What should this reader do?

Read his story, make a selection, and leave a comment:

We are renting the commercial condo that our business is in for $1,800 per month, we can buy it for $160,000 should we?

We like the building, the location is a bit hard to find, and with a 20% down it will really cut down on the monthly expense but I will eat up $32,000 that we could use to expand the business. I don’t have $32k but I have a friend who offered to lend me half of it, I do have half.

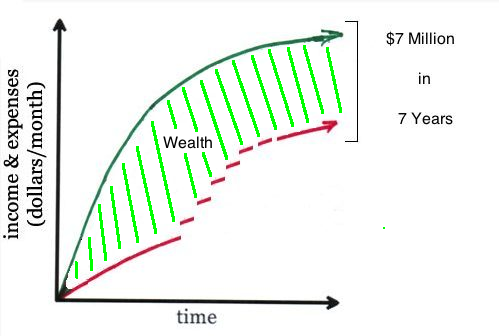

We currently average $15k a month in sales, other than rent we have about $1000 in fixed expenses, I pay myself $2500, and we average about 25% for costs of goods sold. We currently have staff that costs about $2000 per month. This gives us about $4,000 of extra money at the end of each month….so far with this extra money we have bought lots of extra inventory to the point that we have enough, we have bought a commercial truck, the business is 100% debt free and has about $5,000 in liquid assets saved up (And we personally have over $10k), along with 30k in inventory and 10k in tools and equipment. Personally we are debt free other than the house, student loans and car….but with the house at 2% interest and the car at 2.9% and the student loans at 3.25% I don’t see any reason to send any of them more then the minimum because we make 4 times on most inventory that we buy.

So is now a good time to get the building? Or should we keep our cash free to keep buying things that are our core business? We are not in the business of real estate so should we own or rent?

Now, I’m not yet sure exactly what advice to give him, yet, so leave a comment and help us BOTH out 🙂