I’m a voracious reader of anything that purports to teach you how to be rich … when I needed to learn, I read everything hoping to find ‘the answer’ … and, after I made it, I continued reading (but, I must admit that I am more discerning now) mostly out of curiosity (to see what others are saying).

In both cases, I was almost invariably disappointed … hence this blog.

But, I was pleasantly surprised to read an article with a [groan] headline: 5 Secrets of Self-Made Millionaires …

… it’s actually not that bad. Not rocket-science, but not anywhere near as bad as most similar articles and books are.

Here are the 5 ‘secrets’ and my take on each:

1. Set your sights on where you’re going

T. Harv Eker, author of Secrets of the Millionaire Mind [another groan] says:

The biggest obstacle to wealth is fear. People are afraid to think big, but if you think small, you’ll only achieve small things.

Wanting to be wealthy is a crucial first step.

I obviously agree; if you don’t understand why, you must be a new reader [Hint: It’s to do with discovering your Life’s Purpose and Your Number / Date]

2. Educate yourself

You’re reading this blog post … and, I wrote it, didn’t I? ‘Nuff said 🙂

3. Passion pays off

See 1. above … ZZZZZzzzzzzzzzz

4. Grow your money

Well, d’uh!

But, Loral Langemeier, author of The Millionaire Maker, adds something sensible:

The fastest way to get out of that pattern [the never-ending cycle of living paycheck to paycheck] is to make extra money for the specific purpose of reinvesting in yourself.

[AJC: I would delete the last two words, which are hokum; it doesn’t cost much to “reinvest in yourself” except time … for example, this blog is FREE].

I like this part [AJC: I bolded the part that I like the best … I like it, because I did it, too; that’s how I raised the capital to expand to the USA i.e. from profits left in the business]:

A little moonlighting cash really can grow into a million. Twenty-five years ago, Rick Sikorski dreamed of owning a personal training business. “I rented a tiny studio where I charged $15 an hour,” he says. When money started trickling in, he squirreled it away instead of spending it, putting it all back into the business. Rick’s 400-square-foot studio is now Fitness Together, a franchise based in Highlands Ranch, Colorado, with more than 360 locations worldwide. And he’s worth over $40 million.

I also like:

If you want to get rich, you need to pay yourself first, by putting money where it will work hard for you—whether that’s in your retirement fund, a side business or investments like real estate.

5. No guts, no glory

If there’s any one secret in all of this, it’s this one:

Iif you are a timid mouse (like me), you either have to learn to roar (like I had to) or learn to live with a Small Number / Never Date.

Getting the Life’s Purpose ‘religion’ is one way to put the fire in your belly … it worked for me.

Oh, and they leave the best secret to last (at least the author feels it’s the best), which is funny because this would then be Secret # 6:

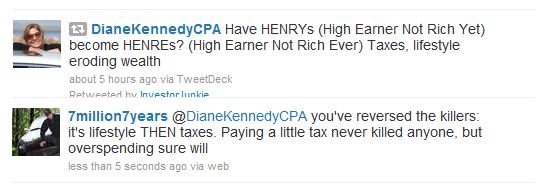

The Biggest Secret? Stop spending.

I agree with everything AFTER the ‘?’ above 😉

If you don’t have the money to invest, don’t spend … it’s simple!

But, I don’t agree with this:

Every millionaire we spoke to has one thing in common: Not a single one spends needlessly. Real estate investor Dave Lindahl drives a Ford Explorer and says his middle-class neighbors would be shocked to learn how much he’s worth. Fitness mogul Rick Sikorski can’t fathom why anyone would buy bottled water. Steve Maxwell, the finance teacher, looked at a $1.5 million home but decided to buy one for half the price because “a house with double the cost wouldn’t give me double the enjoyment.”

Don’t believe that Millionaire Next Door cr*p; some multi-millionaires are frugal – even some Billionaires (most notably Warren Buffett) – but, don’t be fooled into believing that’s the majority of multi-millionaires:

I have a friend who works for a 35 year old Russian immigrant who is now a hugely successful hedge fund manager (yes, he’s survived the GFC as far as I know. I’ll check when I’m on Safari in South Africa with my friend later on this year); my friend overheard him explaining to his daughter that he was going to take the family jet to a business meeting, so she would need to fly on a commercial airliner with her mother to get home from their vacation.

This is what he said to his daughter: “You know that there will be people you don’t know on that plane” … at 8 years old, she had never flown other than by private jet!

Another friend works in MLM and had breakfast with that company’s # 1 distributor – a nice, young lady. She receives a $600,000 check every month. She just bought a mountain in Colorado and a special tractor, so that she could grade her own private ski run.

I hope she puts a lot aside for a rainy day; gives overly generously (money and time) to charity and those in need; and, joyfully spends the rest!

I have a simple rule: spend freely, when it doesn’t make sense not to.

Think about that, and let me know what you think it means …