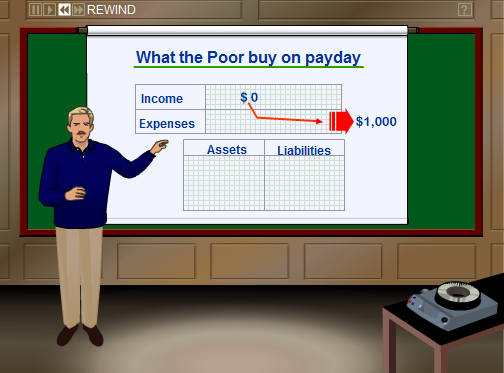

This guy is a network marketing guru; but, don’t let that put you off … this first video [to watch just click on this link] is a first-class explanation of what the rich do that the poor and middle-class do not.

BTW: the first half of the next video that will pop up after this one, is also very good … but, I stopped watching when it started to get into Network Marketing.

Don’t let that stop you if you have an interest in learning more about MLM; as Seinfeld would say: “not that there’s anything wrong with that!” 🙂

I stopped watching after about 30 seconds when he claimed that a house was a liability.

@ TraineeInvestor – That’s straight out of Robert Kiyosaki 101 (a.k.a. Rich Dad, Poor Dad); how about if we instead say:

“Having too much equity in your own HOME can be a LIABILITY … particularly when it comes to attempting to reach your Number [AJC: esp. if Large / Soon]”? 😉

I saw this a few years back. Great video series. I agree that a home in most instances is a liability. If you live in it, it’s not producing you any passive streams of income, unless you are tapping the equity gained from it every so often. I agree with Robert K’s statement: “An asset is something that puts money into your pocket, while a liability takes money out of your pocket”. So far, owning a home for several years has only taken money out of my pocket in upkeep, repairs, interest on hefty mortgage payments, realtor fees upon selling, etc…Maybe after selling a home after owning it for 20 years it will put a little extra coin in your pocket, but it won’t get you wealthy the likes of anything close to a healthy “number”.

“unless you are tapping the equity gained from it every so often”

@ Scott – Hopefully, the 20% Rule ‘forces’ this to occur every few years.

“Maybe after selling a home after owning it for 20 years it will put a little extra coin in your pocket”

@ Scott (again!) – This is the back-of-mind dream, isn’t it? Maintain a lovely home then sell it when the kids move out, to free up extra retirement money.

But, does it really work? Maybe it will, maybe it won’t …

In my area, run down’ homes sell for not much more than nice new townhouses … the sort of trade that most retirees would hope to make … after changeover costs, I can’t see much positive impact to their Number. 🙁

By this definition Obama, Tim Geithner, the FED and the US Gov’t are all huge liabilities.

And by this definition an Asset is a good paying job or anything that generates good cash flow.

Good video though.

-Mike

@ Mike – Text book definitions are also liabilities … except for the entrepreneurs who compile, publish, and sell them! 😉