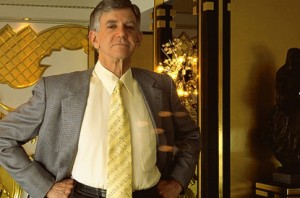

Lots of people trusted this man with their money, but more on that later …

First, I want to tell you about The Finance Buff who wants to offer you personal finance advice … he also wants to know how much you’re prepared to pay, claiming that there’s an under-serviced market here for inexpensive, unbiased personal finance advice:

Usually an under-served market exists when there is a big gap between what customers are willing to pay and what it costs to produce what they want. I suspect that’s the case in the financial advice market.

[But,] I’m willing to help others with their personal finance questions. I don’t necessarily have to make much money from it (my full-time job covers my living expenses), but I do want to at least cover my cost of regulatory compliance and liability insurance.

With most things, you pay peanuts and you get monkeys …

… and, that may be the case here:

I am not a financial advisor. I do have personal opinions, sometimes strong, ignorant, or biased. Everything you read here on this blog is the author’s personal opinion, not financial advice. I am by no means an expert on anything. I don’t intend to mislead, but my facts, figures, and calculations can be incomplete, inaccurate or plain wrong.

Of course, that’s just his legal disclaimer … because, after reading the quality of The Finance Buff’s blog, that may not be the case at all … it could indeed be quality financial advice at a bargain price! 🙂

On the other hand, looking for a top-of-the-town advisor and paying the commensurate high price may not get you the kind of quality financial advice that you would expect, either.

Alberto Vilar [pictured above], 68, co-founder of Amerindo Investment Advisers, faces up to 20 years in jail after being found guilty on all 12 counts of fraud and money-laundering against him. Hailed as heroes by their clients, they made fortunes for themselves in management fees. [But,] their fortunes plummeted at the same time as the dot-com bubble burst. They were arrested in May 2005 after a client, heiress Lily Cates, claimed they had stolen $5 million from her.

Price [does not equal] Quality when it comes to personal financial advice.

For that reason, I don’t recommend that you put your money into the hands of any advisor; in fact, I recommend that you do not seek a personal financial advisor at all … rather, you should look for a personal financial mentor.

There is a difference:

ad⋅vis⋅er

–noun

1. one who gives advice.

2. Education. a teacher responsible for advising students on academic matters.

3. a fortuneteller.men⋅tor

–noun

1. a wise and trusted counselor or teacher.

2. an influential senior sponsor or supporter.

Would you rather trust your financial future to the book-learned “fortuneteller” who will promise to give you a bucket-load of fish …

… or, would you rather trust it to yourself, with the support of the self-made “wise and trusted counselor” who will teach you to fish?

[ AJC: There is another difference: a true mentor won’t ask you to pay for anything more than a lunch or two 😉 ]

Whether you are looking for an advisor, or a mentor, or you don’t care which because you think the difference is moot, after satisfying yourself of their integrity and character, here is what I would look for:

1. If I know my Number and Date, then I would look for a mentor who has made 10 times as much in about half the time, and

2. Doing exactly what it is that I need to do in order to achieve my required annual compound growth rate.

Choosing an advisor and/or mentor by asking these typical ‘financial advisor double-speak’ questions can’t do you any good; you see:

They can’t be aligned with the way you think … instead, they need to be aligned with the way you want to think.

I’m having a hard time finding advisors and mentors who can move me to Making Money 301 (protecting my wealth) … now do you see why?

Your link to finance buff’s website is to a news article…

Ed: Fixed! Thanks for pointing it out 🙂

>They can’t be aligned with the way you think … instead, they need to be aligned with the way you want to think.

That makes a lot of sense- if your mentor thinks the same way you do then they won’t change your outcome significantly.

>I’m having a hard time finding advisors >and mentors who can move me to Making >Money 301 (protecting my wealth) … now do >you see why?

Yes! I suspect that there are few people that have $70 million of their own, and fewer still with a long track record of protecting it! You might have to settle for someone with a lot of experience managing other people’s money that has the right mindset to protect your wealth.

I’ve found that Brian Preston’s podcasts has given very solid MM301 advice: http://www.moneyguy.com/. If I had $7 million to protect I would ask him or someone like him.

-Rick Francis

Dear Sir,

back in May of 2005, the prosecution charged that the $5 million Mr. Vilar and his partner were accused of having stolen from an investor named Lily Cates was only the ‘the tip of the iceberg’ of a massive fraud, and that ‘hundreds of millions’ may be missing. More than four years later, monies owed investors amount to approximately $20 million against more than $40 million in various JPMorgan (former Bear Stearns) accounts frozen by the government when the defendants’ company, Amerindo Investment Advisors, was shut down. Recently the government brought in another alleged victim who they say was defrauded of $20 million, but this victim, a bank entity, refuses victim status, the government concedes in its most recent motion. A year ago a jury found both defendants guilty of the most serious charges after a seven-week trial. The way the evidence was presented, the jury had no choice. It all comes down to strategy: The government argued successfully that the defendants were guilty because they ‘intended’ to steal. This was never proven in court. They asked the judge to sentence Mr Vilar to more than 20 years behind bars, which would amount to a life sentence for a man of his age (69). The defense lawyers, who did not even bring in their own witnesses, called for acquittal, arguing that there were no losses because the ‘victims earned millions more than they invested with Amerindo. A different strategy may well have created a doubt in the jurors’ minds and the outcome may have been quite different (see recent insider trading acquittal). Following the jury’s verdict, the court felt Mr Vilar was a flight risk and sent him to prison where he is today awaiting sentencing. No date has been set. Looking at all the other recent schemes where investors really took a beating (Madoff, Marc Dreyer, etc), one wonders why the government was hell-bent on taking this case out of civil court were repaymemt schedules were successfully being worked out. My French professor praised the American system of law, but he compared it to the Ritz Hotel: You can stay there if you have ther money.

Adrian,

What is your number and date?

I would think it is easy for you to double your money again in 7 years (ie, $7mil to $14mil in 7yrs or less).

Are you looking at $35mil in 7yrs?

By the way, is house prices getting out of whack? A mansion bought for $2mil in 1991 is getting sold for $20mil in 2009. A 10 fold return in 20yrs! Did the rich got richer by 10 fold thru this crisis or is the flood of liquidity inflating every asset prices out there? In that case, should we just concentrate on properties?

Oh that house is in Melbourne and owned by an Ex-CEO of Dunlop Pacifc

http://www.businessday.com.au/executive-style/luxury/melbournes-20m-mansion-20091119-inlm.html

Rick, you gotta be kidding.

Asking Adrian who have made $7million himself to send his money to someone who have not made that much money from his supposed expertise?

The only way that advisor is getting rich is from the management fees he’s getting from those clients of his.

My philosophy is simple. If I want to get rich thru properties, I will want to look for someone who have done it thru properties. So, in order for me to trust the advice of the financial advisor, he must show me that he has already achieve financial independence thru investing(not thru giving advice). That is totally different.

@ WJ – I can’t be sure on the real-estate, my Aussie house is only worth $5 million (no mortgage) … but I can tell you that my US house is bigger/better/newer and ‘only’ cost $1.6 million (although, we’d be struggling to get much more than $1 – $1.2 million today.

I might throw your and Rick’s opposing views re The Money Guy to our readers on Sunday, and see what advice they can give me.

WJ,

I’m not kidding- If Adrian is looking for an advisor to protect his gains with minimal risk then he needs an advisor that thinks that way. I don’t think he would or should turn over control of his money- but he should consider paying for investing strategies.

Becoming independently wealthy using a MM301 process is just too SLOW. If you want someone with a lot of experience managing a really large sum of their own money in a MM301 way you should look for old money. But do they manage it themselves, or do they hire a professional manager?

Adrian, any country club members you could ask?

If a professional has been in business for at least a decade they should have enough of a record to judge their abilities. How they handled 2008 would be very telling.

-Rick Francis

@Rick

> Adrian, any country club members you could ask?

> If a professional has been in business for at least a decade they should have enough of a record to judge their abilities. How they handled 2008 would be very telling.

Like Madoff? Didn’t he get recommended all the time on the country club circuit?

Unless there is real transparency and good auditing (not just reporting, I can fake that), there is always a risk unless you exclusively control the access your money.

Back before we were married (and during the dot-com collapse), my wife had a problem where a broker did a number of unauthorized trades just to fill his pocket. I will say that once it was discovered the brokerage firm stepped in, gave him the boot, refunded her money and “made it right”.

And what do you do if you are so focused on earning money that you don’t have time to manage it? If you have the trust can you outsource it?

@Neil

I would seek advice rather than delegating control over the investment account. Even if you are very busy a MM301 portfolio should not require much management at all- say monthly withdrawals and rebalancing each quarter.

-Rick Francis

@ Rick – I agree; we are talking advice here … the last time I handed over $1 mill to somebody to manage for me, he lost $600k in a few weeks 🙁

Pingback: Do I need The Money Guy’s help? You tell me …- 7million7years

Even seeking advice and strategies is tricky. Who do you trust? How do you know if the advice is right for you? You’d need to speak to doezens to get unbiased perspectives. My observation is people who know how to really bring a return on money are few and far inbetween. Buckle your seatbelt because learning curve could be a long long ride. Hope you live long enough to figure it out.

Heck even Warren Buffet and Suze Orman have opposing views.