I’ve been spending the last few days reacquainting myself with Millionaire Mommy’s excellent blog, but I do see some differences in perspective – even though we are both millionaires …

I’ve been spending the last few days reacquainting myself with Millionaire Mommy’s excellent blog, but I do see some differences in perspective – even though we are both millionaires …

…. but, I suspect that the differences come from degree: she describes herself as a ‘self made millionaire’ … and me a ‘self made multi-millionaire’.

IF this is the case, then I suspect that my point of view and that of, say, Felix Dennis (who is worth hundreds of millions) will equally vary from time to time. Which leads me to my first Rule of Advice:

Only seek financial advice from those who have made at least 10 times what you have already achieved, doing exactly what it is that you are attempting to do.

A long winded-way of saying: only listen to somebody who’s already been-there-done-that …

…. but, more than that: when you get to, say, $3 million or $4 million of your own, you should probably stop reading this blog, as my ideas and your may become self-reinforcing – hence self-limiting.

At that point, it will be time to move on and find some new mentors (maybe even Felix Dennis, himself?!).

The flip-side is that if you are still working towards your first million (say, $100k or networth or less) you probably should be reading Millionaire Mommy’s blog as well as (dare I say, instead of?!) mine; to help you decide which is right for you, let me give an example from a recent Millionaire Mommy post:

Today, I’m sharing a trick that can completely revolutionize your spending habits by changing the way you see the cost of the goodies that merchants want to sell to you.

Here’s the trick: Translate the number of dollars you see printed on a price tag into the number of hours the purchase will require you to work for it. By doing so, you’ll make well-informed decisions regarding what you’re willing to pay for with your irreplaceable life energy.

You should read her post thoroughly to understand it properly – and it’s another excellent “hold back your spending” technique to go along with others such as the Power of 10-1-1-1-1.

But, I wouldn’t use it …

… now.

I may have – if I knew of it – before … but, not now.

You see, when I was concentrating mainly on MM101 (getting my financial house in order), this time value of money approach would make perfect sense, but now that I am transitioning from focusing mainly on MM201 (income and wealth acceleration) and MM301 (protecting my wealth) I think the idea doesn’t make great sense:

I ‘pay myself’ a notional salary of $250,000 a year – this is really a budget for now, as we get our financial house in order after a transition from business to retirement and from the USA to Australia – and have few, if any, ‘business expenses’.

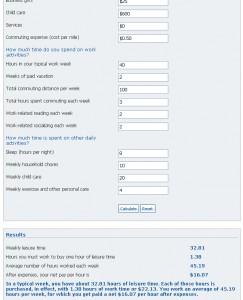

But, for the sake of the calculator, I said that I worked about 20 hours a week on ‘work’ (business/investment projects), and probably spend another 5 hours a week in social activities related to this ‘work’.

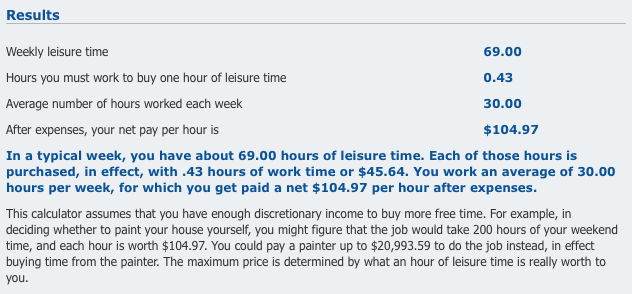

Given all of that, the calculator says that my time is worth about $105 an hour … poppycock!

The test is: would I take a job, consulting activity, etc. that paid me $105 per hour? Of course not!

Would I spend time on an activity that could produce me $105 per hour passively? Probably … but, then I wouldn’t be working 20 hours a week to get it, so the calculator doesn’t work.

In other words: I ‘work’ 20 hours a week for (a) fun and (b) a potential future payback in the millions. So the calculator doesn’t work.

Secondly, if I work 40 hours (i.e. 2 weeks), I can afford $4k worth of goodies …. even I don’t buy $4k worth of consumer cr*p every 2 weeks, and on this calculation, I only have to ‘work’ for 30 weeks to buy a Ferrari … cool! Yet, right now, I don’t think I can really afford one 🙁

Thirdly, and this is for everybody, the calculator only takes into account work-related expenses; it should really also take into account your living expenses, as well … in other words how many hours of work WILL you have to put into saving up enough to pay for that thing that you are considering buying?

If none of this makes sense, here’s some more white noise for you 🙂

“you could hire a Painter and pay him $20,993.97? How big is this house(and I m for hire 😉

I’m Fast, and drip very little paint on your Persian rug LoL…..

Yep. The advice and approach vary depending on where you are and what you are trying to achieve.

For people just starting out, the primary source of income and wealth generation is usually a salary. For people in this position, knowing what each hour of your time is worth is a useful tool.

As you build wealth, things change. The wealth you have already accumulated starts starts to represent an increasingly large sourse of additional wealth and income generation. Eventually (if all goes well), the original earned income ceases to be worth the time spent in earning it (or even meaningful).

Question: if you work for fun – is it really work?

Another useful number how much $/hr work is going into building up your wealth. Say you make $50,000/yr and invest 5,000/yr. There are about 2000 hours in a year working 40 hrs per week so that is only $2.5/hr toward building wealth.

If accumulating wealth is more important than accumulating stuff then that is a better number to use when considering how much working time a purchase really costs you! After all if you forgo that purchase you could put that money to work building wealth, saving yourself those hours!

-Rick Francis

@ Steve – I didn’t even read the ‘fine print’ until I saw your comment … are you available, as I sure don’t want to pay $20k?!

@ Trainee – Yep, it’s work … I’m really sweating after those 20 hours a week … mostly spent at the cafe 😉

Always Available.And Extremely experienced in Painting.Do Paper hanging,Drywall work,some electrical,and yard work. Also do a lot of Pool cleaning.Pretty much whatever is needed(home wise).