Last week, I posed the question: how much should you have saved by now?

With the general consensus being that pre-packaged formulas such as “6.1 times your current salary by age 50” mean a hill o’beans because:

a) the best these ‘common wisdom’ formulas will get you to is just over broke by the time you work to 65 (and, not a day before!), and

b) they fail to take into account that YOU need to have saved enough to ensure that you’ve reached Your Number by Your Date.

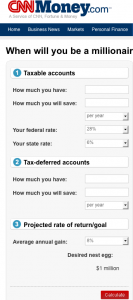

The corollary question is “when will you be a millionaire?”, one which CNN Money attempts to answer with this neat online calculator:

The problem with this calculator is obvious … but, in case you missed it, I blew up the bottom-right corner of the above image for you:

Your ‘desired nest egg’ – in this calculator – isn’t variable … it’s One Million … that’s it!

My issue is that plenty of people (fortunately, none of them readers of this blog) – with the support of an ‘authority’ such as CNN Money – still think that $1,000,000 is something to aspire to!

If $1 million isn’t just a hurdle along the way to your Number – and, a fairly early and relatively small hurdle at that – then you are destined for a VERY late retirement or an early trip to the ashram to meditate all day and eat rice at every meal … not that there’s anything wrong with aspiring to Asceticism 🙂

Adrian

PS I’m sure there’s plenty of other online calculators that will do the job, although I couldn’t find one that accepts >20% annual return and we know that we need more than that! If you find a good one, please post a link in the comments.

1) I like the SAT word

2) Check out:

http://dinkytown.com/java/Savings.html

It lets you change your number and the years you want to reach it by.

@ MY Journey – Thanks. Spelling portion of the test tomorrow 🙂

BTW: thanks for the link; unfortunately, this one only accepts ‘rates of return’ < 20% ... not enough for many of my readers!

I guess mediocrity is the new [insert country of choice] dream. Such low aspirations and targets are a sad reflection on both the degree of financial literacy among the target audience and their perceived level of ambition.

The good news….given the rate that governments around the world are printing money, becoming a millionaire is getting easier by the day (of course the value of being a millionaire is depreciating at a corresponding rate). In anticipation of at least the prospect of increasing inflation in the years ahead I am debating whether to increase my number to compensate (even if it means working for an extra year or two).

Cheers

traineeinvestor

@ Traineenvestor – the trick is to pick the ‘right’ rate of inflation: 3%? 4%? 5% More? Less?

How I calculated my Number already took into account inflation:

1. Pick the annual income that I want in today’s dollars,

2. Double for every 20 years between today and My Date (prorate for shorter or odd periods),

3. Multiple 2. by 20

… that’s my Number allowing for (very roughly) 4% inflation b/w now and then 🙂

@ Adrian

Yep. I was using 3% (slected at a time when CPI numbers were around 2%). I’m no longer sure if that is enough. Maybe 4%? But then again, if most of my money is going to be in equities and real estate I should have a degree of protection against inflation so maybe it does not matter that much if my guess on the rate of inflation is a bit out????

Well, that’s true once your money is IN; in other words: the income that these investments throw off SHOULD keep pace with inflation (as should your capital … fingers crossed).

BUT, you still need to estimate correctly how much income you need in retirement (i.e. your starting Number), which is what my 1. – 3. steps above were aiming to do. Yes?

Adrian

Agree 100%. Fortunately I hope to hit my number and join the ranks of the unemployable within the next three years (possibly extending for a year so I have some play money). Being out in my inflation estimate by 1-2% pa over three years should have little effect on my number.

Cheers

traineeinvestor