Last week, I asked our readers what advice they would give to Chris, who asked for help getting out of credit card debt:

Over the past 2 years I have watched as my credit card debt has risen to over 13K. I have a very well-paying job, making 130K

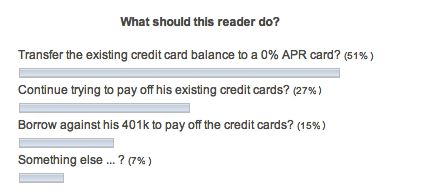

The vote is in and, as the graph shows, just over one quarter of our readers thought that Chris should just continue paying off his existing cards.

But, why pay at 13% interest, when you can pay the same debt at 0%?

And, if it takes you one year to pay off the 13% debt, say, then you should be able to pay it off in just 10.5 months at 0%, so why pay more/longer than necessary?

Fortunately, just over half of you thought that Chris should transfer his debt to a 0% APR card. I like this strategy … as I said last time, a dollar saved is exactly the same as a dollar earned.

This means that Chris has just earned 13% after tax interest, simply by moving the debt to a 0% card!

Of course, that doesn’t mean that you should now go out and rack up a whole lot of expensive c/card debt just so that you can move it to a low – or zero – interest credit card 😉

Whilst a good first move, another reader (whose name is also Chris) pointed out that just moving credit card debt from one card to another is not really a debt reduction strategy; you also need to figure out how to pay the card off before the 0% interest period expires.

Even more than that, this reader advises:

Not only do you need to pay them off ASAP. You need to cut them up so you don’t rack up debt for a third time…No one should be putting a honeymoon (aka vacation) on a credit card without a clear plan to pay it off.

The other option that Chris offered was to pay off his credit card debt by borrowing against his 401k; Chris says that he can borrow the money effectively at 0% and pay it back at his leisure (the ‘loan’ is at 4% interest, but that is actually credited back to his own 401k).

But, another reader, Steve, pointed out one potential flaw in this strategy:

He needs to weigh against what he could earn (inside his 40k) against what he saves from paying off this debt, and what he puts back in. If he is paying himself 4% interest into this 401k program,but could earn 7% by not taking it out, [it] seems like a bad idea.

I don’t think it matters greatly which option Chris takes as long as he:

a) eliminates the 13% APR debt immediately (either by moving it to a new 0% card, or borrowing other 0% funds to pay it off)

b) has a plan to pay off the outstanding (now 0%) debt off as quickly as possible

c) has a plan to stop the debt from re-accumulating once paid off

The bottom line: if you find yourself in a situation like Chris, follow the 2-Step Wealth Creation Strategy that I outlined in a recent post and you won’t go too far wrong in your own financial life 🙂

This makes perfect sense at a fundamental level. The only issue I see is the risk of credit damage and “emergency” spending. The debt is obviously not great to have but even the zero percent card is another hit on the ole credit report. Additionally, extra credit seems to always find an emergency need to attach itself to. What about a margin loan against a portfolio or a credit union loan? I use my margin to pay off higher debt all the time and it does not hit my credit(admittedly there are risks of a margin call).

If the debt is at zero percent, why would you ever want to pay it off – it’s free money that could be put to work earning a return? Maybe I am missing something (a zero interest rate product is not available where I live)?

Pingback: How to pay off credit card debt?- 7million7years | Debt Consolidation Loan Help

Most 0% offers expire after a period of time usually 12 months. At expiration of the trial period, the regular rate of the credit card comes into play.

@ Sean – Good point re keeping an eye on your FICO. I think Chris’ 401k ‘solution’ accomplishes the same thing as your margin call suggestions.

@ ML – Yes. The whole point of these 0% offers, is that the card issuers WANT you to keep a card balance post the 12 month honeymoon period. All the more reason to have a solid, < 12-month 'pay back then cut the card up' strategy, or don't bother signing up for yet-another-card 😉

I think it is very important to ensure that credit card debt is paid off and not ignored typically credit card interest rates are not that low so the existing balance of the card does increase quite rapidly when they are not paid.