My blogging friend, Andee Sellman has unveiled a corker … but, I have a STRICT no advertising, no product placement or promotion policy …

[AJC: it’s the only way that I could think of to convince people that I’m genuine, after all, do I want to say to people “I made $7 million in 7 years, plus an extra $4 a week from my blog” 😉 ]

.. so, I’ll just gently lead in with a story instead:

Many years ago, in a very short-lived experiment, my parents bought my sister a flower shop [AJC: mistake # 1].

However, because they knew that she wouldn’t take any of their advice (just the shop sans advice) they asked me to take the other 50%, which I agreed to [AJC: mistake # 2].

Unfortunately, I had no business experience in those days, so it was like ‘the blind leading the blind’ … however, I did go looking for help.

One of the first things that I tried to do was get some help on the NUMBERS that the shop should run according to; things like:

– What % of our sales should the flowers and other materials that we bought account for?

– What staff and other administrative costs should we allow?

– What salary should my sister draw?

Unfortunately, my accountant wasn’t much help [AJC: he basically told me to come back when I had a tax problem … when the problem was, we weren’t making any money, so there was no tax!], and I did find a benchmarking report on florist shops, but it didn’t really tell me what the numbers meant or, much more importantly, what to do with them.

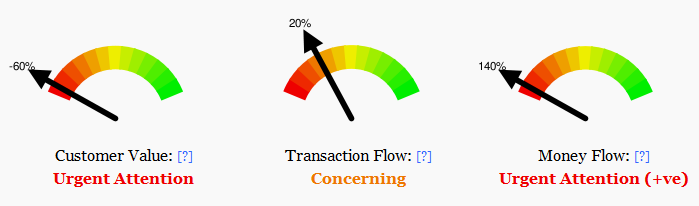

That’s why I was really interested when Andee sent me a link to his new tool – I’ve checked and it is totally free – called the One Minute Business Checkup … I think it would have been of great benefit – even though it is fairly simple, and works on just three (that I could see) critical benchmarks:

A. CUSTOMER VALUE MEASURE

This measure looks at how much of the customer value you are retaining in your business by looking at the value the customer pays you and deducting the cost you incur to make those sales.

From experience we know that if the customer value measure falls below 20% a business will struggle and may fail completely so that is why the benchmark is set at 20%. i.e. retaining 20% of the customer value as a return to the business owner.

Example of Measure

Sales $500,000 Product $250,000 Business Owner $50,000 People $50,000 Marketing Costs $20,000 Distribution Costs $30,000 Total Costs $400,000 Customer Value Retained $100,000 Percentage to Sales 20% B. TRANSACTION FLOW MEASURE

The transaction flow measure is about determining the volume of sales that is running through your business. A business may have very high customer value (margin) but only a trickle of sales to take advantage of that value.

Our quick way of measuring transaction flow is to look at administrative cost compared to the sales in a business.

We have found that to be sustainable a business needs to spend no more than 12% of sales on its administrative costs. Often small businesses need to INCREASE SALES rather than decrease administrative costs to achieve this percentage.

Example of Measure

Sales $500,000 Administrative Wages $30,000 Administrative Expenses $20,000 Total Costs $50,000 Percentage to Sales 10% C. MONEY FLOW MEASURE

The money flow measure is designed to find where the money is hiding in your business. Does money flow easily or are there places in your business where it gets ‘stuck’ and takes time to flow through to you.

A very significant place that money hides in your business is called working capital. There are three significant items:

- Inventory – this can be raw materials, work in progress or finished goods

- Accounts Receivable – this is money owed to you from customers

- Accounts Payable – this is money you owe your suppliers

Money can get stuck in inventory and accounts receivable. It can also be lost from the business by undisciplined payments to suppliers.

The activity in your business can be measured by sales and this needs to be compared to the working capital invested in your business. We have found that to be sustainable and to give your business the best chance to grow, working capital should be no more than 12% of sales. Beyond this, too much of your money gets tied up in the business and is not available to fund growth.

Unlike the other two measures the money flow measure can be negative.

Negative working capital is a very dangerous situation needing urgent attention.

Example of Measure – Positive Working Capital

Inventory $30,000 Accounts Receivable $55,000 Accounts Payable -$35,000 Working Capital $50,000 Sales $500,000 Percentage to Sales 10% Example of Measure – Negative Working Capital

.

Inventory $30,000 Accounts Receivable $55,000 Accounts Payable -$95,000 Working Capital -$10,000 Sales $500,000 Percentage to Sales -2%

If you have a small business, I recommend that you give this a try [ http://oneminutebusinesscheckup.com/ ] and let me know what you think?