Actually, it’s not the problem with Henry, it’s the problem with HENRY: High Earner Not Rich Yet.

Included in this group, a group that most workers mistakenly aspire to, are those doctors and ceo’s (at least those not in the Fortune 500) that I mentioned in yesterday’s post.

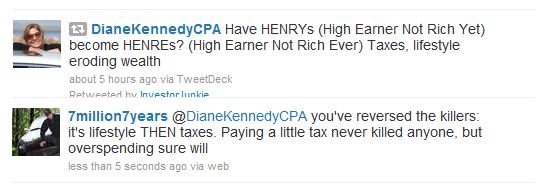

Now, this is only interesting because I can now answer the question posed on Twitter [AJC: you can glance across to the right to conveniently find a link to my Twitter account].

Dianne Kennedy (CPA), I think erroneously, links HENRY’s to taxes then lifestyle, but (as my article some time back about doctors also said), I think it boils down to three non-tax (even though taxes hurt!) issues:

1. As your income grows so does your spending … then some!

2. Keeping up with YOUR Jones (i.e. other high-flying corporate executives and professionals) is VERY expensive

3. You can’t sell a salary package (like I can sell a business, some shares, or a property or two) when you decide to retire

[AJC: You need both a big 401(k) – see reasons 1. and 2. why this doesn’t happen – and a huge golden parachute, which may / may not happen to compensate for reason 3.]

If HENRY’s want to become rich, they have only two choices:

– Get lucky, or

– Invest a very large % of their annual earnings

Let’s assume that a HENRY – conveniently named Henry who happens to be ceo of a medium-sized business – is earning $290,000 and has already managed to save $1 million – our consummate Frugal Investor – and has arranged things so that he can continue to save a very hefty 35% of his salary (this is all pre-tax).

After 22 years, Henry will have saved just enough (in Rule of 20 terms) to replace his $290,000 ceo’s salary … by then, inflation adjusted to $661k per year, assuming that he wants to maintain his lifestyle [AJC: more importantly, assuming that he can – and wants to – ‘ceo’ for 22 more years … if he ‘only’ starts with $500k in savings, he’ll need to work for at least 26 more years].

Seems easy, but human nature [read: urge to spend it up] is what it is …

I should know: I was ceo of my own business, employing over a hundred people across 3 countries (USA, Australia, and New Zealand).

I paid myself $250k per year, and had cars, cell phones, laptops, and health insurance all paid for by my company – I reinvested all the remaining profits in these businesses.

I had a $1.65 million house in the ‘burbs, paid for by cash (s0, no mortage), and two children in school (one private, one public). We traveled domestically and/or internationally once or twice a year as a family, ate at ‘normal’ restaurants (and, the occasional top-tier eatery).

I can’t see how I could have saved 1/3 of my salary … I couldn’t even save 10% 🙁

Of course, I could have saved 10% if I really tried, but my point is that it’s very hard to save 30% of even a high salary, unless you gear yourself up to do it from the very beginning.

[AJC: Look, it’s not my job to tell what should happen as you get richer, but the reality of what will happen and how to do better … when you get to $250k you will bring with you exactly the same spending and saving habits as you have today, if not worse. Moral: start MM101 today!]

In other words, don’t divert all of your creative energy into playing Corporate Lotto (i.e. chasing a higher salary) if you want to get rich – or, even to reach a more humble goal, such as becoming debt free (a dumb goal, IMHO).

First – and, as soon as possible – learn how to get rich (or debt free, or …) by taking action right now, with whatever you can bring to the table.

If your salary happens to improve along the way, all the better … but, don’t rely on it!

AJ, I will admit it – I am a HENRY.

If I look at myself and my colleagues I think high savings rates of 35-50% of gross (!) are actually not that uncommon. There clearly are those who blow all they get or even more, but in general most people are able to save a bunch and achieve their number by a young age (<45).

Key here I think is – as you pointed out – following a sensible life-style from the get go and not "treating" yourself at every corner. When I say sensible, I mean living well within you means and not living like some frugal miser who makes his own laundry detergent.

Big topics to help control spending: housing, cars, toys and entertainment. Its not how much you can afford but how much you need.

The same counts for someone who is successful as entrepreneur. If you just made $20M by selling a company, you will be worth a lot less if you insist on Ferraris, private jets or big yachts, just bc you think you can afford them now.

I believe that there is research which shows that envy is more of a driving factor than greed… that it is relative wealth that matters, not absolute wealth.

This is why the lower 10% in the USA feel so poor, even though they live like kings compared to poor Africans or poor Asians.

So, I completely agree with you about the point about keeping up with the Joneses. I personally don’t like to compete with people on that level; I find it is petty and stupid. I would rather stop socializing with people who do the same with me rather than continue to be friends with them.

I want to surround myself with people who are better than me intellectually or spiritually, not people who think that they are better than me because they have a bigger house or a bigger boat 😉

I think saying debt-free is “dumb” is a little extreme, but not all debt is bad, and devoting your money to paying down a 2% debt when you could be putting it somewhere else can be ill-advised.

My personal dream is to exit the rat race, and to do so non-frugally. I don’t want to “retire”; I want to escape from the rat wheel. I don’t think I need a 250k salary because I do fine on much less than that, but certainly 50k of rat-free income probably won’t be enough either.

I basically want to have the freedom to follow my passions, instead of working dozens of hours a week at something I don’t truly feel passionate about. I know nobody is going to just give it to me, so I’ll have to build my way there. This is what I’m currently learning, and this is what I like about your blog. Great stuff!

At least some high income earners can achieve high savings rates – I managed to save better than 50% of my pretax income for a few years in a row through a combination of spending controls, low taxes and increases in income. Even with two young children and mrs traineeinvestor now “retired” as a SAHM, I am still expect to save 40%+ this year and next year.

It is possible to hit your number based on savings and income – and without living in a cardboard box on a diet of beans and rice. That said, Adrian’s way is probably a lot easier – and more fun than working ridiculous hours for someone else for 20+ years.

“It is possible to hit your number based on savings and income – and without living in a cardboard box on a diet of beans and rice. That said, Adrian’s way is probably a lot easier – and more fun than working ridiculous hours for someone else for 20+ years.”

🙂

More fun, yes. But lower risk? I.e. do I have a surer shot of reaching my number by consigning myself to the Grind for a decade vs. quitting and trying to my find my inner Sergey Brin (and most likely failing)?

I for one will stick with the Grind for a bit longer until either I get thrown out of the saddle or I stumble across a good opp. to do my own thing.

Seems like a good number of us are HENRYs (or HENREs). My wife and I also manage to save about 35% of our wealth and still enjoy a few international trips a year. And we’ll do better now our house remodel is done.

We certainly have had the lifestyle inflation problem that Adrian mentions, and trying to curtail it is a constant challenge. After all, we work hard and we earned it. Right?

I will agree with Diane that people who earn most of their income through a salary are certainly the ones that have the highest tax burden (or really the least chance to mitigate it).

And I’m with Jake in that it will have to be the right deal before move. I fear the you are set into the “ratrace” (and the more successful), the harder it is to switch gears.

“Big topics to help control spending: housing, cars, toys and entertainment. Its not how much you can afford but how much you need.”

@ Jake – In our case, these were either paid for (house), provided (cars), or cheap ($10k for all of our TV’s etc. once off).

If I go from personal experience, the big topics that ‘killed me’ financially-speaking were really the recurring expenses: private school fees ($15k x 2 p.a.); land tax ($30k p.a.); memberships (family gym/tennis); private lessons (tennis x 4; gym x 1; golf x 2); travel ($20k – $40k p.a.); eating out ($200+ p.w.).

As my income increases I’m proud to say I still live like a bum/slob! Pizza anyone?

The key to saving a bundle while in a high paying job:

1. Buy a small house or condominium outright. Ideally would be the smallest space you can be comfortable in, with larger space there is more to clean, more utility costs and more taxes.

2. Defer on having kids or don’t have children.

3. Budget 10% of your gross income for discretionary spending & travel.

4. You should still be able to save 45-50% of your pre-tax income.

-Mike