Welcome Budgets Are Sexy readers!

Today’s post is a pretty good place to start, if you are interested in finding out a little more about how I like to think about personal finance …

And, for my regular readers, head on over to Budgets Are Sexy’s blog and read my provocatively titled guest post (“Why Most Personal Finance Blogs Are B.S.”). The blog’s editor asked me to write something “feisty” and, judging by the comments, I think I did just that 😉

Don’t be afraid to leave a comment on that site (or here, if you prefer) to let me know what you think?

__________________

“How much interest can I earn on $1 million?”

This is the question, if I am to believe the google search statistics, that I am being asked more often than any other …

And, the answer is very simple: if you keep $1 million in the bank, earning about 1% on a CD, you’ll have $10,000 a year in interest. Given that inflation is running at two or three times that, you are running a (very) losing race.

So, the bigger question that you should be asking is: Why do you even care how much interest you can earn on $1 million?

$1 million today, if it’s to last your lifetime, probably only replaces a $35k income (in today’s dollars). It could produce more, but if you don’t know how to make more money than $1 million in your lifetime, you’ll never know how to actively invest it for higher returns.

So, I’m guessing that what you really want is to know how much interest you can earn on $3 mill. – $10 mill. today, or even more.

What you should be asking is:

1. How much income do I want to generate without working (I’m guessing $100k – $350k p.a.)?

2. Multiply 1. by 20 (my rough Rule of Thumb for an active investor) to get your Number (likely to be in the $2m – $10m range)

3. When do I need to reach my Number (probably 5 to 10 years. Any less and you’re dreaming; any longer and you don’t really have what it takes)?

4. Then you need to spend some time with an online annual compound growth rate calculator to work out what annual % return you need to be generating to get there, on time (3.) and on budget (2.).

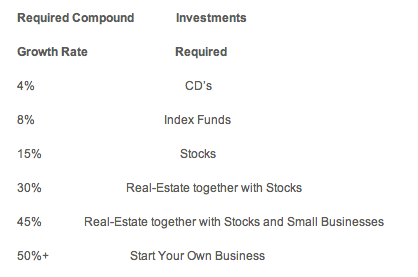

Then, use this handy table to work out what sort of things you should be learning about and investing in to get that sort of return:

Now, these returns aren’t what you get ‘off the shelf’ … rather, they require hard work (plus the kind of education that you get from this blog), but they are achieveable (after all, that’s how I made $7 million in just 7 years, starting $30k in debt).

How much do you think you need to earn passively to be happy, and when do you think you need it?

You could go to Kiva, and use it to support businesses in struggling economies and get 16%, whilst feeling good about supporting a good cause!

@ Ashton – A growing sector, but I’m not a huge fan of P2P lending (as an investment):

http://7million7years.com/2010/01/13/peer-to-peer-lending-a-7m7y-tool/

You do not make any interest by lending on Kiva. Kiva is a platform for supporting entrepreneurs in emerging countries and you donate your contributions. You can make interest by lending on Lending Club or Prosper.

@ Rohit – You are correct, and thanks for the clarification.

To be clear, I don’t support P2P lending for the reasons that I state above and elsewhere on this site [ e.g. http://7million7years.com/2011/03/17/the-problem-with-p2p-lending/ ] but, I do support charitable giving / support ESPECIALLY micro-lending or giving for business purposes in disadvantaged communities (e.g. via Kiva or others) – where you either do not, or do not EXPECT, a return of any kind – as you are giving people a fishing rod (rather than just donating fish) … to use an old analogy 🙂