There was a question on Quora that asked something along the lines of “what is the most overlooked factor in starting a business?”.

There was a question on Quora that asked something along the lines of “what is the most overlooked factor in starting a business?”.

This applies equally to an online or offline business … and, I was surprised that none of the responses mentioned it:

Risk

.

In order to launch a business, you need to be able to overlook risk.

Even though risk can be managed, if you sat down to think about all the possible things that could go wrong with your proposed business, well, you would never start it.

So, I think you need to be able to overlook risk – and, move well out of your comfort zone (unless you are already into extreme sports and other forms of death wish!) – if you are to think about starting a business that consumes considerable time and/or money (no ‘hobby businesses’ here).

Hopefully, this now paves the way for a sensible discussion around a rather controversial Wisebread article sharing Darwin’s thoughts on How to Start a Business With Your 401(k).

Darwin’s view is that, rather than taking on expensive debt, it may be better to start your business by withdrawing all or part of your 401k using “a little known, but increasingly popular provision in the tax code referred to as the Rollover as Business Startup (ROBS). It allows someone to start up a new business venture with funds from an old 401(k) account without incurring the dreaded early withdrawal penalties meant to deter people from using their 401(k) accounts like piggy banks.”

A sensible – negative – response is offered by one reader:

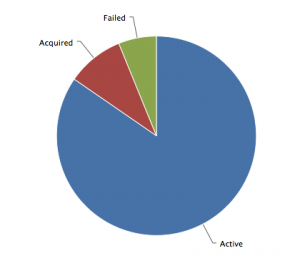

To avoid going into debt is a pretty bad reason to raid your 401(k). If your business fails you can always declare bankruptcy – bankruptcy can’t touch most 401(k)’s – you’ll still have your retirement savings…roll it over into the business instead, have it fail…and you’ll have nothing.

And, I agree – to a point: your 401(k), although woefully inadequate for its intended purpose (i.e. ensuring your retirement) is useful as an insurance policy when all else in your financial life goes wrong.

Cashing in your insurance policies because you need money is the last thing that you should do!

But, this viewpoint ignores some basic realities:

1. Going into business, for a true entrepreneur (the type that can build a $7m7y business) is a “must do”.

Starting my own business was all I could think of for 4 years (yes, I was slow to act), and risking everything (career, etc.) was simply par for the course. I’m not saying this is ‘right’, just that it’s how an entrepreneur thinks.

2. Raising significant debt finance is almost impossible for a new business.

Sure, you can (and should) tap out your sources of traditional finance: refinancing your house (if you’re not already upside down on your mortgage); max’ing out your credit cards; trying for a personal loan (fat chance once the bank manager finds out what it’s for).

I do not think cost of the debt is an issue (if it’s available TAKE IT because it’s deductible and you’ll pay it off if your business is successful). I do think access to debt is … I think you’ll find it’s just not available; at least, not in the amounts required if your business requires access to substantial capital (e.g. for shop fit-outs, software builds, stock purchases, etc.)

3. Equity Capital can be equally difficult

The first place you should go for funds for your new venture is the 4 F’s: Founders (see above), Family, Friends … and, Fools. These days, Fools are very hard to find (they’ve already had their pockets emptied in the crash!) and Family and Friends are less likely to dig into their pockets than ever before.

So, that may leave your 401(k).

If that’s the only source of funds for your new venture, what will you do?