Trent at A Simple Dollar poses an equally simple question: Do You Want to Appear Rich? Or Do You Want to Be Rich?

Trent at A Simple Dollar poses an equally simple question: Do You Want to Appear Rich? Or Do You Want to Be Rich?

Now, if this were a frugal-living blog, I think you know what my answer would be, but – like Trent – I have some personal experience of living beyond your means to keep up with appearances: I grew up in a house where my family clearly lived beyond its means.

But, my father confided our true financial position to me – and, only to me – so, I became financially self-sufficient at a very young age. Others saw this as me having a strong sense of responsibility; however, if they knew my dark financial secret, they would see it as merely as the early manifestation of a strong survival instinct.

Whatever the fiscal lessons that I learned at a young age, they have clearly been to my long-term financial benefit …

Having said that, by nature, I like the good things in life … being rich suits me 🙂

However, even before I made $7 million in 7 years, I knew how to appear rich by being clever with the money that I had.

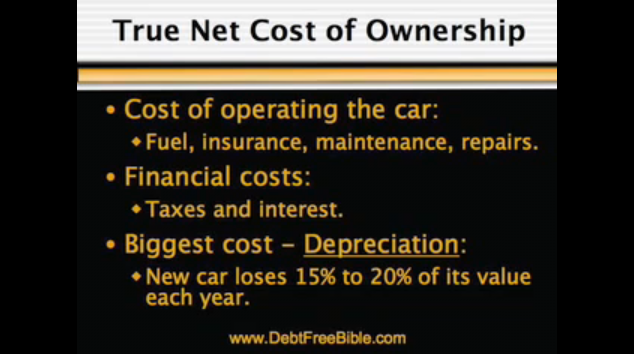

For example, when my friends were buying new Australian or Japanese cars (hence riding the depreciation roller-coaster to the tune of 15% to 30% per year), I bought a ten year old 911 Porsche.

Not only did I have a ton of fun racing it – and, rolling it on and off tow trucks whenever it had mechanical problems 😉 – I made money when I sold it.

Clearly, buying used is one way to appear rich (and, enjoying some of the fruits of your labor now) without actually holding yourself back from becoming rich by overspending.

Another way is to avoid the fiscal habits of either the Debt Wealthy or the Buy Wealthy: don’t buy or borrow-to-buy ‘stuff’ i.e. depreciating assets like cars, boats, and vacation homes.

If you must have some of these things, then take a leaf out of the book of the Rent Wealthy: rent whenever you can afford to, otherwise go without.

For example, it’s been said that you can charter a boat that is one size larger than you could afford to buy five times a year for about the cost of owning that smaller dinghy that you were about to buy. Similar logic applies to vacation homes, etc.

Use this rule of thumb (i.e. at least 5 weekends a year – every year – of use) to help you decide when you should buy or rent … assuming that you could afford to buy according to the 5% rule 😉

A week or two ago, a reader – who shall remain nameless as they are currently in negotiations – asked for some advice on selling their business:

A week or two ago, a reader – who shall remain nameless as they are currently in negotiations – asked for some advice on selling their business:

What do cars and radioactive material have in common?

What do cars and radioactive material have in common?

… well not exactly a new measure, more a new definition.

… well not exactly a new measure, more a new definition.