Well, the first thing thing that I will say is that you had better finish what you start …

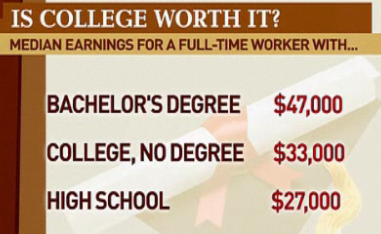

… because, if you don’t complete your four year college-level degree, you will probably still end up with the average student debt of $20,000 but only earn $4,000 a year more for your troubles!

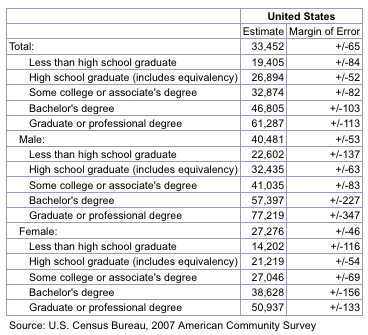

But, let’s take a closer look at what the US Census Bureau has to say about students who do complete their degrees against those who don’t:

OK, so for a $20k ‘investment’ (at least, if we assume the average debt left behind), the average college grad. can earn an extra $19k – $20k per year; sounds like a great deal?

It seems that we forgot to account for the extra four years of income that the high-school grad (but no college degree!) earned while you were off at the frat or sorority house!

So, let’s say that the college graduate starts (4 x $27k) + $20k behind the 8-ball … how long does it take him to catch up?

Well, if we assume that both achieve 4% yearly salary increases (starting from the same date that both are working, keeping in mind that the high-school-only grad. has already put four solid years of work in) and earns 8% on their investments (fueled by consistently saving 15% of their gross income), then we can see that it’s a ‘no brainer’:

– The College Grad would have saved $794,000 after 26 wonderfully exciting working years, and

– The High School Grad only saved $468,168 after 26 equally wonderfully exciting years working.

So, college is ‘worth’ $326k, in this admittedly highly-oversimplified example …. yippee!

But, readers of this blog aren’t thinking of spending the next 26 years working in the Quick E Mart, studiously saving 15% of their hard-earned income, just to earn 8% p.a. …

… no, they are preparing to be investors (say, real-estate and stocks) and/or entrepreneurs. Activities that high-school grads – and, even high-school drop-outs – can and certainly do in equal numbers to college grads!

You see, serious money making doesn’t discriminate on the basis of education … some of the world’s richest people have little to no formal schooling.

And, they aren’t wasting their ‘no college’ years earning $27k (and, salivating over their next 4% pay-rise) … no, they are busy reading this blog and starting their business/investment careers.

They have realized that serious wealth comes not from what you earn, but from the return that you earn on your money. So, with just the benefit of 4 years head start, they can turn a $20k per year earnings deficit into the same amount as a high-flying College Grad, by only increasing their annual return on that 15% savings from 8% to only 11.5%.

[AJC: If they can increase their return to serious real-estate investment territory of 20%, they will blow the college savings rate away by amassing nearly $3 mill. in 26 years, and if they achieve ‘entrepreneurial’ 50% p.a. returns, well they will join the ranks of the rich with more than $300 mill. to their name … really!]

Of course, if you choose to go to college – as I did, and will encourage my children to do – there’s nothing that says that you can’t also be an equally good entrepreneur and/or investor, on the side … or full-time 😉

Real-estate development is a risky BUSINESS, but it can be very lucrative and – provided the market doesn’t turn on you, hence the risk – you can predetermine HOW MUCH money you are likely to make and WHEN you can expect to have it sitting in the bank. All in all, not a bad MM201 activity … one that scales from small projects to large ones.

Real-estate development is a risky BUSINESS, but it can be very lucrative and – provided the market doesn’t turn on you, hence the risk – you can predetermine HOW MUCH money you are likely to make and WHEN you can expect to have it sitting in the bank. All in all, not a bad MM201 activity … one that scales from small projects to large ones. These exist all over the world …

These exist all over the world …

Take Mike’s point about raising business capital, from this

Take Mike’s point about raising business capital, from this  There’s nothing wrong with being debt free …

There’s nothing wrong with being debt free …