I was really impressed with the quality of our readers’ analysis of last week’s video post (from ABC’s excellent show, the Shark Tank, which is about a group of entrepreneurs who listen to various pitches before deciding whether to invest their own money), so I thought that I should do this follow-up piece, while the video is still reasonably fresh in our minds.

In case you didn’t see the video, or need a refresher, here is the link: http://7million7years.com/2009/11/12/take-the-money-and-run/

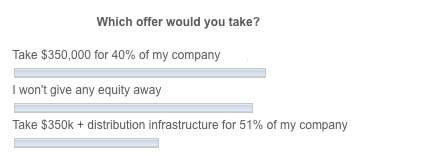

The reader poll shows that people are reasonably split between not giving any equity away at all, or giving away a minority … fewer still wanted to give away a controlling interest.

So, who is right? More importantly, what did the girls decide?

I once told you that most business decisions are made emotionally and justified rationally later, and I believe that this is a classic case of that, but more on that later … for now, let’s simplify this seemingly complex decision (competing offers of $350k then $500k then back to $350k again, against equity of 40% to 65% then back to 51%) into two sets of binary decisions:

Decision Point # 1: To give away equity or not to give away equity, that is the question?!

Rick Francis makes the ‘no equity’ argument quite well:

I wouldn’t have given the equity away- it sounded as if they didn’t really NEED the 350K to keep their business going. They have some big customers and are getting repeat orders. They want the $ for marketing, $350K will NOT make them a household word, and I doubt it would dramatically increase their sales. Their product is in major hotel chains THAT can be their main marketing. They could use the internet to make very targeted ads for a small fraction of $350K which they should be able to do as an operating expense.

And, in a strange twist, Scott actually helps to illustrate the reverse argument:

I wouldn’t give an ounce of equity away on this. You could read the sharks from the first 30 seconds that they were salivating over this. Even if it took me 5-6 more years to reinvest every penny I could into marketing and if I had to do everything I could to tell the world about that idea, including trying to land a spot on Oprah

You see, I think the equity / no equity decision boils down to time … without the Sharks’ help, can you get your business to the point where it will deliver your Number by your Date? If not, then with the Sharks’ help, can you reach your Number/Date?

That extra 5 to 6 years that Scott is talking about could be a killer … not to mention, the longer you wait the more chance there is of stronger competition raining on your parade.

That would be the driving force for the equity / no equity decision for me; while I would prefer to keep 100% of the equity (and control), do I need to compromise in order to win the main game, which is being able to finally live my Life’s Purpose within a reasonable period of time?

At least, that’s how I would look at it …

Decision Point # 2: How much of my soul do I sell?!

Once you’ve decided to sell (part of) your soul to the devil … or, in this case part of your company to the Sharks, it becomes a matter of how much to sell, and here, the trend is clear: our readers want to give away a minority stake. WJ was clear and succinct on this:

I would give away equity only to the point of still being in control.

Whereas, Trainee Investor sees both sides:

Either I would only give away minority equity on terms that left me with control and relatively limited fetters on my ability to run the company OR the investor would have to provide something more than just a monetary investment (such as the ability to significantly expand distribution in a manner which would otherwise have been beyond me).

Here’s how I look at it: the girls – in this case – reached decision point # 1 by deciding that they did wish to give away some equity in return for some benefit (cash and expertise/guidance from the Sharks), otherwise they would not be on the show.

So, now they need to decide what to give away and how much … and, this boils down to simple mathematics.

But, “wait” you say “surely you can’t give away control?”

And, I say: “you already have”

You see, as soon as you sign the shareholder’s agreement, you will find that your control over the company is no longer entirely yours, no matter what equity you still hold: 1% or 99%.

The shareholder’s agreement will be full of “by unanimous decision of the board”, and you can be sure that the Shark sits on that board!

I know, because I have been a 51% joint venture partner and a 40% joint venture partner and it made not an iota of difference … I still had a similar lack of effective control in both cases …

… I have even been a 100% owner and my clients and bankers still held the real control over my company. But, does it really matter all that much? Aren’t we all interested in making the company a success?!

‘Control’ is not all its cracked up to be 😉

So, if you are giving away control – and you will, trust me – just by entering into an agreement with an outside investor, then its time to start looking at what you get. In this case:

– $350k for 40% equity + Barbara’s guidance, OR

– $350k for 40% equity + finance/distribution/administration support for 11% equity + the guidance of 3 mega-millionaires.

To me the decision isn’t even close: once you’ve decided that 40% of your company is worth $350k then tell me where you can buy a complete operational and administrative infrastructure for your business (not to mention close a guaranteed line of funding) for less than 11% / 40% x $350k = $100k?

Folks, it’s the bargain of the century, but you have to be a Shark to see it 😉

BTW: remember that ’emotional v rational’ thing that I mentioned towards the beginning of this post? Instead of the simple math that I would have used to make the correct choice, Luis summed up exactly how they made their emotional choice:

Unbelievable! They made their decision on “I really like Barbara, like I really like her”. Barbara read them right “You got spunk” and at the end “…you are going to be happy”.

Unbelievable, indeed!

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …