Just as a young man’s fancy turns to you-know-what when spring is in the air, this not-so-young investor’s fancy turns to real-estate as soon as he arrives back in the home country.

Just as a young man’s fancy turns to you-know-what when spring is in the air, this not-so-young investor’s fancy turns to real-estate as soon as he arrives back in the home country.

But, I am 5 years out of touch as to values; not to mention, I have grown accustomed to values in ‘per square feet’ and Australia is all metric: ‘per square meter’ rules the day …

… what to do, what to do?

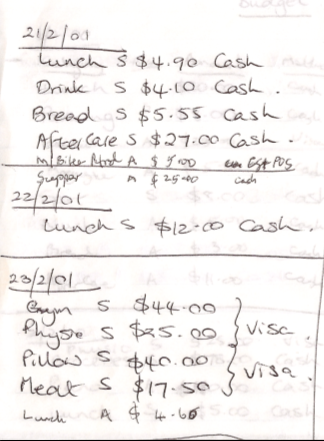

Take a look at the scanned image; it’s really my hand-writing; I submit this near-illegible, piece of potential embarrassment for two reasons:

a) Bad handwriting is a sign of intelligence – ever looked at an old-fashioned, handwritten doctor’s prescription? And,

b) It proves that I really do this stuff that I’m telling you about. It works!

You see, the funny squiggles on the scanned image told me all that I needed to know about commercial real-estate values in the Melbourne inner-city suburb of South Melbourne [AJC: unlike many major US cities, the ‘south side’ of Melbourne is not dangerous … it’s ‘chic’] in less than half an hour, here’s how:

Assessing Rental Values

I visited an on-line commercial real-estate site [AJC: this won’t work for residential; but, it will work for larger multifamily, as well as offices, warehouses, etc.]; in the US I use loopnet.com and in Australia I use sites like realestate.com.au

I then scrolled through listings of my target property types (in this case, offices) in the area of my choice (in this case, South Melbourne) and listed Properties for Rent – two columns:

Column A: size of building (i.e. rentable area);

Column B: annual rent

I then entered the same figures into a spreadsheet and graphed the two columns as a line chart; here’s the actual one that I produced for South Melbourne:

This simple graph shows the size of the properties that I was looking at along the bottom (Column A along the X-axis) and the annual rent being offered up the side (Column B up the Y-axis) … and, it tells me an awful lot:

– The smaller the property, the larger the (relative) rent

– The average rent is $249 and the median is $306 (both easy to calculate using the built-in tools in the spreadsheet)

But, you can really see what is happening on a graph like this – something that you would probably miss entirely if you were just scrolling through listings – there seems to be two separate rental markets: one around the $200 per square meter price point, and another one around $300 psm.

Now, if I was really looking to rent (I’m not; I’m a buyer), and if I was looking to rent a space around the 500 square meter size range, I’d be asking to inspect the three properties around the $200 per square meter price point first, then I’d start working my way up. I might also look at a couple around $300 to see if there is a quality difference … I’m betting ‘no’.

Assessing Purchase Values

Using the same on-line commercial real-estate site, I then scrolled through the ‘for sale’ listings of my target property type and again listed Properties for Sale as two columns:

Column A: size of building (i.e. rentable area);

Column B: sale price

As before. I entered the same figures into a spreadsheet and graphed the two columns as a line chart (again, for South Melbourne):

This graph – similar to the first – shows the size of the properties that I was looking at along the bottom (Column A along the X-axis) and the sale price being asked up the side (Column B up the Y-axis) … even though there’s usually fewer ‘for sale’ than ‘for rent’ listings, it tells me even more:

– The smaller the property, the larger the (relative) sale price

– The average sale price being asked is $4,600 per square meter (sounds like a lot – and, it is … prices are high in Melbourne – but you can just divide by about 11 to see the price per square foot) easy to calculate using the built-in tools in the spreadsheet).

More importantly, at least for the smaller properties on offer, there are two distinct price points: $6,000 psm and $3k – $4k psm … now, you can divide the list into Class A office space and Class B/C if you have enough listings, because that will probably explain such a large difference. And, there’s nothing like a quick ‘drive by’ or two to confirm.

Since I’m looking for 400 square meters, for a co-working project that I am looking at, this is telling me pretty quickly that if i can find a decent office in that size range for $1+ million, I might be onto a bargain … and, that’s something that I just love 🙂

Oh, by comparing the average rents to the average sale price (and confirming with a few listings where both a rental price and sale price are offered – which happens more often than you may think), I get a quick indication of current cap. rates: around 6.2% in Melbourne … I must have rocks in my head even thinking about investing here!

At the very least, by doing this exercise, I have very quickly and easily laid the groundwork for a sensible discussion with a local Realtor …

BTW: If the properties in your area vary by class (eg Class A, B, C) and by types of leases offered (eg Triple Net for some, but not for others) then you may want to graph these separately … but, start on one graph and see what that shows you.

We all know the

We all know the  Q: How do you eat an elephant?

Q: How do you eat an elephant?

The blogoshpere is alive with posts that trumpet that Suze Orman has changed her financial advice .. some of it inspired by this excellent article from

The blogoshpere is alive with posts that trumpet that Suze Orman has changed her financial advice .. some of it inspired by this excellent article from  … who knows?

… who knows?