Mike is a divisional CEO for JP Morgan (runs a whole country for them!), and he earns $250,000 in a bad year and $350,000 in a good year. He’s running fast and aiming high.

Mike is a divisional CEO for JP Morgan (runs a whole country for them!), and he earns $250,000 in a bad year and $350,000 in a good year. He’s running fast and aiming high.

But, is Mike aiming high enough?

If you weren’t following the comments on this post, then you were missing out on more than 50% of the benefit of that post … I think that also holds true for most of my posts; our readers rock!

Anyhow, Mike said:

I’m 36 and have already got up to the savings level of someone who is 50 or 55… question is when do I want to take it easy and stop working for a while- or at least working make myself rich instead of JP Morgan, who owns the company I’m running!

Aspiring to the savings level of someone who is 50 or 55 is no great shakes; it’s where Mike goes from here that will dictate his future, so I asked Mike a few questions:

Disclaimer: We know next to NOTHING about Mike’s true situation, so nothing here constitutes financial advice* … it’s best if you – and, Mike – treat this as a hypothetical, merely illustrating how to apply 7m7y ‘rules’ to somebody on an income rather than working their own business/investments. On with the questions …

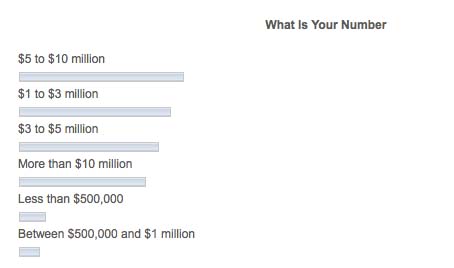

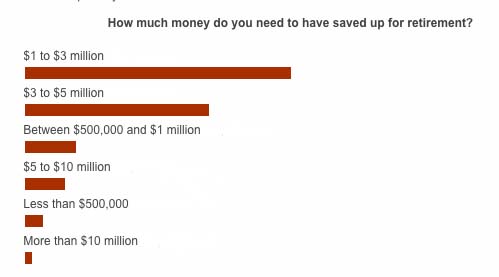

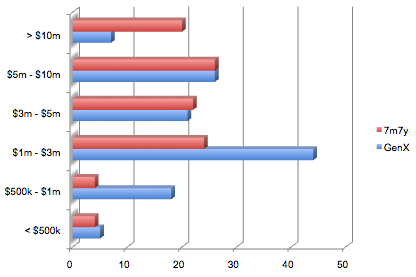

1. What’s your Number?

2. What’s your Date?

3. Why?

4. What’s your Current Net Worth?

It may be that Mike’s presumably super-high salary (after all, he is running JP Morgan in his neck of the woods!) combined with an aggressive savings / investment strategy will do the trick …

Mike’s response:

Salary isn’t super high – only $260K USD a year (base salary & guaranteed bonus) – max variable bonus on top of this is another $100K so it’s comfortable but not huge.

My number is abour 10 million – would like to hit it in the next 14 years or sooner.

Current net worth is 1.7M USD with $1.3 M in very liquid assets (cash…) Residence is fully owned and monthly burn rate is pretty low.

Given that Mike’s Prime Financial Objective should be to reach his Number by his Date, his financial strategy should be the one that he is most comfortable with that seems most likely to achieve that target …

… IMHO, he (or anybody) should only choose a more ‘active’ (read: risky) strategy if it’s a by-product of the strategy that he truly resonates with …. for example, I would start a business even if plonking my money in CD’s would have been enough – that’s just me [AJC: but, it wouldn’t have been all of my money – or even a lot – going into starting that business].

What does this mean for Mike … I mean, Hypothetical Mike? 😉

Well, let’s go through the steps:

STEP 1 – What is Your Number / Date?

Mike’s Number is $10 Million and his date is circa 2023.

STEP 2 – What is your Required Annual compound Growth Rate?

Starting with his $1.7 million Net Worth [AJC: reading between the lines, Mike’s paid off house may not even ‘break’ the 20% Rule – and if it does, not by much, so I don’t see a problem here] our faithful online calculator shows me that Mike ‘only’ needs a 13.5% Required Annual Compound Growth Rate on his Net Worth.

[Tip: If you haven’t used this calculator before, it’s simple: Mike’s ‘ending value’ is his $10 million Number; his ‘starting value’ is his current $1.7 million Net Worth – although, I would be tempted to subtract cars/furniture and any other personal ‘stuff’ that can’t be easily turned into cash and/or loses value … house is probably OK to include here – and, ‘the number of periods’ is just his 14 year Date]

STEP 3 – Select your Growth Engine

This is where it gets fun … Mike simply needs to take a look at Michael Masterson’s table of ‘money making strategies’ – handily reproduced for you in this post – to see that any number of strategies will be enough to propel him from $1.7 million to $10 million in 14 years: anything from stocks to real-estate to small business.

But, not CD’s … this calculator shows that Mike’s biggest risk is actually the low-risk ‘investment’ option that he has so far chosen: cash …

… if he keeps ‘investing’ in cash, Mike’s Number will be struggling to reach $3 million in 14 years, rather than the $10 million that he needs 🙁

Rather than being the ‘safe haven’ that it appears, keeping his assets overly-liquid is actually stopping Mike from reaching his financial objectives … worse still, it’s forcing Mike to think about chasing more income, when it’s the exact opposite strategy that Mike should be following!

That’s why, I recommend that Hypothetical Mike choose stocks and/or real-estate in whatever mixture of either / both that suits his temperment.

Now, we are talking Value Stocks when we suggest a 15% compound growth rate, and reasonably well-geared (i.e. no more than 25% – 30% starting equity) commercial real-estate – mixed with stocks – when we suggest a 30% compound growth rate.

But, here is the key …

… for Mike, and anybody else whose primary Making Money 201 ‘accelerate your income’ tool has been climbing the corporate totem pole to a position where (a) income is [relatively] high, (b) expenses are reasonably low, so (c) saving rates are high, their net worth will most likely grow even if they merely plonk their money in their 401k and/or Low Cost Index Funds…

You see, Mike will continue feeding his Net Worth with both Investment Returns AND additional salary contributions.

This means that Mike will most likely reach his Number simply sticking his money into low cost index funds:

Mike should follow the advice that Warren Buffett gives to all the Hypothetical Mikes of this world … in fact, it was virtually tailor made for his situation:

If you are not a professional investor, if your goal is not to manage money in such a way that you get a significantly better return than world, then I believe in extreme diversification. I believe that 98 or 99 percent — maybe more than 99 percent — of people who invest should extensively diversify and not trade. That leads them to an index fund with very low costs.

Given that Mike’s current salary / job makes reaching his Number a virtual gimme – with such a variety of relatively low impact [AJC: certainly in the context of amassing a $10 million fortune!] Index Fund, Value Stock, and/or Real-Estate investment strategies available to him, what would you advise him when he says:

Right now my best option is to continue to get a successful track record (already turned around the business and changed it from major losses to modest profits) and maybe I can find a better gig.

What advice would you give to Mike?

I know what I would say 😉

* [Insert: ‘Not qualified financial advisor; not financial advice; seek qualified advice before investing; take two Tylenol and call me in the morning; yadayadayada’ disclaimer message of choice]

The story so far:

The story so far: