If you want to understand the difference between ‘simple’ interest and ‘compounding’ interest – and, if you want to understand why it makes a difference as to how often you compound that interest – then watch this video (until the presenter starts writing with a blue pen … from that point on, only watch if you are a mathematician) …

Tag Archives: wealth

Can you ‘small ball’ your way to wealth?

Mitch suggests that while you are waiting for the “landmark victory … i.e. a four-bagger, a game changer … one that propels your business to a new level” you should play a little ‘small-ball’ with your business:

Mitch suggests that while you are waiting for the “landmark victory … i.e. a four-bagger, a game changer … one that propels your business to a new level” you should play a little ‘small-ball’ with your business:

Small ball for me is the ability to deliver small but meaningful enhancements to your business in succession and continually.

A 2% improvement here, a 1% improvement there and a 4% pick up in efficiency here – those small bits can really add up. If you stopped to think about how you can deliver a 10% or a 20% improvement in your business it could be a struggle. Or you might have a few good ideas, but the resources to get there may be out of reach.

Instead, if you thought about how you could improve your business by 1% or 2% you’d likely come up with a bunch of practical, implementable ideas. And the good news is if you string those wins together you get your 10-20%! Even better, if you keep doing it you’ll go way beyond.

Thinking back, I can’t really recall if I was a ‘small-ball’ type of business person … perhaps I was, but just called it ‘business as usual’, which is what I guess it should be … in fact, it’s the small stuff that you should empower your staff to go after (with encouragement, culture, recognition, and incentives) while you, perhaps, focus on the strategic picture (assuming that you have staff … otherwise I guess you’re going to have to do all the small-and-big-ball stuff yourself!).

If I suggested that you needed to find a way to produce a compound growth rate of 33% in your business to help you reach your Number, you might balk …

… but, if I suggested that you look to increase a few key areas by a mere 10%, would you be quite so wary? Probably not.

Jay Abraham, perhaps the greatest (and, most practical!) marketing mind of the modern era, illustrates this perfectly … in this case, by demonstrating the power of cumulative changes in, say, your marketing and sales strategy:

If you had [say] 1,000 active clients, and if you had an average order of $100 for each time they were coming in, if they bought two times a year, that works out to an annual revenue of $200,000.

# of Clients Transaction Value per Client Transactions per Year Total Income

1,000 x $100 x 2 = $200,000But if all you did was increase those three categories by a mere 10% each…

# of Clients Transaction Value per Client Transactions per Year Total Income

1,100 x $110 x 2.2 = $266,200It would increase your annual revenue to $266,200—a 33% increase!

Now, if you have a ‘normal’ business … one operating profitably, and with a reasonable gross margin (which means, that you have more fixed than variable costs), then I don’t need to tell you that the effect on your bottom line could be much larger than 33% … do I?!

You can now see why this is one of the most powerful business lessons that I ever learned … and, Jay told me via a written document, exactly the same way that I am now telling it to you.

So, If you have a business, don’t waste time; meet with your key staff [AJC: or, yourself 🙂 ] today to look at how you can increase each of:

– The number of clients that you have [sales and prospecting],

– The average order size [upselling and cross-selling],

– The number of times that they buy [repeat-selling and back-end sales].

Simple … effective!

Become an expert in your chosen field …

Recently, I wrote about how important it is to improve your ‘public speaking’ skills, as that skill alone can give you an incredible edge in your business and/or investing life; Jacob asks:

How do you get in front of the large companies in the first place?

Before I answer that question, let me backtrack a little:

This isn’t a blog about how to earn more money in a job or consulting … because those, alone, are unlikely [AJC: for most] to get you to your Number by your Date.

But, as Luis gently reminded me, this is a blog about “how you can make $7 million in 7 years … no scams, no schemes … just good old financial advice!” so I had better be talking to those with large Numbers and soon Dates!

So, why did I choose today’s topic?

Because, you probably want to start a business to really ramp up those required annual compound growth rates …

… the problem is how do you transition from a small fish in a huge sea of competing businesses? Especially, if your business services other businesses (i.e. B2B) … and, particularly if the Fortune 1,000 is your stomping ground …

1. With better sales?

Possible, but unlikely, because Friendly McConglomerate – that multi-billion-dollar-multinational around the corner – already has a sales rep in each state, lunching your best prospects right now!

How do you, on your lonesome – even with the help of your out-of-work brother-in-law (who is ‘busy’ mooching off your limited capital and patience) expect to get to, let alone win over, all of those guys when you simply don’t have the gold Amex cards to splash around like your competitor’s reps?

2. With better marketing?

Hmmm …. you mean those leaflets that you stuck on all of those lampposts around the neighborhoods that you service? I’m sure they will really zing compared to that multi-barreled discount-coupon-backed television, radio, magazine, and letterbox drop campaign that your competitor’s ‘top of the town’ advertising agency cooked up!

3. With a better product?

Whoever it was who said: “build a better mousetrap and they will beat a path to your door” was wrong! A ‘better product’ ONLY works on the back of excellent sales and marketing, so you had better refer back to 1. and 2. above 😉

But, don’t sweat it, even with all their money, your major competitors are not really collaring the market either …

… and, while they’re out there spending money, there is still one way that your B2B business can compete – nay, totally smash – your ham-fisted-big-budgeted corporate competitors; it’s to:

Be seen by your clients – and competitors – as the expert in your chosen field.

You see, your competitors are actually wasting their mega-millions trying to get to – then ineffectively schmooze with – the middle managers who don’t even have the capacity to actually make buying decisions without referring their proposals to the Big Guys Upstairs …

… but, if you are the expert, you are side-stepping this whole time-and-money-wasting ‘sales process’ simply by using your Industry Expert status to:

1. Gain free publicity in the general media and/or trade press that the decision-makers actually see and read, and

2. Virtually demand – and, get – interviews with those same ‘top management’ guys for the clients who actually need and want your product or service, and

3. Present your ‘proposal’ to all the decision makers so that you set the ground rules that your competitors will need to follow.

So, Jacob, the answer to your question about how do you get in front of the large companies is simple: become the expert in your field and all doors will magically open.

Just remember that being ‘the expert’ gets you to the table … it’s then up to you to close the deal.

In an upcoming post, Jacob, I’ll tell you HOW to become an expert in your chosen field, something that I’ve done 2.5 times already!

It’s easier … and, much quicker … than you think 😉

The time of your life?

I’ve been spending the last few days reacquainting myself with Millionaire Mommy’s excellent blog, but I do see some differences in perspective – even though we are both millionaires …

I’ve been spending the last few days reacquainting myself with Millionaire Mommy’s excellent blog, but I do see some differences in perspective – even though we are both millionaires …

…. but, I suspect that the differences come from degree: she describes herself as a ‘self made millionaire’ … and me a ‘self made multi-millionaire’.

IF this is the case, then I suspect that my point of view and that of, say, Felix Dennis (who is worth hundreds of millions) will equally vary from time to time. Which leads me to my first Rule of Advice:

Only seek financial advice from those who have made at least 10 times what you have already achieved, doing exactly what it is that you are attempting to do.

A long winded-way of saying: only listen to somebody who’s already been-there-done-that …

…. but, more than that: when you get to, say, $3 million or $4 million of your own, you should probably stop reading this blog, as my ideas and your may become self-reinforcing – hence self-limiting.

At that point, it will be time to move on and find some new mentors (maybe even Felix Dennis, himself?!).

The flip-side is that if you are still working towards your first million (say, $100k or networth or less) you probably should be reading Millionaire Mommy’s blog as well as (dare I say, instead of?!) mine; to help you decide which is right for you, let me give an example from a recent Millionaire Mommy post:

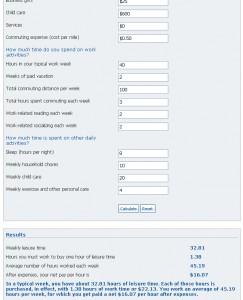

Today, I’m sharing a trick that can completely revolutionize your spending habits by changing the way you see the cost of the goodies that merchants want to sell to you.

Here’s the trick: Translate the number of dollars you see printed on a price tag into the number of hours the purchase will require you to work for it. By doing so, you’ll make well-informed decisions regarding what you’re willing to pay for with your irreplaceable life energy.

You should read her post thoroughly to understand it properly – and it’s another excellent “hold back your spending” technique to go along with others such as the Power of 10-1-1-1-1.

But, I wouldn’t use it …

… now.

I may have – if I knew of it – before … but, not now.

You see, when I was concentrating mainly on MM101 (getting my financial house in order), this time value of money approach would make perfect sense, but now that I am transitioning from focusing mainly on MM201 (income and wealth acceleration) and MM301 (protecting my wealth) I think the idea doesn’t make great sense:

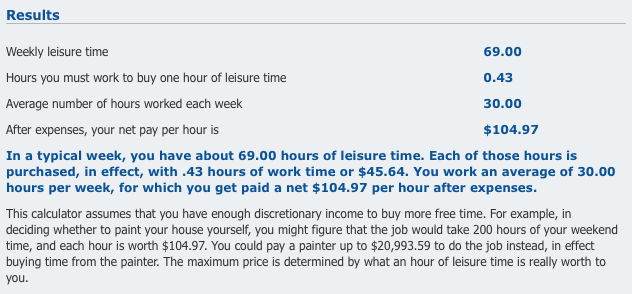

I ‘pay myself’ a notional salary of $250,000 a year – this is really a budget for now, as we get our financial house in order after a transition from business to retirement and from the USA to Australia – and have few, if any, ‘business expenses’.

But, for the sake of the calculator, I said that I worked about 20 hours a week on ‘work’ (business/investment projects), and probably spend another 5 hours a week in social activities related to this ‘work’.

Given all of that, the calculator says that my time is worth about $105 an hour … poppycock!

The test is: would I take a job, consulting activity, etc. that paid me $105 per hour? Of course not!

Would I spend time on an activity that could produce me $105 per hour passively? Probably … but, then I wouldn’t be working 20 hours a week to get it, so the calculator doesn’t work.

In other words: I ‘work’ 20 hours a week for (a) fun and (b) a potential future payback in the millions. So the calculator doesn’t work.

Secondly, if I work 40 hours (i.e. 2 weeks), I can afford $4k worth of goodies …. even I don’t buy $4k worth of consumer cr*p every 2 weeks, and on this calculation, I only have to ‘work’ for 30 weeks to buy a Ferrari … cool! Yet, right now, I don’t think I can really afford one 🙁

Thirdly, and this is for everybody, the calculator only takes into account work-related expenses; it should really also take into account your living expenses, as well … in other words how many hours of work WILL you have to put into saving up enough to pay for that thing that you are considering buying?

If none of this makes sense, here’s some more white noise for you 🙂

The key to wealth?

You’re probably attracted to this blog because you want to get wealthy … and, if you’re anything like I was (and, now still am for ‘professional interest’) you probably read any and all decent books on personal finance in the hopes of finding those very ‘keys to wealth’.

You’re probably attracted to this blog because you want to get wealthy … and, if you’re anything like I was (and, now still am for ‘professional interest’) you probably read any and all decent books on personal finance in the hopes of finding those very ‘keys to wealth’.

But, you’re probably wasting your time …

The key to wealth isn’t to be found in this blog or any other blog, book, seminar or boot camp. Not convinced?

Well, Millionaire Mommy Next Door poses the one question that you should be asking:

If the answer to wealth is revealed between the covers of the books proliferating in bookstores, why aren’t more people wealthy?

Just brilliant, thanks for an outstanding post, Millionaire Mom!

So, why aren’t more people wealthy?

Why do I think that you’re probably wasting your time reading all of those books/blogs on personal finance …

… including this one?!

The answer, of course, is equally simple:

It’s not what’s in the books that counts, but what you do with the information.

I work on this blog daily; I give you the information – factual and ‘as it happened’ – that I really used to make $7 million in 7 years.

What have you done with this information, so far?

Make the move ….

Guys, as the economy improves (if it improves) interest rates will surely rise, as they already are in other countries.

Guys, as the economy improves (if it improves) interest rates will surely rise, as they already are in other countries.

If you haven’t already done so, seriously think about buying some fire-sale real-estate and locking in the the interest rate for 30 years; one strategy – especially if the banks won’t let you take out a 30 year fixed rate mortgage on an investment – is to buy your NEXT home now (it need not be any bigger/better than your current), taking the 30 year fixed on that one, and keeping your current as a rental.

I’m not sure if that’s exactly what Lee was thinking when he asked:

Although the market in our area has held up fairly well through this housing crisis, it’s definitely a buyers market. I don’t think I’d get top value for my home. So, I’ve seriously been considering renting it out after we move. If I did rent it, then I could go a couple different routes:

1. Refinance current home to 30 year (to help cash flow) and take enough cash out to put 20% down on our new home.

2. Refinance current home to a 30 year but take no cash out to get the payment down to a very low amount to have a very good positive cash flow. Then put 20% down out of pocket on the new home.

3. Take out a home equity loan on the current home just to cover the 20% down payment on the new home loan (30 year).

4. Just go ahead and sell our current home so I can take advantage of the tax free capital gains … I could then use part of it to put 20% down on our next home … and use the remaining as a down payment on one or two rental properties.

5. I have to throw in one scenario just because of that little guy I call Mr. Conservative that sits on one of my shoulders, lol! I could just pay my current home off within the next 2 years or so, then rent it out with a large cash flow, and use that cash flow to pay the mortgage of the new home we buy.

6. Maybe something I’m not even thinking of?

I think I see a case of paralysis by analysis coming on, so we had better head this off at the pass …

… while I can’t give direct personal advice (as I told Lee), I can point out that in cases like this it’s always good to ask yourself a couple of key questions before Mr. Conservative starts to get very vocal (in your subconscious) and you end up taking no action at all, so I suggested that Lee run some numbers:

a) What would be the situation on your current home, if you just took out a new (or refi) FIXED rate 30 yr mortgage, and put tenants in … what would be your new monthly mortgage payment and what monthly rent could you conservatively [it’s good to have Mr Conservative on your shoulders] expect?

b) After pocketing the excess of 75% of rents over mortgage from a) above – or, making up the deficit on the excess of mortgage over 75% of the rent – how much per month do you think you could save from your other sources of income assuming for the moment that you have FREE accommodation for yourself somewhere?

[AJC: the 75% of rents is to allow a buffer for vacancies and other costs of renting … just a very rough approx. for now]

Once you answer these two questions, my feeling is that the best scenario for you will become obvious … I hope 🙂

In Lee’s case, here are his current numbers:

3 bed / 2 bath 1450 sq ft. home in a great location.

Cost Basis: $158,000

Current value: $210,000

$96,000 (9 years 6 months) remaining on a 15 yr mortgage @ 4.625%

Current P&I repayment: $1,042 per month

And, if he refinanced the $96k remaining balance his bank has given him two options for a 30-year fixed loan:

$508/month @ 4.875% Closing costs: $2,000

$493/month @ 4.625% Closing costs: $2,700

For rent, Lee thinks “being ultra conservative” $900/month to $1100/month, which means:

Using 75% of excess over mortgage ($300) and assume living in FREE accommodations, I could easily save $3,000/month because that’s what I save currently even with my $1042 mortgage. Throw in not paying our current mortgage and having $300 in additional cash flow and $4,000+/month would not be unreasonable.

For now those are the numbers, although I have to say the 75% of excess over mortgage number is probably high considering taxes and insurance on this place are about $200/month. But as you said, these are rough numbers for now.

So, Lee is getting closer to being able to make a meaningful decision; here are the steps that I suggested:

STEP 1: OK, it seems to me that if you decided to keep your current home as a rental, you would lose money if you stuck to your your current $1k pm mortgage, and produce a positive cashflow of $100 to $200 p.m. if you refinanced.

STEP 2: It seems to me that your $3k pm savings rate will be enough to cover the expected $200k mortgage on your new home. Right? BTW: You WILL fix for 30 years, too (because this will become an ideal 2nd rental, eventually)?

STEP 3: Next, all you need to think about is how to raise the deposit; well, if you don’t have it now, go back to Step 1 and revisit these numbers, assuming that you refi, say, $150k instead of $96k. I’m guessing that you’ll be close to B/E – or, a slight monthly loss – on the rental?

STEP 4: You keep 25% of the rent (plus another $200, say) to cover taxes, ins, and contingencies PLUS you have plenty of excess monthly savings to cover you, until this ‘provisioning fund’ builds up.

Now, what do YOU think Lee should do?! Here’s what he thinks:

I think the smartest thing would be to refi without taking any equity out so that I have a nice cushion of cash flow. I would then need to come out of pocket with the down payment for the new home which I should be able to do, and even if I need a little help, I could always get a small home equity loan on the rental temporarily. But I feel pretty confident I could raise enough cash to cover the down payment without having to do that.

My next step…develop my plan of action.

Take Lee’s advice: model these questions to develop a plan of action that works for you … and, take it! 🙂

Speech Night!

They say that the most important skill that you can have in your [business] life is to be able to SELL.

And, why shouldn’t it?

– You want to buy a house? You need to shmooze the bank manager … SELL him on why he should give you the loan.

– You want to get married? You’d better woo the spouse-to-be and their parents … SELL them on letting you join their family.

– You want to get a job? You should brush up on your interview skills … SELL them on why you should get the job over all the others applying.

– You want a pay-rise? You had better impress the boss … SELL her on why you – above all others – deserve the promotion.

– You want your start-up to break-even, the maybe make a few bucks profit … who else is going to do the SELLING for you??!!

Unfortunately, I’m actually a terrible salesman, and am very uncomfortable in a one-on-one ‘convince the other guy to give me what I want’ situation.

Luckily, I actually think that the ability to sell is only the second most important [business] skill …

… the first – most important – one came back to me when I attended my daughter’s Speech Night tonight.

In case you’ve never been to one of those, it’s when a bunch of kids each select a random topic and write – then present to their classmates and parents – a 3 minute speech.

Now, I remember the first time that I spoke in public: it was while I was still at college and I was asked to be Best Man at my friend’s wedding; well, all I remember was:

a) I was so nervous that my knees were literally wobbling as I spoke, and

b) I had no idea what to say … I only remember that it was ridiculously schmaltzy like some cheap, drug-store gift card.

I also remember my first ‘real’ work-related speech: it was at a training course for selling, sponsored by the company that hired me straight out of college. I remember that my speech, my delivery, and my materials (overhead transparencies, hand-drawn/colored like some some 5th grader!) were terrible, and my instructors were more than happy to let me know 🙂

The turning point came when – at a later course, after I learned at least SOME presentation skills – I was video-taped giving a practice talk, and (naturally) felt very uncomfortable and unconfident … but, I soldiered on as best I could, resigned to be as embarrassed as usual when I saw the tape.

However, when I was finally shown the tape, the person I saw on the screen was somebody else entirely: he looked relaxed and confident … I couldn’t even see his leg shaking 😛

From that moment on, my career as a ‘public speaker’ was launched!

Realizing that it didn’t matter how I felt that counted, but how my audience perceived me, I rapidly went from strength to strength, actively seeking opportunities to stand up in front of a whiteboard, write-on-wipe-off felt-tip marker in hand.

This, more than any other single skill, accounts for my success in business, investing and Life:

– If I wanted to fund my businesses and investments, I presented my financial plans to my bank manager and his team, careful to fully explain the opportunity and address all of their potential concerns; the presentation format allowed me to be proactive, yet still leave room for additional questions. This allowed me to secure millions of dollars in funding, even when I had absolutely NO assets behind me!

– When I wanted to get married, my real job began at the first family dinner as I carefully presented myself in the best possible light with (sparingly applied!) carefully chosen anecdotes.

– When I wanted a promotion or pay-rise, I made sure that I had a an opportunity to have my boss see me doing something that most people (including him!) are afraid to do: being relaxed, confident, informative, and entertaining in front of an audience. This made me one of the most successful ‘experts’ in my field, within only a couple of years of taking up that particular specialty.

– When I wanted large companies to buy what my company had to sell (and, later, to buy my company), I always came up with a crackerjack presentation that addressed all of their buying considerations (which I had been careful to assess in prior “ask polite questions and listen to what they have to say” meetings); being the only person standing up really allowed me to control the flow of the meeting and helped me to sign multi-million dollar contracts all over the world.

In other words, I let the presentation do the selling, which really took the pressure off me having to perform as a Salesman …

… and, it became clear to me: everybody respects the person standing on the stage.

As for my daughter: she did an awesome, confident speech … as did many of her classmates.

In my opinion, if they keep it up, they will have a flying start in their later business life … and, so will you, if you take the time to learn – and, practice – speaking to an audience.

Rent or buy? Rent to buy!

Please take a moment to answer this poll [AJC: which is in response to my No Ads On This Site Policy] by clicking on this link: http://www.misterpoll.com/polls/456056

Please take a moment to answer this poll [AJC: which is in response to my No Ads On This Site Policy] by clicking on this link: http://www.misterpoll.com/polls/456056

It’s just one, short question; thanks!!

…. now, back to today’s post:

___________

Jim wants to know if he can turn his current rental into a Rent To Buy:

I have moved from a (rented) flat costing me ~33% of my (net) monthly income to a small house costing 25% (net). (Of course, being a First Time Buyer, I’ll be breaking the 20% net worth rule to put down a deposit, especially given the level of deposit required to get a decent rate here in the UK).

The current owner seems enthusiastic about the option of selling it to me at some point, but I’d like to ask advice on what sort of ‘offer’ to make. i.e. what sort of contributions my rent payments would be / discount off the market value.

I’m thinking if we both have a valuation done, I offer 15% off the average of the two?

I’m not sure that the Rent-2-Buy works in Jim’s case, because he’s already in the house and paying the rent!

But, let’s assume that Jim is willing to sign a longer lease, it will then depend upon whether he is able to bypass the agent or not.

You see, for a rent-to-buy to work, basically you are trying to say to the owner:

Rent to me for longer, then I will:

1. Save you the agent’s fees and commissions, because I will be staying in the house and will keep it as my own (“so, you don’t need an agent to manage me”)

2. Save the 2 to 4 week’s typical vacancy each year as the typical shorter-term tenants move on (you will need to find out what’s common in your area AND what the owner’s experience has been).

Then wouldn’t it be reasonable to split those ‘savings’ with the current owner (by way of a ‘credit’ towards a future purchase of the house)?

BTW: Jim, it’s OK to break the 20% equity rule on your first home, because it helps to get you into a house:

http://7million7years.com/2008/01/28/should-you-rent-or-buy/

AJC.

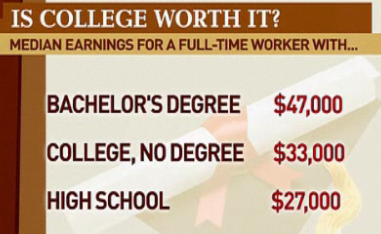

Is a college degree worth it?

Well, the first thing thing that I will say is that you had better finish what you start …

… because, if you don’t complete your four year college-level degree, you will probably still end up with the average student debt of $20,000 but only earn $4,000 a year more for your troubles!

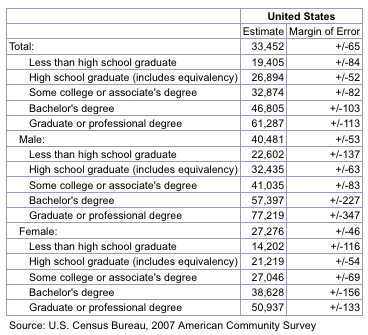

But, let’s take a closer look at what the US Census Bureau has to say about students who do complete their degrees against those who don’t:

OK, so for a $20k ‘investment’ (at least, if we assume the average debt left behind), the average college grad. can earn an extra $19k – $20k per year; sounds like a great deal?

It seems that we forgot to account for the extra four years of income that the high-school grad (but no college degree!) earned while you were off at the frat or sorority house!

So, let’s say that the college graduate starts (4 x $27k) + $20k behind the 8-ball … how long does it take him to catch up?

Well, if we assume that both achieve 4% yearly salary increases (starting from the same date that both are working, keeping in mind that the high-school-only grad. has already put four solid years of work in) and earns 8% on their investments (fueled by consistently saving 15% of their gross income), then we can see that it’s a ‘no brainer’:

– The College Grad would have saved $794,000 after 26 wonderfully exciting working years, and

– The High School Grad only saved $468,168 after 26 equally wonderfully exciting years working.

So, college is ‘worth’ $326k, in this admittedly highly-oversimplified example …. yippee!

But, readers of this blog aren’t thinking of spending the next 26 years working in the Quick E Mart, studiously saving 15% of their hard-earned income, just to earn 8% p.a. …

… no, they are preparing to be investors (say, real-estate and stocks) and/or entrepreneurs. Activities that high-school grads – and, even high-school drop-outs – can and certainly do in equal numbers to college grads!

You see, serious money making doesn’t discriminate on the basis of education … some of the world’s richest people have little to no formal schooling.

And, they aren’t wasting their ‘no college’ years earning $27k (and, salivating over their next 4% pay-rise) … no, they are busy reading this blog and starting their business/investment careers.

They have realized that serious wealth comes not from what you earn, but from the return that you earn on your money. So, with just the benefit of 4 years head start, they can turn a $20k per year earnings deficit into the same amount as a high-flying College Grad, by only increasing their annual return on that 15% savings from 8% to only 11.5%.

[AJC: If they can increase their return to serious real-estate investment territory of 20%, they will blow the college savings rate away by amassing nearly $3 mill. in 26 years, and if they achieve ‘entrepreneurial’ 50% p.a. returns, well they will join the ranks of the rich with more than $300 mill. to their name … really!]

Of course, if you choose to go to college – as I did, and will encourage my children to do – there’s nothing that says that you can’t also be an equally good entrepreneur and/or investor, on the side … or full-time 😉

Safe as houses?

Well, I did ask for it, and the first cab off the rank for the ‘diss Adrian party’ is Dan who thinks that one of my favorite posts – Contrary to Popular Opinion, Paying Off Your Mortgage Is The Dumbest Move You Can Make – is ‘ridiculous’. Seriously, thanks for opening up an important new discussion with this comment, Dan:

Well, I did ask for it, and the first cab off the rank for the ‘diss Adrian party’ is Dan who thinks that one of my favorite posts – Contrary to Popular Opinion, Paying Off Your Mortgage Is The Dumbest Move You Can Make – is ‘ridiculous’. Seriously, thanks for opening up an important new discussion with this comment, Dan:

This is ridiculous. The author apparently believes he is untouchable and will never lose his job, get sick, or die.

You can do all the complex math you want, but the simple fact of the matter is that Risk is the biggest variable, and I don’t see it show up in your equation once.

Don’t be stupid America, and dont prescribe to a system that encourages you to continue owing people money long after you need to.

Pay off your house, free up some income, then pay off your credit cards, pay off your car, and be a happier, less stressed individual.

Hmmm …. paying off your mortgage as a ‘risk management tool’?

Before we even consider why anybody in their right mind would pay off a (say) 8% mortgage before paying off a (say) 19% credit card or car loan, let’s review the substance of my “don’t pay down your mortgage early” argument:

Look at everything that you own as a business: if it’s your own home, separate the ownership of the property in your mind from it’s use …

… for example, even if it’s your own home, treat yourself as your own tenant and figure the rent that you would otherwise had to pay when doing the sums.

Then evaluate the investment against any other investment or ‘business’ …

… but, if you’re still trying to get rich(er) quick(er)?

If you own a home, don’t pay it off … use the upside to help you buy more and more of these wonderful, one-of-a-kind, almost-too-good-to-be-true ’businesses’ …

If you have other sources of income (businesses, investments) don’t spend it or reinvest all of it … use some of the spare cash to help you buy more and more of these wonderful, one-of-a-kind, almost-too-good-to-be-true ’businesses’ …

That’s my advice to you, but only take it if you want to be rich!

But, Dan says that the ‘math’ matters not, you should consider what happens if you “lose [your] job, get sick, or die”. Well, what happens?

If you have paid out your mortgage, your money is locked in the safest bank vault imaginable … all you have to do it sell the home to access the cash. Just pray that the market is an up market and not a down market, when these events outside of your control force you to sell. Or, would YOU prefer to choose the timing? Hmmm …

Of course, you could just borrow some money against the house; but then, aren’t you now putting yourself in EXACTLY the financial situation that Dan wants you to avoid: i.e. “owing people money long after you need to”?

And, even if you still do want to use your Zero Mortgage Bank, what are the chances of the bank actually lending you (or your survivors) any money when you are jobless, sick, or dead?

Oh, and let’s say that you do happen to be unfortunate enough to “lose [your] job, get sick, or die” while you are still in the 10-15 year period when you are well ahead of the 30-year payment curve, but haven’t paid off the mortgage in full, yet? How easy will it be to refinance, or even convince your bank to hold payments for you? Even if you THINK they will, you had better be certain 😉

What do you reckon? Dan’s on the right track? C’mon, be honest … would you feel safer paying off your mortgage early, or letting it ride?