OK, so I’ve found a few online calculators that I don’t like, but it’s time to quit bitchin’ … here’s one that I do like:

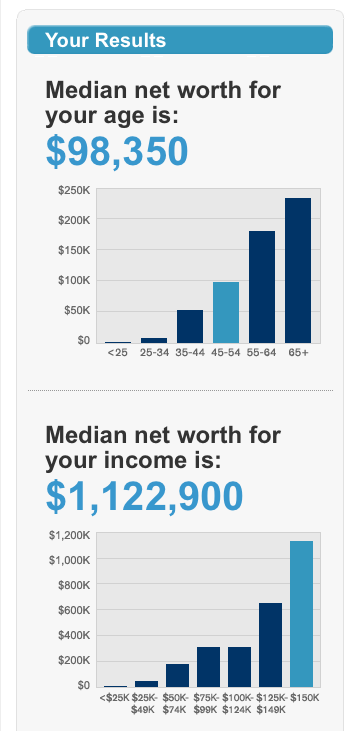

This one asks just two questions to determine how your Net Worth ‘stacks up’ against others, by age and by income.

Here’s how I stacked up just before I retired (a.k.a. Life After Work) at age 49 and was still drawing a ‘salary’ of $250k:

[AJC: OK, so I’m ignoring all of my other business and investment income, etc., etc. for the purposes of this particular rant]

Again, the obvious question is: how much SHOULD I have accumulated in my net worth?

Let’s assume that I just want to replace my then-current gross income of $250,000 by the time I reach 60 … a reasonable goal, if you ask me, but still way, way more optimistic than the general population would hope for:

Step 1: $250k is roughly $385,000 by the time I reach 60 … a simple estimate of adding 50% every 10 years to allow (very roughly) for 4% inflation gets close enough to the same result without using an online calculator or spreadsheet.

Step 2: So, if I want to keep the same standard of living – with all the arguable pluses and minuses of grown up kids and greater health and insurance costs … not to mention more green fees 😉 – I’ll need to generate a passive income of at least $385k that, according to our Rule of 20 (which assumes a 5% ‘safe’ withdrawal rate), means we need $7.7 Mill. sitting in the bank (well, in something that will give us a RELIABLE 10%+ annual return).

Step 3: If I plug my starting Net Worth (let’s go for the generous starting average for people on my super-generous assumed current income) into this online annual compound growth rate calculator, I can see that I need just over a 19% average annual compound growth rate between now and then.

OK, so I have my target, now let’s take a look at how likely I am to achieve it (you see, it’s not as bad as it sounds: I can keep adding a % of my salary to my Net Worth, as well as reinvesting any investment gains and/or dividends) …

… to my mind, I’ve had 27 years of ‘practice’ to get where I am today – if I match CNN Money’s ‘profile’ – using:

– How much I had saved when I started working, and

– What % of salary I’ve managed to regularly save over those years, and

– What average investment returns I’ve managed to achieve in that time.

Well, I’ve been working for about 27 years, and I started full-time work with about $6k of car and pretty much nothing in the bank. So, if I plug in my current net worth (again, assuming that it’s what CNN Money says is ‘average’ for my super-high assumed income); what I started with; and 27 years between the two … the calculator shows that I must have averaged 21%, so no problem!

Except that I had to receive massive salary increases to get from my starting salary of $15,000 [AJC: I thought that was huge! And it was … in the early 80’s 😉 ] to my current (assumed) salary of $250,000 … in fact, my pay increases would have needed to average between 11% and 12% every year for 27 years! Now, that’s hardly likely to continue …

So, if I assume an average compounded investment return (e.g. stock market) of 12% for the past 27 years … which seems pretty darn generous, if you ask me … then, I would have needed to be smart enough to save nearly 40% of each pay packet for the entire 27 years (including putting some of it … a lot, I suspect … in my home).

Running that forward (assuming a more sedate, and probably much more likely, 5% salary increase each year until I retire at 60) and I CAN reach my Number!

In fact, I overshoot by about $1 mill., so I can even afford to drop my regular savings rate to ‘just’ 35% of my before-tax pay packet … easy, huh?!

So, it seems doable, except that I see four problems:

1. I need to have a starting salary of $250,000 per year

2. I need to have a Net Worth of at least $1.12 million by age 49

3. I need to be able to save 35% of my GROSS pay packet

4. Even after all of that, I still NEED to work until I’m 60!

[groan]

Adrian.

PS How DID I stack up at age 49? Easy: $7 million in the bank. What did I start with just 7 years before that? Nothing: I was $30k in debt. So, is it ‘doable’? Absolutely: And, this is just the place to find out how 🙂

I’m not sure how useful that calculator is.

The “age” number is not useful (at least not to me) as it does not take into account forward looking objectives (number, time to reach number etc) or even historical financial circumstances.

The “income” number is well….I get the same median number for all incomes from $150,000 to $10 million or more. I do not accept that people earning $10 million a year have the same median net worth are people earning $150K a year.

Your approach to working towards achieving a number in a given time frame is more useful.

@ TraineeInvestor – It never occurred to me to even check other numbers! One simply assumes the authority of CNN Money 😉

I’d like to hear what other readers found …

Hi Adrian,

obviously the calculator is useless for practical use. The question that occurred to me while reading this post was what do all of the people who follow this kind of terrible advice do when they think they can retire and then can’t?

I guess they either work longer than they wanted or sacrifice major aspects of the type of retirement they originally wanted. I’ll take neither, thank you very much!

In a related note, what are some things that you thought you would want/need to budget for in retirement that you ended up not needing? How about things that have come up that you wish you would have budgeted for?

As always, great post! Thanks!

AJC,

You got very lucky with your commercial RE appreciation. Excellent results and for sure you played it right, but I wouldn’t bank on repeating that trick every 3 years…. not for a while anyway. Of course I’m looking to see if there are opportunities out there.

As you calculated, it would be near impossible to save your way to $7 million, and with the Obama administration pushing for higher taxes it will be even harder for future generations….

-Mike