While you are evaluating whether you can even afford to enter the WSOP this year [Hint: I don’t pay $10k to enter a poker tournament; but I don’t mind playing a few satellites to try and win a seat], consider what last year’s winners COULD have bought with their money: http://www.pokerlistings.com/blog/what-to-buy-with-wsop-main-event-moneyz

While you are evaluating whether you can even afford to enter the WSOP this year [Hint: I don’t pay $10k to enter a poker tournament; but I don’t mind playing a few satellites to try and win a seat], consider what last year’s winners COULD have bought with their money: http://www.pokerlistings.com/blog/what-to-buy-with-wsop-main-event-moneyz

Let’s say that you do beat 6485 ‘losers’ to make it to the Final Table of the Main Event (a.k.a. The November Nine), what do I suggest that you do with your winnings?

You finish 9th (pays ~ $1.2 million):

Firstly, you need to console yourself with being in the most embarassing position of having all of your friends, relatives, and hanger’s-on watching you bust out first by buying yourself a gift or two [AJC: I’m not suggesting that you buy the Chopard Super Ice Cube Watch!] …

… my usual Making Money 101 advice for those dealing with large amounts of ‘found money’ is to spend no more than 5% of your windfall [AJC: for this post, I am assuming that (a) you are not a professional poker player, and (b) the amount that you win is life-changing].

Now, before you go spending most/all of that ‘guilt free’ $60k on a car, realize that in a number of years it won’t be as new and exciting as it was when you bought it, and you may not be able to afford to replace it.

Why?

Well, the 5% Rule accounts for ALL of your possessions (incl. furniture, clothes, art, knick-knacks, guitars, consumer electronics, etc., etc.), not just your car … if you spend 5% of your entire net worth on a car now, you may have problems buying ‘other stuff’ later.

[AJC: Remember, the 5% Rule states that ALL of your possessions other than your house and investments must not account for more than 5% of your entire Net Worth at any point in time. In fact, a good rule of thumb is that your car/s should not be worth more than half your possessions – or 2.5% of your Net Worth – leaving plenty for other purchases]

So, buy a smaller (but, still nicer/newer) car, and a vacation, and some celebratory rounds of drinks with family – but, do NOT start paying off their debts and buying them stuff as you ain’t their ‘rich cousin’ even though $1.2 million may sound super-rich to them 😉

Now, how about the other 95%?

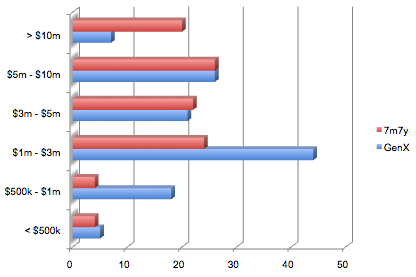

Well, if your Number is $1,140,000 then you get to retire!

But, if your Number is larger than that, then realize that what you have just earned is seed capital to reach your Number.

Think about it: $1,140,000 x 5% (which is regarded as a reasonably ‘safe’ withdrawal rate) = $57k a year to live off. Nice for some, but hardly a $7 million in 7 years lifestyle.

Keep your job, invest the entire $1,140,000 in something as motley as Index Funds, and you could double your capital in 10 years (assuming an 8% return). Put it into Real-Estate ($100k down, and $140k buffer against vacancies and repairs/maintenance) and you could end up with a lot more. Invest a portion in your next start up, and invest the rest (“just in case”), and you could be the next Bill Gates.

This advice probably also applies to the 8th ($1.3m), 7th ($1.4m), and 6th ($1.5m) place finishers …

Next week, I’ll tell you what to do if you finish 5th 🙂

Last week

Last week