By now we all know that the quickest / surest path to stock market success is the IPO:

By now we all know that the quickest / surest path to stock market success is the IPO:

Take a company worth 3 to 5 times earnings and throw it onto the New York Stock Exchange (or NASDAQ, if you prefer) where it is valued at 15+ times earnings and … wacko! … instant billionaire.

Just ask the boys and gals at eBay, Google, Yahoo, and Microsoft!

Of course, there are a few problems, according to James B. Arkebauer, founder of Venture Associates, and author of “GOING PUBLIC: Everything You Need to Know to take your Company Public, including Internet Direct Public Offerings”:

1. Your company has to be IPO-size:

Many underwriters require that your company is generating sales of $10 to $20 million annually with profits of $1 million. To obtain a NASDAQ listing, you need $4 million in tangible net assets. However, most IPOs today are much, much larger with most offering sizes over $100 million.

2. IPO’s are expensive:

The following figures are considered minimums and many larger offerings will have costs that greatly exceed these numbers.

- Legal – $50,000 to $150,000

- Accounting – $20,000 – $75,000

- Audit $30,000 – $200,000

- Printing – $20,000 -$80,000

- Fees $10,000 -$30,000

3. IPO’s take a lot of time and energy to execute:

[It can take] 3 -12 months (6-9 average – when well prepared) … [including] detailed discussions on information pertaining to:

- Business product/service/markets

- Company Information

- Risk Factors

- Proceeds Use (How are you going to use the money)

- Officers and Directors

- Related party transactions

- Identification of your principal shareholders

- Audited financials

4. The IPO process can fail; IPO’s are all about marketing, but that marketing can fail:

It’s often said that IPOs are sold, not bought. That means a road show and a Q&A with the company’s top officers – in short, marketing.

5. Your company may not survive after the IPO; according to Management Today:

The probability of a new listing surviving in its first ten years falling sharply to 37 per cent by the 90s from 61 per cent in the early 70s

Of course, you only need to worry about the company lasting long enough after an IPO to get your money out … I’m not sure about the USA, but in some countries your money is escrowed for two years to ensure that you retain some ‘skin’ in the company along with all the suckers … I mean shareholders … who bought in to your dream. In other words, an IPO is best seen as a way to raise capital for growth, rather than a ‘quick, easy, and profitable’ exit for the owners.

Flexo at Consumerism Commentary

Flexo at Consumerism Commentary

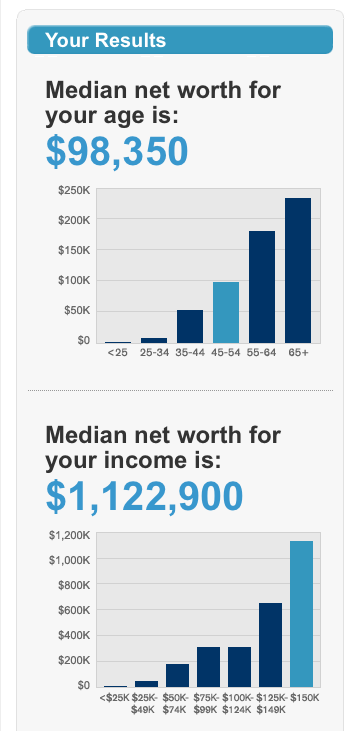

This is rapidly appearing to become a blog about your Number … of course, that’s not the case: it’s a blog about money, specifically about how to make $7 million in 7 years, but you can pretty quickly see that having a real financial goal in mind is a powerful focusing tool.

This is rapidly appearing to become a blog about your Number … of course, that’s not the case: it’s a blog about money, specifically about how to make $7 million in 7 years, but you can pretty quickly see that having a real financial goal in mind is a powerful focusing tool.