This used to be me … it sucked! 🙂

Category Archives: Business

Home Business Success?

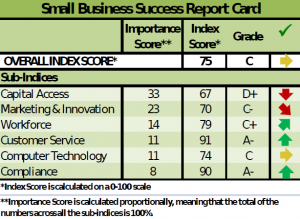

Andee Sellman, friend and occasional $7million7years contributor, refers to the Small Business Success Index study saying:

There are about 6.6 million home based businesses that generate at least 50% of the owner’s household income.

Now, assuming that home based businesses have either no – or very few – staff, I think that means that there are about 18 million home based businesses that are generating less then half the owner’s household income.

Now, think about this: the chances are that the whole household has a maximum of two full-time salaries – IF the owner of the small business runs it purely after hours …

… so, most home based businesses are making less than one full-time salary.

Let’s look at the most successful 6 million of these businesses: what are the chances that many of them are doing much better than “50% of the owner’s household income” – or, a maximum of one full-time wage (but, probably, much less!)?

Not much, I would think.

Now, there are exceptions: if you say that Facebook was a home-based business when it started … or, Apple … or, Google. But, most are just small online/offline concerns … low cost, low revenue, low return.

Chances are, you aren’t going to earn a lot from it, or sell it for a lot.

So, what’s the value of starting a home based business?

Well, unless you’re one of the very lucky ones, it’s in what you do with:

1. What you earn: this is extra income (assuming that you just haven’t thrown your old job in until it replaces your income … plus more) that you SHOULD be investing 100% of (some back into the business … some into outside investments, RE is ideal because the extra business cashflow can help fund any shortfall in the first few years), and

2. What you learn: there is no better way to learn about business than by running a business (preferably, with the resources of sites like Andee’s to help you); sure, my son made a couple of grand between the ages of 12 and 14 running his little eBay business from home … but, the lessons that he learned – not just business lessons, but Life lessons – will become priceless!

No, Michael Masterson’s 50%+ compound growth rate is reserved for businesses that can grow rapidly, have intellectual property that is both desired and protected, and have owners who are inspired by their Life’s Purpose to reach extraordinary heights …

… but, even the most humble home-based business can be a huge turning point in your financial life.

I highly recommend that you give it a go … and, keep trying until you find The One that helps you reach your Number 🙂

One of the best tips for small business owners …

One of the very best wealth-building secrets for business owners has nothing to do with improving your business … and, everything to do with turning that spare cashflow into appreciating assets:

Just like buying your first home is a 7million7years key wealth building strategy, so is owning your own property for small business owners, just as the guy in this video recommends … I can’t vouch for his financing strategies as I don’t know enough (but perhaps some of our readers do?) …

… but, simply buying my own office generated in excess of $1 million extra net worth for me in just 5 years.

I bought an office block for $1.27 million; I then completely rehabbed it (including new offices, workstations, phone system, and computer equipment) for another $500k, which I leased over 5 years (with a $1 balloon/final payment).

The mortgage interest and the lease payments were 100% tax deductible from my business income (actually, I charged myself a high commercial rent as the property was in a different company name).

I sold the building for nearly $2.5 million just 5 years later!

You gotta know your customer …

If you’re in business, then you had better get to know your customer. I’m sure that you’ve heard that before, but what does it really mean?

The true meaning hit home for me not long after I received this unsolicited e-mail promoting a new rating service for bloggers:

For the first time, publicists will be able to research, connect and manage Social Media relations in a single integrated platform. MyMediaInfo has scored thousands of blogs based on key metrics creating the MMI score. A trial is available at http://mymediainfo.com/register.jsp or give us a call at (888) 901-3332 to speak to a product specialist.

Excellent!

Point 1 of getting to know your customer:

Bloggers are vain/curious … they want to know that their blog is being read, and how it rates against other blogs [AJC: c’mon … if you’re a blogger, you can’t tell me that you aren’t checking your site stats quite often!].

I’m no exception, so I click through to their web-site and am sent a confirmation message:

Thank you for registering for a free trial of MyMediaInfo. A product expert will call you within 1 business day to activate your account and provide a brief tutorial.

Bummer!

Point 2 of getting to know your customer:

Bloggers are shy; no way does a blogger want to hand over their personal contact details and phone number to anybody [AJC: except maybe the publisher of the New York Times].

Here’s what I said:

Uh, this is the internet and the world of bloggers … we stay semi-anonymous, so don’t expect a big take-up on providing phone numbers!

I recommend that you provide a trial link that speaks for itself and only requires an e-mail address to register … bloggers will only be interested in seeing how their own site ranks, anyway 🙂

You gotta know your customer 😉

If you’re also a blogger, would you have registered and given your phone number? Maybe you’re not as shy as me?

Is there enough profit in it?

Here’s a story about increasing your profit margin from 17% to 117% to 1,017% …

… I want his “Irish friend” working for me!

The One Minute Business Checkup!

My blogging friend, Andee Sellman has unveiled a corker … but, I have a STRICT no advertising, no product placement or promotion policy …

[AJC: it’s the only way that I could think of to convince people that I’m genuine, after all, do I want to say to people “I made $7 million in 7 years, plus an extra $4 a week from my blog” 😉 ]

.. so, I’ll just gently lead in with a story instead:

Many years ago, in a very short-lived experiment, my parents bought my sister a flower shop [AJC: mistake # 1].

However, because they knew that she wouldn’t take any of their advice (just the shop sans advice) they asked me to take the other 50%, which I agreed to [AJC: mistake # 2].

Unfortunately, I had no business experience in those days, so it was like ‘the blind leading the blind’ … however, I did go looking for help.

One of the first things that I tried to do was get some help on the NUMBERS that the shop should run according to; things like:

– What % of our sales should the flowers and other materials that we bought account for?

– What staff and other administrative costs should we allow?

– What salary should my sister draw?

Unfortunately, my accountant wasn’t much help [AJC: he basically told me to come back when I had a tax problem … when the problem was, we weren’t making any money, so there was no tax!], and I did find a benchmarking report on florist shops, but it didn’t really tell me what the numbers meant or, much more importantly, what to do with them.

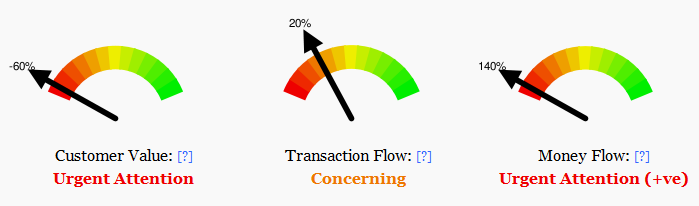

That’s why I was really interested when Andee sent me a link to his new tool – I’ve checked and it is totally free – called the One Minute Business Checkup … I think it would have been of great benefit – even though it is fairly simple, and works on just three (that I could see) critical benchmarks:

A. CUSTOMER VALUE MEASURE

This measure looks at how much of the customer value you are retaining in your business by looking at the value the customer pays you and deducting the cost you incur to make those sales.

From experience we know that if the customer value measure falls below 20% a business will struggle and may fail completely so that is why the benchmark is set at 20%. i.e. retaining 20% of the customer value as a return to the business owner.

Example of Measure

Sales $500,000 Product $250,000 Business Owner $50,000 People $50,000 Marketing Costs $20,000 Distribution Costs $30,000 Total Costs $400,000 Customer Value Retained $100,000 Percentage to Sales 20% B. TRANSACTION FLOW MEASURE

The transaction flow measure is about determining the volume of sales that is running through your business. A business may have very high customer value (margin) but only a trickle of sales to take advantage of that value.

Our quick way of measuring transaction flow is to look at administrative cost compared to the sales in a business.

We have found that to be sustainable a business needs to spend no more than 12% of sales on its administrative costs. Often small businesses need to INCREASE SALES rather than decrease administrative costs to achieve this percentage.

Example of Measure

Sales $500,000 Administrative Wages $30,000 Administrative Expenses $20,000 Total Costs $50,000 Percentage to Sales 10% C. MONEY FLOW MEASURE

The money flow measure is designed to find where the money is hiding in your business. Does money flow easily or are there places in your business where it gets ‘stuck’ and takes time to flow through to you.

A very significant place that money hides in your business is called working capital. There are three significant items:

- Inventory – this can be raw materials, work in progress or finished goods

- Accounts Receivable – this is money owed to you from customers

- Accounts Payable – this is money you owe your suppliers

Money can get stuck in inventory and accounts receivable. It can also be lost from the business by undisciplined payments to suppliers.

The activity in your business can be measured by sales and this needs to be compared to the working capital invested in your business. We have found that to be sustainable and to give your business the best chance to grow, working capital should be no more than 12% of sales. Beyond this, too much of your money gets tied up in the business and is not available to fund growth.

Unlike the other two measures the money flow measure can be negative.

Negative working capital is a very dangerous situation needing urgent attention.

Example of Measure – Positive Working Capital

Inventory $30,000 Accounts Receivable $55,000 Accounts Payable -$35,000 Working Capital $50,000 Sales $500,000 Percentage to Sales 10% Example of Measure – Negative Working Capital

.

Inventory $30,000 Accounts Receivable $55,000 Accounts Payable -$95,000 Working Capital -$10,000 Sales $500,000 Percentage to Sales -2%

If you have a small business, I recommend that you give this a try [ http://oneminutebusinesscheckup.com/ ] and let me know what you think?

Stuck for a new business idea?

I’m not sure why anybody would be stuck for a business idea?! We get at least one million-dollar idea a day [AJC: you may not think so, but it’s anytime that you are dissatisfied … inside every problem is a million dollar solution just waiting to break out], but we either fail to recognize it or – more likely – act on it.

I have two solutions:

1. Carry a small pen and a notepad (yes, an iPhone or PDA is a great substitute) and …. use it!

Write down every idea that you get, then make sure that you act on each: do something to verify that your first idea has / hasn’t merit and … act further: do some research, talk to somebody in the industry, etc., etc. If you feel, at any stage, that it isn’t for you, put a line through it and REPEAT for Idea # 2 and so on.

2. Or, if you are The Vacant Parking Lot Of Business Ideas, don’t fret … just buy this book (Hint: buy the .pdf from his web-site at half the price that Amazon charges).

Disclaimer: I haven’t read the book, but that’s not the point … as far as I am concerned, it only needs to give you a list of ideas to explore – any additional valuable content is a bonus.

Still not sure that you want to spend the ten bucks on helping you reach your Number? Shame on you … but, here’s an excerpt, anyway:

Travel or invest?

Ryan from Planting Dollars asks:

Having been raised by self made real estate millionaires it’s not shocking that I agree with the vast majority of what you have to say. The reason I’m emailing you is because I was wondering if I could get your advice.

As a 23 year old recent college graduate I understand the power of real estate investing and building businesses, but at the same point would like a nomadic lifestyle and be able to travel while living frugal at a young age. In my experience real estate and most business ventures aren’t possible with this lifestyle. So I’m simply wondering:

If you were in my situation, how would you perceive this challenge and what types of businesses would you pursue?

Simple: anything internet!

Specifically, anything internet that trades in downloadable products and services (information products are ideal), or of the ‘virtual infrastructure’ type (e.g. FaceBook) … of course, once you become successful, you will need staff and support of the financial kind, and these require phyical access more often than not [AJC: Venture Capitalists are soooo 90’s 🙂 ].

That’s the short answer; now for the long answer 😉

The first thing I would suggest that Ryan do is to ask the “self made real estate millionaires” who raised him for their advice … after all, they’ve been there / done that … know Ryan better than possibly anybody else … and, being a parent myself I have no doubt that they ABSOLUTELY have his best interests at heart!

As to the second part of Ryan’s question, which asked whether I would “place travel and new experiences in [my] twenties as more important or less important than investing and capturing the time value of money?”

The easy answer is that (by some coincidence) I just addressed this in some small way in yesterday’s Video-on-Sunday post …

…. but, the harder answer is “it depends”:

– I would rank those Life Experiences very highly

BUT

– If the desire to be an entrepreneur burns bright, and you have a rip-snorter of an idea just bursting to get out … well THAT can be the “new experience” that Ryan mentions, and it may very well more than make up for itself by funding your future travels.

I would be willing to delay a boringly ‘normal’ savings plan a little for those one-of-a-kind of Life Experiences.

Let’s say that you do decide to compromise, by being that nomad, yet starting a business; what’s the ideal business for this sort of traveling, hands-off lifestyle?

As I said above, anything Web, however I suggest that you buy a copy of the 4-Hour Work Week first!

But, I would also say not to be so quick to discount real-estate …

… I maintained 5 condo’s and a small’ish office block in Australia whilst I was living in the USA.

Buy anything by Dolf De Roos and Dave Lindahl, both of whom claim to own real-estate in far flung places (Dolf across the world, and Dave across the USA) and learn all you can about ‘hands off’ real-estate ownership; it can be done.

Of course, Ryan still has direct access to Millionaire RE mentors … so, he should first ask his parents what they do with their RE investments when they wish to travel?

Some business valuation advice …

While we’re on the subject, here is some good advice on valuing (and, improving the value of) you business from a business broker …

… if you like the info, here are the next three videos in the series:

http://www.youtube.com/watch?v=pbIbNZ-mHpA&feature=related

http://www.youtube.com/watch?v=4iwSIlo8VDA&feature=related

http://www.youtube.com/watch?v=XfKFvMUmc8c&feature=related

That’s it!

BTW: The last video is the only one that really answers the question about how to value a business 🙂

How to value your business …

Last week I told you about a reader who thought that he wanted to sell his business, but pretty quickly realized (after a bit of prodding from me) that he was really selling a product as he had not made any sales as yet.

Last week I told you about a reader who thought that he wanted to sell his business, but pretty quickly realized (after a bit of prodding from me) that he was really selling a product as he had not made any sales as yet.

So, this week, I wanted to cover the basic ‘street smart valuation’ methods for selling (or, part-selling) various types of businesses:

1. Professional Practices

These types of businesses (e.g. accountants, finance/insurance/stock brokers, doctors, attorneys, etc.) generally are the easiest to value as their sale price is usually governed by industry-standard formulas, often based on some multiple of fees rather than profits.

So, an insurance broker may sell for, say 2 x annual fees/commissions.

The easiest way to find out how to value your professional practice is to buddy up to a few of your peers and see what experience they have and to ask your industry association. It is also useful to see if your accountant (or another) has experience with any of their clients who may have bought/sold practices in your specialty.

2. Small businesses

Most other sole practitioner and/or small businesses sell for a multiple of their profit (per their most recent income tax returns); typically the business is bought/sold for a multiple of 3 – 5 times after-tax profits, but the range can vary widely.

Brad Sugars claims that his opening (and usually closing!) bid is zero … but, he may take the over the business’ leases (premises and/or equipment); since most small businesses lose money – barely paying their owners a ‘salary’ – this can be a surprisingly good deal!

Of course, if a large company (preferably one listed on a stock exchange) wants to acquire you – and, you can demonstrate a history of good profits – you may be able to negotiate a larger multiple … perhaps heading in the direction of the multiple that the public company itself is getting on the stock exchange (you can find a company’s P/E ratio on any good finance web-site).

Somewhere around 7 to 10 times after tax profits would be considered outstanding.

3. Venture Capital Ready

Let’s say that you have a small business and feel ready to take it to the next level, but you need some additional cash, effectively by selling them part of your business (i.e. trading some of their cash for a lot of your equity) … after watching Shark Tank you feel that you are ready to negotiate with some venture capitalists. What will they pay for a share of your business?

Well, you really need to know what sort of return they expect on their money:

If a company does have the qualities venture capitalists seek including a solid business plan, a good management team, investment and passion from the founders, a good potential to exit the investment before the end of their funding cycle, and target minimum returns in excess of 40% per year, it will find it easier to raise venture capital.

Think about it; a venture capitalist may invest in 10 businesses and lose their money on 7 of them, break even on 2, and rely on your business to make up for the other 9 duds 😉

If they could make (say) just 4% on their money just by letting it sit in the bank, then surely they’re going to need at least 10 times that return if they give it to you on a 10-to-1 failure:success ratio, aren’t they?

Now, 40% returns means that if they give you $1 million, they will expect to be able to get out in 5 years and walk away with well over $5.25 million!

So, here (in simple terms) is how they will make their offer to you (if you are still in self-delusional mode and think that you will be making the offer to them, watch some more Shark Tank!?):

1. Assess how much investment they will need to make in order to meet the growth needs of your business (this WON’T include giving you a pay-rise or any cash in your pocket … at least, not until THEY cash out first),

2. Decide how long they are prepared to wait to realize their investment (i.e. take their cash out by selling or IPO’ing the company)

3. Calculate the % and $ return they would need (in our example, this is the $5.25+ million that I mentioned above)

4. Assess what sale price the business is likely to get

5. Divide 3. into 4. and this is what minimum % of your company they will expect to get for their investment (in our example, this is $1 mill.)

So, if they think you have a $10 mill. business on your hands, they will want at least 53% of the company for their $1 mill. investment …

… and, I assure you, you will only get the $1 mill. if you are already doing really well 🙂