There’s nothing wrong with being debt free …

There’s nothing wrong with being debt free …

… which seems like I am flipping, when I should be flopping, about debt. Until you realize that I can just as equally claim that there’s nothing wrong with being in debt, either.

You see, it depends.

In fact, what I contend is that the majority of my readers NEED to be in debt … but, that’s not the same as advocating debt for debt’s sake.

Confused?

Let me explain by introducing you to a new reader, Lee, who asks:

I’ve been reading about this 20% rule and it does make sense, but after what happened with real estate over the past 18 months do you still think this is a good approach? Right now, I have about 55% equity in my home. To get my home to only be 20% of my networth I would need to refinance it to 80% LTV. I have a pretty low rate (4.625%) and only have 9 years 8 months left on my mortgage. Would you still recommend someone in my situation refinancing?

After a lot of confusing to’ing and fro’ing [AJC: you can go pack to that post and read all of the comments … in fact. I would encourage it, because this is one of my Top 3 most widely read posts], I asked Lee what I think are the critical questions:

1. Do you have a Date in mind, when you REALLY want (nay, NEED) to stop working so that you finally have time to live your Life’s Purpose?

2. Do you have a Number in mind, that represents how much you need in your nest egg (be that the bank, ‘passive’ investments, your house – although, you may need to think how you plan to access those funds to live from – etc.)?

If not, I suggest that’s your first task: think about your Number and Date. Already (or just) got them?! Good … now;

3. Will your current financial plans and strategies get you to your Number by your Date?

To which Lee responded:

As far as retiring by no later than 55, yes my current path will easily provide for that. If I choose to the pursue the passion I mentioned earlier, then that would impact the amount of money I would need in the short term, but would not affect my long term retirement goals.

If your current financial strategy is working for you – i.e. in that you are happy with your current work and financial arrangement, and believe that you can achieve your Number by your Date – why would you even think about changing anything, Lee?!

So, let me go back and clear up the confusion about debt for my other readers:

– If you can achieve your Number by your Date WITHOUT the use of debt then PLEASE do so,

– Otherwise, what choice do you have but the wise application of debt?

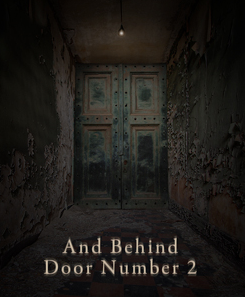

… I just happen to believe that for the vast majority of my readers, Door # 2 (‘wise application of debt’) is the one that holds their prize 🙂

Your right, there are a few who will undoubtedly reach their number/date,without incurring debt. But perhaps their number/date is set very low as to make that achievable without debt. However,many of us have plans which mean we will have larger numbers needed by our planned retirement date. So, for those, debt becomes about the only way short of robbing that guy who already has his number/date achieved.And,I personally wouldn’t suggest that to anyone. 😉

@ Steve – Yes … usually some combination of small Number and/or late Date. There’s nothing wrong with that … provided that your Life’s Purpose is achieved 🙂

Just give be a big, giant(albeit strong and safe) lever, just as Archimedes said and, i’ll move the earth, or in this case, my finances toward my number by my date! 😉