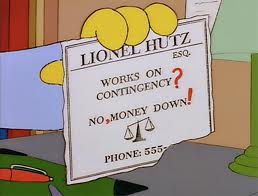

You’ve heard of ‘no money down’ deals for buying real-estate, but you probably have never done one yourself. But, did you know that it’s much easier – and, more profitable – to do ‘no money down’ deals in business?

You’ve heard of ‘no money down’ deals for buying real-estate, but you probably have never done one yourself. But, did you know that it’s much easier – and, more profitable – to do ‘no money down’ deals in business?

[Originally published on Biznik, the small business online network: http://biznik.com/articles/how-to-buy-a-business-with-no-money-down]

You’ve seen the late night infomercials on cable: “buy my course for only $149 (plus S&H) and learn the secrets of how to buy 52 properties this year with NO MONEY DOWN”.

Naturally, you’re sceptical – and, so you should be because ‘no money down’ deals on real-estate are far more rare than the infomercials would lead you to believe [AJC: post-financial crisis, now almost impossible] … and, some of the ways that they are done are ‘on the edge’ of ethical business practices to say the least.

That’s why I have purchased a lot of real-estate over the years, but have NEVER done a ‘no money deal’.

But, did you know that it is possible to do ‘no money down’ deals on businesses? And, not only are these deals ethical, but they can be win/win for everybody involved?

And, they can be so easy to put together that my 13 year old son [AJC: this was a few years ago, now] put one of them together for himself!

1. Let me start with my son’s example, as it is a good illustration of how simple the process can be:

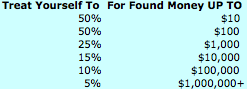

My son started a small e-Bay business, but he didn’t have the capital to meet the minimum order requirement of $100 from his online wholesale supplier.

So, he asked me to put up half the capital for that first order for him: $50. In return, he offered me 45% share in the business, which I accepted.

He made that order and sold the stock within one month and promptly bought me back out!

[AJC: he handed $50 back to me and said he wanted his 45% back; I didn’t have the heart to say “son, it doesn’t quite work like that …”]

Not quite ‘no money down’ … but, close.

Now his e-Bay business nets him a cool $30 a week (not bad for a kid who only gets $26 a month in Allowance)

[AJC: Now I’m extra sorry I handed back my equity for $50, because his latest online/part-time business – he’s still at high school – makes him $150k a year]

2. I had the opportunity to take over a defunct family business: it was a finance company that needed both working capital and bank funding (a lot of it!) to run.

Unfortunately, at the time, I had neither the capital nor the access to bank funding … in fact, I was $30k in debt. But, I did have a customer list.

So, I used the same ‘no money down’ technique that my son used: I found an investor (who happened to be a competitor, often the best place to go for help) who put up the 25% capital that the business required to get started.

I then found a bank willing to finance the remaining 75% simply secured against the ‘paper assets’ of the business.

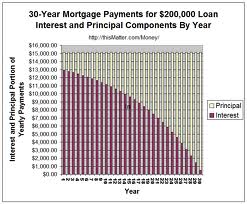

If you think about it, this is very similar to a ‘no money down’ deal on a property: find a partner willing to put up the deposit money in return for, say, a 50% share of the future profits, and a bank to lend you the balance as a mortgage over the property.

If the business is growing, my advice is to buy your partner out as soon as you can afford to … that’s what I did: we parted good friends. Make sure you always do the same.

3. Another way to do a ‘no money down’ deal for a business is where you have an asset that a larger company needs for their own business (preferably a non-profitable division of a larger company … believe me, there are plenty out there).

Most people are happy to sell this ‘asset’ to the larger company, or perhaps consult to them, for a fixed fee. Instead, consider ‘trading’ what you have for equity. Here’s how I did it:

I had some software that I used in my business that made our operation quite profitable; I found a Fortune 500 company that had a division operating in the same niche, but in another non-competing location, and discovered that they were still operating on older technology, hence, were unprofitable.

They offered to buy my software and consulting to help turn their own business unit around. However, we instead proposed a joint venture. For the ‘price’ of the software and our expertise, we received a majority share in that business unit. No money down!

It only took us two years to make the business profitable (using our software) and, we on-sold our share soon after for a huge return. We made about 7 times more profit by trading assets for equity than a simple software sale would have provided.

4. These are the types of ‘no money down’ deals that you should be looking for if you want to get into business or if you want to expand your existing business. But, there is an even simpler way:

If you want to buy an existing retail business with an existing lease … no matter what the asking price: ALWAYS start by offering No Money Down. Simply offer to take over their lease.

Many times that will be enough to do the deal … people need to sell their businesses for many reasons (marriage, divorce, moving) and are tied to their leases. By offering to take over their lease, you are removing a major headache for them … no money down!

Now that you have seen how easy it is – and, how lucrative it can be – to buy any type of business with No Money Down, maybe you will give it a try?

If you already have, please let me know your experiences …