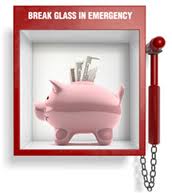

A couple of weeks ago, I shared my thoughts on how – and why – to set up an emergency fund with just $0. For a start, it doesn’t take much cash 😉

A couple of weeks ago, I shared my thoughts on how – and why – to set up an emergency fund with just $0. For a start, it doesn’t take much cash 😉

I suggested using a HELOC, or tapping your 401k in case of a true emergency. Some of our readers had other suggestions:

– Trainee Investor suggested selling stocks (they can be liquidated pretty quickly), or taking an unsecured overdraft.

– Evan suggested adding the “Cash value portion of a whole life insurance policy to the list. You can have the cash in your account within a day or two”

– Investor junkie says that you can avoid selling your stocks by taking a margin loan [AJC: just beware of the dreaded ‘margin call’ which can force you to sell your stocks – possibly at a loss – if there’s a drop in market price]

And, Yahoo Finance provides their view of the The Best (and Worst) Ways to Raise Fast Cash; check it out. Then let me know if you’ve changed tack with your own emergency fund, or if you still prefer to fund it with cash?