Please keep sending your questions and comments either via e-mail [ ajc @ 7million7 . com ] or via the comments; I answer as many personally and/or here as I can …

… for example, Mike asks:

Are your rules of thumb like making 15% year on year in the stock market still true in an environment when treasuries and inflation is so low?

One of the reasons pension funds are blowing up left and right is that there are assumptions on portfolio rises of 8% per year… so should you be pulling down those numbers of expected returns?

This is a great question … so much so, I’m wondering why anybody hasn’t challenged them before, considering the current market.

Yet, my answer would be – and was – and is:

We’re not concerned, here, with what stock markets are doing now, [not] like pension fund managers and traders are …

The reason is simple: we’re not trying to invest to achieve the greatest possible returns now, as traders and pension fund managers hope to achieve …

… we’re here simply to reach our [large] Numbers by our [soon] dates.

By ‘large’, we’re talking $7 million (give or take a few million) and by ‘soon’, we’re talking 7 years (give or take a few years).

We’re not talking this year, or even the next, or the next, or …. we’re totally focussed on that end result.

Besides, traders and fund managers who chase the market fail … and, fail miserably 🙁

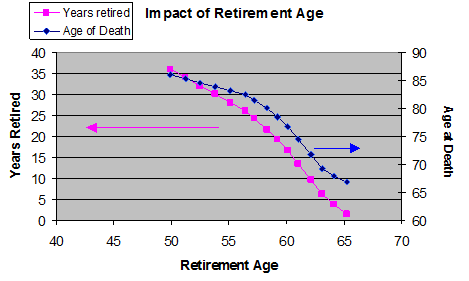

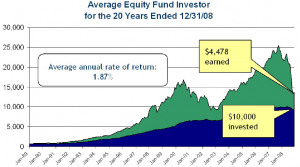

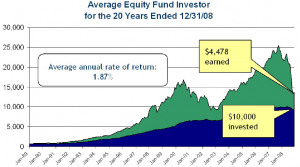

Here’s what happens to ordinary folk who try and time the market, because they are worried about [temporarily] low returns or are chasing [temporary] high returns:

This shows that no matter what gyrations the market had over the last 10 years – as shown by the green area – the typical investor never managed to keep up – as shown by the blue area – not by a small margin, but by a HUGE CHASM, managing a return of only 1.87%

Think about it: the average investor (that’s you and me) only managed less than a 2% return, over the 10 year period 1998 to 2008, when the market returned over 8%.

That’s worse than simply sticking your money in the bank!

[AJC: to show it’s not just a function of the current market, this huge discrepancy also held true for Dalbar’s earlier study]

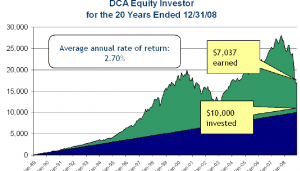

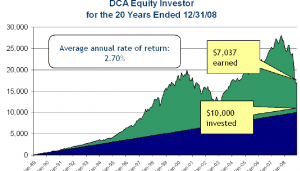

And, if you think that’s because the average investor is a know-nothing dolt and you can do better; here’s what professional fund managers managed to achieve:

2.7% … that’s the best that even the professionals could manage.

Why?

Because both professional fund managers and investors (yep, even those who BELIEVE that they are buy/hold long-term investors) switch in and out of the market, altering their strategy [AJC: a nicer phrase than greed and panic] as markets rise / and fall … obviously, timing things terribly.

That’s why when I talk about investing – and, the associated rules of thumb – I look at the average returns over a long period. I sometimes even advocate looking at the lowest average returns over a similar period.

Yes, if your Number is soon, then you will need to look up my references (they are sprinkled thoughout my posts) and choose more appropriate estimates and take your chances along with the rest of the speculating masses …

… but, for planning your Number and then acting out your strategy you can – and, probably will – do much worse than simply following my ‘rules of thumb’.

After all, I have made $7 million in 7 years – and, this blog is all about helping you do the same – using these exact, same strategies that I teach here.

* Footnote: in the interests of full disclosure, here’s what I told a reader on Monday:

I hope that everything here rings true; I try and give all stories from personal experience. But, not everything happened for me in a nice, clean order: for example, I only found out about the 20% Rule a couple of years ago.

Sometimes, I simply have no choice but to talk from personal experience about ‘rules’ that I found out about a little too late 😉