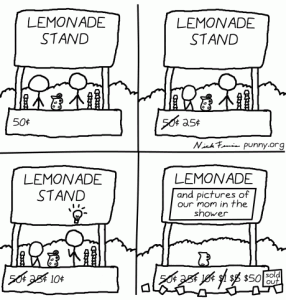

In my last post, I suggested that banks are profitable businesses because they have such a large mark-up. If they’re so great, my son asked, why don’t I simply plonk my cash into a safety deposit box and dole it out to willing borrowers like some kid with a lemonade stand?!

In my last post, I suggested that banks are profitable businesses because they have such a large mark-up. If they’re so great, my son asked, why don’t I simply plonk my cash into a safety deposit box and dole it out to willing borrowers like some kid with a lemonade stand?!

Why not, indeed?

The simple and obvious answer is risk, which the bank handles, I said to my son, with a combination of volume (to spread risk), people (to manage risk), and systems (to assess and ‘price’ risk).

However, Rick Francis offers perhaps a better-lemonade-stand-solution (?) … Peer-to-Peer Lending:

There is a fairly easy way to become the bank- peer to peer lending. It doesn’t remove the risk of default but does allow for diversification and there is a framework to asses the risk. They break loans into many small pieces that different individuals fund, so you don’t risk too much on any one loan.

Yep, P2P Lending certainly helps to address one of the banks’ three mechanisms for handling risk: you can spread your loans (the bank lend $400k many/many times over … you lend $40 many/many times over).

But, what about the experienced PEOPLE? It can take some time/trouble to sift through all of those loan apps listed on the leading P2P sites, as Jake points out:

P2P lending requires you to pick through hundreds of loan apps, and filter it to the set that you believe has the best risk / return ratio.

Then you have to diversify – invest in many loans so that a single default will not wipe you out. I think that you should invest no more than 1% of your portfolio into a given loan – so lets say you need to invest in at least 100 loans. Unfortunately, that requires you to pick through probably 1,000 applications hand-by-hand (you already discard the vast majority based on search criteria).

That’s frankly just too much work to be worth it, no?

it’s worth it for the bank, but probably not worth it for you and me (even though you can filter/sort the loan applications by various criteria) ‘just’ to get that 10% return that Rick has experienced …

And, we still haven’t addressed the risk management SYSTEMS that the bank applies, what does P2P offer there? Many sites, as Rick pointed out, offer some sort of FICO-based ranking, but banks rely on a lot more than that (for example, where’s that little thing called ‘collateral’?!) …

The only compensation for these last two (PEOPLE and SYSTEMS), that I can see, is that P2P borrowers may not want to default for a combination of:

– Getting locked out of the P2P sites … perhaps a similar mechanism to eBay’s Rating system is available?

– Perhaps it’s enough that P2P borrowers appreciate the opportunity that they have been given and don’t wish to abuse it by defaulting?

It is perhaps these two reasons that help to explain why micro-lending in 3rd world countries has such a low default rate?

But, it’s the simple logistics that Jake pointed out that put the kibosh on P2P for me …

Have you had any experience with P2P and would you use it again?