… well not exactly a new measure, more a new definition.

… well not exactly a new measure, more a new definition.

Let’s think about some stages of wealth:

1. Debt Wealthy

At some stage, after half a lifetime of struggle, you will most likely have a mortgage, a partially paid off car loan, some residual student loans, and probably a few credit card bills hanging around.

If you’ve come to this blog via the other personal finance blogs floating around, then this probably bothers you enough to want to do something about it …

… as for the rest, many will struggle with this debt until the day that they die.

But, not the Debt Wealthy!

These lucky few will have risen up the corporate or business ladder high enough that their income is enough to service this debt and a little more:

– They can finance their house, car, boat, and caravan/vacation home

– What they can’t finance, their job or business provides (car, phone, laptop, corporate dinners)

– They have enough left over for a domestic trip or two every year sitting up the back of the plane,

– And, enough to eat and clothe themselves well, and to educate their children.

Their only problem – one that they choose never to voice, yet the one that has the bread-winner tossing and turning in their sleep every so often – is the ‘what if” …

… what if:

– They lose their job/business?

– They get sick?

– They get divorced?

They have no plan other than hoping for the best … and, for many, this is enough and for the rest …

… well, sh*t happens 😉

2. Rent Wealthy

But, for a lucky few – and, never through saving but always through Their Big Lucky Break – a huge wind-fall gain comes in; it could be:

– Selling their business

– Retiring (or being retrenched) with a huge Golden Parachute

– Winning the lottery or the Inheritance Jackpot

Presuming that they understand how to deal with this situation and don’t go crazy [AJC: reading this blog should help], they can probably:

– Finally stop working

– Begin to live their Life’s Purpose

– Pay off all of their debts (houses, cars, etc.)

… and, they should still be Rent Wealthy … a really nice stage of life, because they should have enough passive income (again, if they don’t go crazy) to rent whatever they want, whenever they want it; for example, they can rent:

– Seats somewhere towards the pointy end of the plane (or, even by charter),

– Hotel rooms anywhere in the world that come with at least a few stars,

– A Really Nice Convertible for a drive in the country once or twice a year,

– Time on the golf course as often as they want

… and, the list can be virtually endless.

I should know, because with $7 million I am Rent Wealthy 🙂

3. Buy Wealthy

Of course, if their Big Windfall is really an Obscenely Big Windfall, then a Really Lucky Minority becomes wealthy enough to buy everything that I can rent, either in whole (or, in multiples if they are Oprah) or in parts (eg fractional ownership):

– They own their own personal jet either outright or by fractional ownership,

– They have one or more vacation homes (owned in full or fractionally) around the world,

– They own at least one Really Nice Convertible or share ownership of a few,

– They have memberships at one (or many) Really Nice Private Golf Clubs.

The interesting thing about all of these stages is that they have one thing in common …

… can you guess what that might be?

You are much more comfortable at the top end of each stage than you may be at the bottom of it!

At the bottom, you are always trying to keeping up with The Jones (you know, the ones who can borrow, rent, or buy much more comfortably than you). Others think you are fine, in reality, you are struggling:

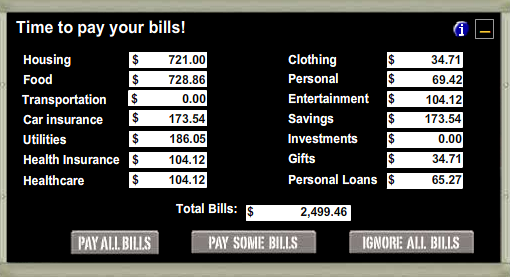

– to pay the mortgage, if you are Debt Wealthy

– to pay the bills for all of those discretionary expenses, if you are Rent Wealthy

– to pay for the maintenance and upkeep of all that stuff you own, if you are Buy Wealthy

So, what’s the lesson, other than a cute observation?

It’s simply this:

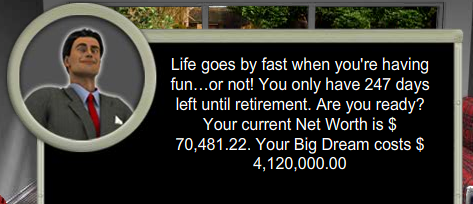

When you consider your Life’s Purpose, don’t pop yourself into the bottom of the next stage.

Instead, hold yourself back either permanently or until you have enough passive income to drive you to the ‘sweet spot’ of the next stage.

Aim toward the mid-to-upper part of the stage that you think may be enough for you …

… for example: for me, Rent Wealthy is plenty 😉

How about you?

Motley Fool tells us

Motley Fool tells us

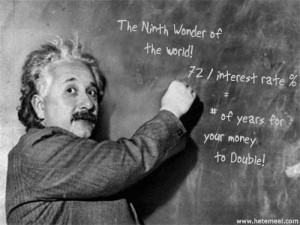

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …