more)

1 will make the other 9 ‘failures’ all worth while!

Based on these numbers, to invest in the ‘bricks and mortar’ world would be simply too expensive … especially if the 9 failures came before the 1 success (obviously, the VC doesn’t know which one will be successful or she would never invest in the other 9), but not so the online world.

It’s not a stretch to see that several – or, even 10 – (potential) Facebooks and Twitters could be created with a $500k investment pool and some smart, committed cofounders. If FaceBook was started with $1,800 (or so the movie implied), then $50k should buy a whole lot for one online business … and, $500k should be enough for all 10 that it might require to find that single, wonderful success story.

So, it seems that I am on the way having met with my two cofounders today. Unusually, I didn’t know them before hand …

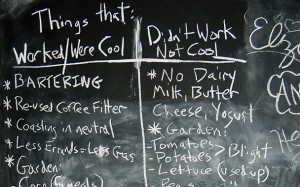

But, I’m getting away with myself: this isn’t my first recent such startup (obviously, my older B&M businesses were also startups in their day, eventually being sold for tidy sums). In fact, I have two complete, functional Web 2.0 (whatever that may mean!) sites sitting on a shelf, gathering dust.

With both of those, I made the mistake of building Kevin Costner’s Field of Dreams (because, I already had the relationships with the right IT build team) and thought if they build it THEY – the right cofounders – would come. But, they didn’t 🙁

So, this time, I decided to find my cofounders first (marketing and operations) before funding the IT build. Pretty obvious really … not sure why I didn’t see it at the time. I guess it was the case of having too much money burning a hole in my pocket – and, burn it did!

So, this time, I patented the idea (another waste of money, but more to make sure I wasn’t infringing on anybody else’s turf), put up a couple of ‘stealth-mode’ placeholder sites, and set out to find The Team.

I realized that I needed people with experience in the online space; so I cast a search for “social marketer [my city]” (there’s a neat little tool you can use: google) and found a meetup group that happened to have a ‘mail all members’ facility … so, I joined and spammed all the members with a “looking for partners” message.

I realized that I needed people with experience in the online space; so I cast a search for “social marketer [my city]” (there’s a neat little tool you can use: google) and found a meetup group that happened to have a ‘mail all members’ facility … so, I joined and spammed all the members with a “looking for partners” message.

You don’t get anywhere in life by being conventional 😉

Today, the three cofounders met (me and the two I found by cold-calling for partners) and agreed that we’re moving ahead with my new idea …