I often get comments from new readers asking where to start: so, I start from the premise that living frugally and working for 20 to 40 more years to retire on the equivalent of $15,000 today isn’t what you had in mind? If it is, then this blog isn’t for you 🙂

I often get comments from new readers asking where to start: so, I start from the premise that living frugally and working for 20 to 40 more years to retire on the equivalent of $15,000 today isn’t what you had in mind? If it is, then this blog isn’t for you 🙂

OK, so you’re still reading … great! In that case, the place to start is to work out what you want from your life and how much it will cost you to get it; here is a site that shows you how to work all of that out: http://www.shareyournumber.com/ Visit it (and, join the Community) … not only is this site totally free, I promise that it will be truly Life Changing.

Once you confirm that you do need to make $7 million in 7 years or $3 million in 10 years (or anywhere in between) then you’ll probably want some ‘quick start tips’; well, let’s start with your greatest expense: your house. This post – if you follow all the backlinks – will tell you all you need to know to make sure that your house actually HELPS you get rich(er) quick(er) instead of poorer: http://7million7years.com/2009/01/12/how-much-house-can-you-afford/.

And, if you’re struggling with questions around debt, then this post will totally change the way that you think about ‘good debt and bad debt’: http://7million7years.com/2009/03/25/debt-snowball-debt-shmowball-as-long-as-youre-rich/.

If you’re still with us after that, then sign up for e-mail updates and trawl through the site to see what you can find, just like this guy did …

_______________________

I’m glad that some people still rummage through my older posts, as the principles of money don’t age (reference the Richest Man In Babylon, for example) …

I’m glad that some people still rummage through my older posts, as the principles of money don’t age (reference the Richest Man In Babylon, for example) …

… so, I was pleased to have this opportunity to renew this discussion when John commented on this post about cars:

I know it has been over a year since you published this but I was wondering if you could comment on a few calculations I did after reading this post. My disagreement is mostly with the Finance Vs Cash option. The buying a used car part I totally get.

Let’s say I wanted to buy a car with an MSRP of 30,000. If I put 10% money down and get a loan of 27000 for 5 years at let’s say 5% APR. At the end of 5 years I will end up paying 33,571 for the car. If I had paid in cash I would have paid 30,000 for he car. The depreciation on the car would be the same in both cases. So I ended up paying 3,571 more for the car by choosing to finance it instead of paying cash.

But here’s the thing, by financing the car, I also ended up with 27,000 of cash which I can invest elsewhere. To recover the extra 3,571 that I’ll have to pay on interest for the loan, all I need to do is to put this 27,000 in an investment that can give me an APY of 2.52% only, which is not very difficult to find at all.

This suggests that buying with cash, even for a depreciating asset, does not make all that sense. Am I missing something here?

John is basically putting forward the idea of applying Cash Cascade principles to your car … and, given the parameters that he has set, John is absolutely right: it would be better to finance your car and invest the cash elsewhere …

… at least, in principle.

However, in practice, I’m not so sure that the Cash Cascade actually would suggest that you DO finance the car.

Here’s why:

Reason # 1 : It’s unlikely that you will see 5% APR on a auto loan

5% APR car loans are not unheard of, but they are relatively rare; MSN Money cites the current national averages for auto loans as:

| National Averages: |

Low – 3.99% |

Average – 6.18% |

High – 10.49% |

So, while auto loans as low as roughly 4% (an internet only ‘special’) are available, most are in the 6% – 10% range; and, don’t forget to factor in any added fees!

Of course, you MAY be able to take a 5% HELOC on your house to raise the cash for the car, but I wouldn’t recommend a short-term loan (i.e. a HELOC) for a long-term use (i.e. financing your car over 2 to 5 years) because the bank can change the terms – or even cancel your HELOC – whenever they feel like it. Then you might be stuck with getting a more conventional loan at a higher rate (there goes your 5% loan!).

On the other hand, a refi may do the trick … but, you need to watch both the 25% Income Rule and the closing/refi costs, which are likely to push you well over the 5% if amortized over the expected life of the car loan (you’d be crazy not to have a 2 to 5 year loan payback expectation).

Reason # 2 : It’s likely that you can beat a 5% APR auto loan

This seems to contradict Reason # 1, but doesn’t …

… you see, if you do find a 5% APR loan, it will most likely be offered by an auto dealer. However, the chances are that it comes with a catch: the car isn’t discounted as much as it could be!

A low (or even zero) APR loan is a very common manufacturer / importer / dealer incentive … but, they do a deal with their finance company (often manufacturer-owned, like GMAC) whereby they pay the differential interest rate for you and up front. Back to the catch: they load the price of the car to offset the pre-paid interest component. Sneaky, huh?

Reason # 3 : Even if you can’t beat the 5% APR auto loan you’d better have the cash ready

But, let’s assume that you go to the Pentagon Federal Credit Union for the only 4% APR rate that I could find that wasn’t loaded with fees, and they do give you the loan …

… you had better have the cash ready to buy an investment reasonably quickly.

If you don’t have already have the cash saved up then you should be prepared to save up until you have the lump-sum cash then decide if you want the car only or both the car and the investment. No point borrowing money for the car and trying to save up for an investment … unless, you really, really, really need the car right now! 🙂

… oh, and if you’ve read all the way to here, then you might want see what my 7 Millionaires … In Training! are up to; kind of like American Idol Meets The Apprentice …except it’s online 🙂

Warning

Warning Smart Money Daily

Smart Money Daily

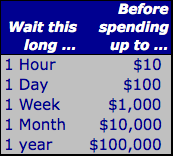

Well, when the ML Mercedes first came out, I simply HAD to have one of those [squeal] little SUV’s that drives like a car … after some self-imposed ‘time out’, I decided that I really didn’t need the car right now.

Well, when the ML Mercedes first came out, I simply HAD to have one of those [squeal] little SUV’s that drives like a car … after some self-imposed ‘time out’, I decided that I really didn’t need the car right now.

I’m glad that some people still rummage through my

I’m glad that some people still rummage through my