Last week I suggested that a great way to compete against your larger, more established competition (particularly if you are a small business trying to sell products or services to larger businesses) is to become an expert in your chosen field.

Problem: Your LITTLE COMPANY cannot hope to be able to compete on even footing with the BIG CORPORATIONS you will most likely be facing off against.

Solution: You change the game: you make it about PEOPLE … better yet, you make each person at each corporation compete with YOU, rather than your company competing with theirs!

Implementation: You make being small/unique an advantage … YOU become the expert that your clients will want to come to for advice [read: products and services]. Forget the advertising, forget the telemarketing, forget the doors slammed in your face.

Becoming an expert is something that I am quite ‘expert’ in having done it 2.5 [twice and a bit] times already 🙂

So, let me tell you how I did it:

1. The first time that I became an expert was when I was working my first Big Corporate Job, straight out of college …

I was asked to work with a guy who was doing an assignment with one of the national banks to help them do some forecasting; at first I balked because the technique that he was using seemed rather technical, and I hate anything detailed/technical. As it turns out, this character flaw became one of my greatest assets.

You see, I came across a little-known-even-less-used Canadian technique that used simple rules-of-thumb to replace the laborious detailed calculations of the more commonly used method that I was busy – under quiet sufferance – learning.

What I found, though, were three things that really excited the clients:

i. The Canadian method could be explained easily to the business people who were making the decisions based on the forecasts, and

ii. The forecast results lent themselves to pretty graphs and pictures, again favored by the ‘business leaders’ over the detailed tables produced by the more common method,

iii. It had a fancy name (not dissimilar to the type of name in the graphic at the top of this page) with a cute acronym.

… oh, and two fantastic advantages for me:

a) Only I had the keys to this ‘new car’, and

b) it was quick and easy for me to both understand and implement.

Bingo!

Instant expert … not bad for a guy with a little over two years’ industry knowledge competing with guys who had been doing this stuff for 20 years.

Who do you think got the ‘big bucks’? 😉

2. The second time that I became an ‘expert’ – this time in a totally different field – was when I got the idea to start my second business (the one that I eventually sold: employing well over 100 people, with operations in Australia, New Zealand, the USA and with consulting contracts all over the world) …

The first thing that I realized was that if I came up with the idea in Australia, it must exist in other parts of the world, since I’m really not that bright 🙂

And, if it exists in other parts of the world, then where more likely than the USA?

So, I scheduled a reconnaissance mission to the States and happened on the head office of the oldest – and, most respected – such company in Philadelphia … and, the owner welcomed me with open arms!

So, not only did I walk away with a business plan and operational model, but I had some key statistics for the USA market that would help me examine the business need in Australia, when I got back.

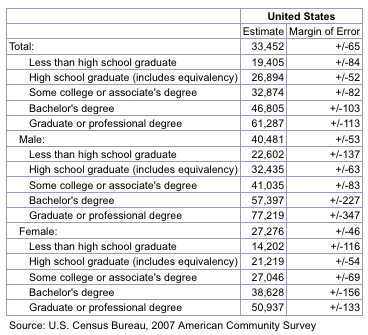

The first thing that I did – now, this is the real advantage of a college education [AJC: which, you now don’t need, because you just need to hire a smart college intern and tell her to do everything for you that I write in the next paragraph] – was to:

a) Reproduce the Market Intelligence report for the Australian market: even though I didn’t know anything about the business that I was getting into, neither did anybody else in Australia because I was the first. But, I didn’t need to know anything, because I just found somebody who did and copied them [AJC: of course, in your market, you may need to hire such a person, or go overseas and model an existing business as I did, or … any ideas from our readers?]

b) So, all I had to do was find some key industry stats and ‘guesstimates’ (hey, if I didn’t have an exact answer … nobody else did either!) and crunch the report with Australian numbers and dollars. This turned out to be easier than I thought.

c) Then I wrote a neat little Press Release – this was before they became known as Media Releases – [AJC: want to know how to write a press release? Try google, again!], and

d) Sent it out – along with a copy of my 6-page report – to some media guys whom I thought might be interested … this was easy: I just bought a few ‘trade’ magazines in the subject areas that I was interested in and found the right guys in the table of contents page … you could, of course, buy a media guide that lists all of that stuff, if you like [hint: google].

Then I waited, hoping for a tiny mention that I could refer to in business correspondence e.g. “Adrian’s Little Corporation – as featured in You Gotta be Joking Monthly – invites you to ….” to give me that hint of credibility.

Now, a little luck comes in handy, because I received a phone call from the first guy that I sent it to – who wrote for Australia’s equivalent of Forbe’s magazine – who told me that he was interested in my report, asked me a few questions, then asked when I’d be available for photographs.

Photos!?

Now I’m thinking a little thumbnail, and a quote!

Well, I was blown over when a few weeks later the magazine hit the newsstands and I saw that I had received a full page write-up – plus big photo – full of “Cartwood, Australia’s leading expert says ….”

Instant expert … again!

Now, I’m not suggesting that my phones rang off the hook; in fact, they didn’t ring at all …. but, this was not a sales/marketing exercise, it was a credibility -building exercise.

As a result of this simple process, two great things happened:

i) I asked for (and the magazine was kind enough to send me) a box of overruns: extra copies of the magazine that they may normally pulp – and, if they didn’t want to give them to me, well, what was a couple of hundred bucks to buy as many as I could lay my hands on? I used these as ‘business cards’ to give potential prospects, either to get – or, to kick-off the first meeting; these were highly effective ‘credibility builders’! I also ordered a whole stack of reprints of the article, which I used as my main ‘marketing brochure’ for years. Double the credibility, half the cost of a slick brochure 😉

ii) This is where luck steps in (everything prior to this positions you to make your own luck): a lady who runs a college-certified ‘for profit’ course recognized (from the photo in the magazine) me at a trade show and asked me to develop a one day course on the subject area of that article. I was paid $1,000 a day (plus travel expenses) to put myself in front of a captive audience of my best possible sales prospects … and, from this very course came my first 5 clients.

[AJC: Imagine being paid to sell your own product to clients who pay to hear your ‘pitch’!? Now, this is probably a subject for another post, but people ask: “why did you teach your secrets to clients?”. The answer is simple” you can teach people all you like, but the real secret is in the implementation … people would much rather BUY than DO. I have found that the more you give away, the more that comes back to you]

BTW: Now, do you see how important it is to try and polish your ‘public speaking’ skills as much as you are able?

3. Finally, it was a pleasure to be able to embark on the process of reinventing myself as an expert in a third field, this time one in which I actually had put in the ‘hard yards’ to learn as much about through personal experience before becoming ‘the expert’ rather than after 🙂

Of course, I’m talking about what I’m doing now: personal finance … specifically, how to get rich(er) quick(er), a subject in which I (humbly!) think I am expert in and one of very few, if not the only speaker of any genuine credibility, having achieved what I teach about before writing the books and getting the fat speaking contract.

Since this one is a work in progress, and more of a vague directional feeling than a solid strategy, I will outline for you roughly the steps as I think they may unfold:

Step 1: Write a blog (a) to get my ideas into the market, give them some ‘air’, and see what works from a literary sense, and (b) get some sort of audience/exposure,

Step 2: If I am lucky, get noticed by some producer, publisher, news or magazine editor and be given the type of opportunity that gets my message out to a large national/global audience,

Step 3: Write a book and (a) find an agent/publisher or (b) self-publish

Step 4: See Step 2!

Step 5: Write another book

Step 6: See Step 4!

Step 7: See Step 5!

If I needed the money, I might organize my own speaking engagements and spend more time wooing the ‘traditional media’, instead of relying on Step 2. But, I don’t so I won’t 🙂

And, if I am ‘unlucky’, I’ll keep going with Steps 1., 3., 5., and 7. for as long as you and I keep enjoying it!

Guys, as the economy improves (if it improves) interest rates will surely rise, as they already are in other countries.

Guys, as the economy improves (if it improves) interest rates will surely rise, as they already are in other countries.