This is my SECOND EVER “$700 In 7 Days” Social Giveaway”, just in time for Xmas … why ‘social‘?

This is my SECOND EVER “$700 In 7 Days” Social Giveaway”, just in time for Xmas … why ‘social‘?

In exactly 7 days I am giving away $700 cash with a $350 first prize and the remaining $350 split between whoever referred the winner to this page and who referred them and so on … There are NO CATCHES (other than I will only pay by PayPal transfer).

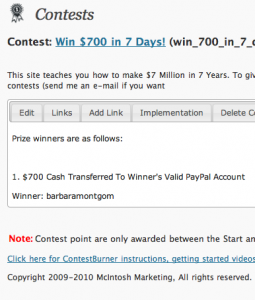

Barbara was the Lucky First Prize Winner of our first ‘$700 In 7 Days Social Giveaway’ (Steve and Trisha split the remaining prizes):

I just want to say thank you! WOW I am still in shock that I won the contest…. it was a great Thanksgiving Day Surprise. Congrats to both Steve and Trisha who won prizes as well.

All you need to do is ENTER for your chance to win your share of $700 cash in just 7 days (first prize is a cool $350), when I announce the winners exactly one week from today … simply enter your details below for your chance to win …

Instructions: Choose a short User Name (eg “Steve12”) for yourself and enter AJC42 as the user name for the person that referred you (only one entry per person; refer friends – giving them YOUR username for even more chances to win a cash prize, see below for details):

Wait! There’s More!

If you refer your friends using the link below and they enter USING YOUR USER NAME as the person who referred them (eg “Steve12”), then if they win a prize so do you!

After you sign up to join the $700 In 7 Days Giveaway, send (e-mail, tweet, facebook, etc.) your friends this invitation link: http://7million7years.com/contest/ + your User Name

Example: “I joined the $700 in 7 Days Giveaway, you can join too by visiting http://balloon.mit.edu (my User Name is Betty16)”

If anyone you invite, or anyone they invite, or anyone they invite (…and so on) win money, then so will you!

We’re giving $350 to the first User Name that we pull out of the hat, but that’s not all — we’re also giving $150 to the person who invited them. Then we’re giving $100 to whoever invited the inviter, and $50 to whoever invited them, and so on… until we have given away the ENTIRE $700!

It might play out like this:

Angie joins the giveaway contest, selecting the User Name “Angie52”. http://7million7years.com/contest/.

Angie then e-mails the link http://7million7years.com/contest/ + her User Name to Bob, who uses it to also join the contest. Bob enters, choosing the User Name “Bob11”, who posts the link http://7million7years.com/contest/ + his User Name to Facebook. His friend Charlie sees it, signs up, then twitters about http://7million7years.com/contest/ + her User Name. Dave clicks the link and uses Charlie’s User Name to join…

… then his name is pulled out of the hat!

Dave is the person who wins the main prize. Once that happens, we send Dave $350 via payPal for winning. Charlie gets $150 for inviting Dave, Bob gets $100 for inviting Charlie, and Angie gets $50 for inviting Bob. The remaining $50 is donated to charity.

Easy and fun to win!

Remember: You only need to join to be in the running to win the $350 First Prize. Then, if you also want to multiply your chances of winning a cash prize of at least $50 simply send this link http://7million7years.com/contest/ + your User Name to all of your friends … the rest happens automatically!

Instructions: Choose a short User Name (eg “Steve12”) for yourself and enter AJC42 as the user name for the person who referred you (unless you already have a user name from a friend who referred you) then send this link http://7million7years.com/contest/ (+ your User Name instead of mine) to all of your friends (via e-mail, Twitter, and FaceBook) and let the fun begin!