If you’re not ‘twittering’, you’re missing out …

If you’re not ‘twittering’, you’re missing out …

I always thought that Twitter was about “just got back from the dentist and he said “no cavities” … whoohoo!” or just about advertising your latest post. Well, it is both of those things … but, not anywhere near as much as it used to be. At least when it comes to ‘following’ (a Twitter term) personal finance writers.

Now, it seems to be more about genuine subject-matter-related info in small bites, as well as saying “hey, I saw this cool article on …”.

Now, that’s useful – even to me – and it will be very useful to you.

If you like, you can start by following me at http://twitter.com/7million7years … I promise that it will never (OK, hardly ever) be mundane 😉

______________________________

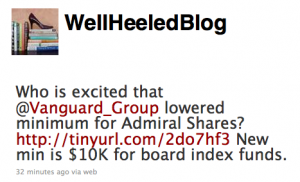

Which brings me to a recent tweet from WellHeeledBlog, whom I’ve just started following:

According to Meriam Webster’s online dictionary, ‘well-heeled’ means: having plenty of money.

My question is: if you are well-heeled why do you even care that Vanguard Group lowered the minimum entry level for Admiral Shares? Of course, WellHeeledBlog may not care, but thinks that some of their readers may and is, therefore, providing a useful reader service.

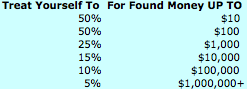

My point – because I like and follow WellHeeledBlog and will continue to do so – is that I don’t care and neither should my readers … long-term. Many of you may care – today (perhaps, because you are only starting on your path to wealth) – but, long-term you should not care, simply because these sorts of money tips will not make you rich.

My blogging – and, twittering – niche is to take my readers to $7 million in 7 years (or some other Large Number / Soon Date).

On the other hand, I started $30k in debt and so will many of my readers. So, this type of money-saving info is useful in the beginning of your financial journey … but, not for long – and, not for the important parts of your financial journey.

Fortunately, that’s where I step in …

You see, this sort of ‘beginner’ financial info is available everywhere, and I don’t see the point of simply rehashing stuff that you can find elsewhere.

If you do need this kind of entry-level personal financial advice, go elsewhere, find the info you need, save money, and get yourself (partially) out of debt, then come back here to find the reality of how to get rich.

That’s my niche, and I hope you are finding it as enjoyable/useful to read as I am in writing it? 🙂