A couple of weeks ago, I responded to a reader request from a young doctor who is on what can only be described as an OMG level of income:

A couple of weeks ago, I responded to a reader request from a young doctor who is on what can only be described as an OMG level of income:

I am a young physician (early 30s) making approximately 800k per year. After expenses and taxes, I am left with ~300k to save/invest.

Never mind the fact that he is losing approximately $500k a year in “expenses and taxes”, a $300k take home is still pretty good in anybody’s language!

There was plenty of well-considered reader debate and advice for the young doctor, including this highly-reasoned argument from traineeinvestor:

I’d suggest he continue to focus most of his energy on maintaining or growing his professional income. Time spent on side ventures and investments should be limited so that it does not interfere with the $800K professional income.

In terms of investments, given his time constraints, I’d go with a Boglehead approach, possibly supplemented with some geared cash flow positive real estate (especially if he lives in the US and can take advantage of depressed prices and long term fixed borrowing costs).

I agree on both counts:

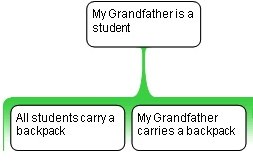

a) When you are earning a super-high level of salary, your primary goal should be to protect that source of income. It’s a river of money: you should do everything in your power to keep it flowing!

b) However, you shouldn’t just let the money flow into the taxman’s pocket, then into yours, and then out again by increasing your spending. Instead (and in keeping with our ‘river’ analogy) you should also build a downstream dam.

And, you should only open the sluice-gates to let off a much smaller amount than is going into the dam …

And, you should only open the sluice-gates to let off a much smaller amount than is going into the dam …

Why?

Because that’s the only way that the dam gets to fill up!

This way, when the river stops flowing (ideally, at a time of your choosing i.e. early retirement, but it could be forced upon you even earlier for a variety of reasons), you can keep the sluice gates open, knowing that there’s still enough water in the dam to keep the flow running for the rest of your life.

In other words: you don’t want the dam to run dry before you do 😉

But, this is much harder to achieve than you may think, so here’s where I differ – but, only slightly – starting by reversing the order of traineeinvestor’s otherwise excellent investment strategy:

I’d go with a geared cash flow positive real estate approach (especially if he lives in the US and can take advantage of depressed prices and long term fixed borrowing costs), possibly supplemented with some Boglehead-type investments.

The reasons are two-fold:

Firstly, I’m not accepting that 62.5% (i.e. $500k) of our doctor’s $800k earning capacity can simply be wiped off in “expenses and taxes” …

… professionals are just sitting ducks when it comes to taxes.

But, by implementing a nicely geared (and, maybe even cashflow negative after depreciation allowances) real-estate strategy, there may be deductions that can legitimately increase his super-high professional’s take-home income, without falling afoul of the tax man.

This is a clear-cut case of where a professional’s advice can add huge value [AJC: not in asking “is real-estate a good investment for me” but in asking “is real-estate a good tax-advantaged but highly legitimate investment vehicle for me?”], and our doctor should not take another step without seeking such professional advice.

Secondly, he should go through every single expense with his accountant and see what he can reduce or better manage. Nobody can afford to burn $500k worth of dollar bills …

… not even a super-high-income doctor.

Secondly, real-estate (especially when prices are depressed) is just a great long-term investment.

With his $300k (and, hopefully much more once he implements some of his accountant’s tax and cost-management advice) cashflow plus any income that he receives from his tenants, the doctor can afford to leverage quite a large portfolio of such high-quality, long-term, income-producing investments.

And, it is this large portfolio that becomes his growing ‘dam’ of cash, trickling out at perhaps a $100k – $150k sustainable annual spending rate … one that he should be able to index with inflation and maintain for his whole life, whether he (one day, perhaps quite soon) chooses to work full-time, part-time, or not at all.

And, isn’t that the whole (financial) point of it all?