It’s fairly safe to say that Mike is NOT a fan:

It’s fairly safe to say that Mike is NOT a fan:

I happened to stumble on this site doing some research on debt free. No wonder I’ve never heard of this site or even the radio show apparently associated with it. Anyone who thinks that living debt free is the wrong thing to do needs to have their head examined. That’s like saying Ohh we shouldnt live debt free we’re on the planet to make banks rich on our hard earned money. Nice mentality you got there. It just doesn’t hold any water. The question you should be asking yourself is would you rather live be constantly paying out your hard earned cash to banks making money off you not paying for your own assets or should you own your assets outright and control a greater portion of your hard earned cash? The choice IS obvious.

But, what of Mike’s aversion to paying the banks interest?

I look at banks a little differently to those like Mike who are averse to paying their interest, fees and charges …

… sure, I don’t like how they can mount up. And, I don’t like how the banks can make ‘super profits’ in good times and seem to get away with it. And, I don’t like those snooty tellers who look over their glasses at you, when you want to make a withdrawal, like they’re doing you some sort of favor by letting you have your money 😉

But, I can put that aside, when I realize that here is a partner who is willing to put up some – or even most (if it’s a real-estate transaction) of the capital to fund my latest entrepreneurial or investment endeavor, yet they want virtually no say in how I manage that business / investment once they have put their money in … and, I even get virtually 100% control over all of the daily management decisions and even, pretty much make the ‘sell’ decision on my own.

And, all they want is a few % per year return on the money that they put in … no share of the speculative upside!

Where else can you find a partner like that?

So, Mike, I ask you: what’s your objective?

– To get rich(er) quick(er)?

– Or is it to avoid putting any of your money into somebody else’s pocket?

I don’t mind which path you choose, as long as it gets you to your financial objective i.e. Your Number by Your Date …

… if not, you will do well in life – not just your financial life – to stop obsessing about what the other guy might be getting out of the deal, and start obsessing about what you might be getting out of that same deal 🙂

I wonder what our readers think? Tell us about your good/bad experiences with bank funding …

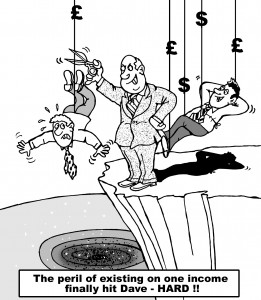

If you needed any evidence that the ‘global financial crisis’ – on a global macro level – and problems with the US real-estate market – on a global micro level – are still affecting people in the their day to day lives, you need read no further than

If you needed any evidence that the ‘global financial crisis’ – on a global macro level – and problems with the US real-estate market – on a global micro level – are still affecting people in the their day to day lives, you need read no further than  Today, I want to share one of my secret weapons for purchasing real-estate: it absolutely kills

Today, I want to share one of my secret weapons for purchasing real-estate: it absolutely kills  By now we all know that the quickest / surest path to stock market success is the IPO:

By now we all know that the quickest / surest path to stock market success is the IPO: