Buying islands aside, how does being rich change your life?

Paul Graham, not depicted in the photo to the left, the founder of Y Combinator [AJC: the incubator for famous internet startups such as Drop Box and AirBnB …. if you have to ask what these are, you are over 30] says this (when asked “how did your life change after FU money?”):

There are some things that change. For example, you learn to distinguish problems that can be solved with money from those that can’t. You can buy your way out of a lot of schleps.

Life doesn’t get an order of magnitude more enjoyable, because you still can’t buy your way out of the most serious types of problems, but a lot of annoyances are removed.

The best part is what I thought would be the best part: not having to worry about money. Before Viaweb I’d been living pretty hand to mouth, doing occasional consulting. It felt like treading water, in the sense that while it wasn’t hard, I knew in the back of my mind that I’d drown if I stopped. Getting rich felt like reaching the shore.

One thing you learn when you get rich, though, is how few of your problems were caused by not being rich. When you can do whatever you want, you get a variant of the terror induced by the proverbial blank page. There are a lot of people who think the thing stopping them from writing that great novel they plan to write is the fact that their job takes up all their time. In fact what’s stopping 99% of them is that writing novels is hard. When the job goes away, they see how hard.

I can relate to this on a number of levels:

Firstly, you can buy yourself out of what Paul calls “schlepps” and what I will simply call “annoyances”.

The pool dirty? Call The Pool Guy.

Something broken around the house? Call the handyman.

Can’t be bothered cooking? Eat out … expensively. In fact, never eat a cheap steak again.

But, you can’t solve personal problems (of the really personal kind) or health problems with money … you, of course, can afford to treat them a little (or a lot) quicker/better than before.

But, what I’ve found is that your major problems become about money: how to stop losing it; how to make it last; how not to be cheated out of it; how to invest it … and, so on.

I’m not not sure if there’s a bigger Number, where even some of these problems go away …

… if there is, I’m guessing it’s well-north of $10m.

I can sympathize with Paul on the book thing: it’s hard to write and publish one. Just ask Debbie, my coauthor [AJC: ours is finally coming out … soon].

But, the question remains: what exactly is FU money?

Well, a LOT more than you think!

Here’s what David S Rose, a well-known ‘super’ angel investor in Silicon Valley, says:

Being a millionaire ain’t what it used to be :-).

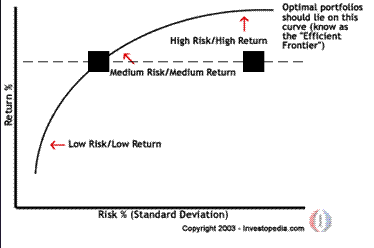

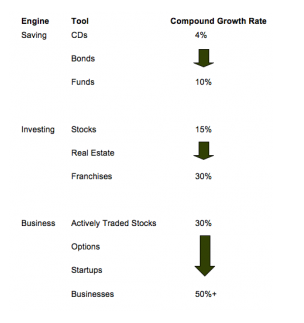

In thinking about net worth, it’s helpful to consider everything using a common denominator, such as your potential annual income based on the return that the wealth could theoretically generate. (Because otherwise, if you start spending your principal, you won’t be a millionaire very long.)

So, for example, a million dollars put into the safest CD you could find, might, if you were lucky, generate 1.5% interest each year… which is $15,000!

Even if you had, say, $5 million, and were willing to take a fair bit of risk and put it all in the stock market where it might (with real luck) generate 4% annually, you’d still be making “only” $200,000 a year. Take out taxes (being generous, let’s use the 20% rate at which Obama paid) and you’re at $160k.

That’s enough to rent a nice apartment (or pay the mortgage on, say, a +/-$1m house), take a nice vacation each year, and probably pay private school tuition for one or two kids… but you’re certainly not going to be flying your own Gulfstream with only $5 million.

Next, if we skip over the run-of-the-mill deca-millionaires and jump to someone with $100 million in assets, NOW for the first time are we just getting to the point where you have a good bit of flexibility.

Assume that with this kind of cash you begin to have access to some good hedge and venture funds, so maybe you’ll be able to consistently get 8% on your money. And now that you’re in the privileged class, we’ll figure you can match Mitt Romney’s 13% tax rate. This means you’ll net out to about $7 million disposable income annually.

At this level you can do pretty much anything you’d reasonably want. Pay the mortgage on a $10m mansion as well as a $5m summer place in the Hamptons, put four kids through Ivy League colleges, fly first class anywhere you’d like, make half a dozen angel investments at $250K each, eat out every night at five star restaurants, vacation on the Riviera, and have a full-time cook, butler, nanny and chauffeur. I expect you’d even tithe $1m annually to good causes, which probably gets you named Man of the Year for a big local charity.

All in all, not a bad place to be! But still no Gulfstream, no $35 million penthouse in midtown Manhattan, no building named after you at your alma mater, no mega-yacht docked outside your Riviera estate, no getting Justin Bieber for your daughter’s quinceanera, no 24/7 security detail like the President, no executive-producer credit on Avengers 2, no invitation to the Allen & Co retreat, no mega-trophy-spouse.

All that needs to wait until you get your first billion and put it to work.

Here we’ll assume that with enough portfolio diversification you’ll finally hit a Google or LinkedIn, and be able to comfortably plan on >10% annual returns from your professionally-managed holdings. And since you’re now an oligarch, let’s say that your hardworking gnomes will figure out how you can limit your taxes to the same <10% that will likely surface once Mitt releases his older returns.

This means you’ll now have close to $100 million a year after taxes, and FINALLY you can afford all those things you’ve always dreamed of! While you might not be able to pull off in the same year BOTH the $85 million pièd a terre in Manhattan that Russian guy bought for his daughter, AND the $150 million megayacht of the Sultan of Dubai, you’ll be in pretty good shape.

However, those constraints DO make a difference when you’re playing in the big leagues, so figure that you’ll have to step up to the next category, before there really are NO practical limits to what you can do and how you can live.

Once you get above the $10 billion level, all is good, and you can both help change the world (viz. Bill Gates) AND indulge yourself in any way you desire (viz. Larry Ellison and various sultans). From this point on, it’s simply a matter of score-keeping in the great Monopoly Game of Life. You’ll need to decide for yourself how important your place on the Forbes list is, and whether you care about your standing relative to Mark Zuckerberg ($10 billion), Michael Bloomberg ($22 billion), David Koch ($25 billion) or Warren Buffett ($44 billion).

Some of David’s points are spot-on: for example, retiring today with $1m nets you $15k (to $40k, in case you’d rather believe the financial planners who advocate a 4% ‘safe’ withdrawal rate than David) …

… retiring in 20 years with $1m is poverty level (roughly halve whatever number you believed, above, because of the eroding effect of inflation).

And, I can’t talk about anything more than $7m.

But, at that level, I can certainly agree with David that it buys me a (very) nice house and I certainly can afford to “take a nice vacation [or two] each year, and [definitely] pay private school tuition for one or two kids”.

But, is that FU money?

I certainly don’t feel that way …

… I still have ‘money worries’ of the kinds that I listed, above.

But that just may be the syndrome that Spectrum (a Chicago-based consultancy that specializes in understanding the High Net Worth individual and family) found when they surveyed a number of people whose net worth was in the $1m, $5mill, and $25m+ ranges about how much money that they would need in order to feel wealthy.

Almost invariably, the answer was: “about double”.

Hmmm …. 😉

.

.