The first part of the $7million7year Formula For Wealth is pretty simple, therefore so is its application:

Where (W)ealth is a function of (C)apital and (T)ime

It’s pretty useful for teaching your children to save part of their allowance; other than that, you need more help than I can give you if you still don’t know that you should be investing at least some of your money (i.e. capital) 😉

But, what about a more difficult questions? Like deciding whether or not you should pay off your mortgage early?

Dave Ramsey would suggest that you pay off your mortgage NOW and INVEST (presumably, once those funds are no longer required in order to pay off your mortgage) LATER.

According to the base formula, you are still putting your money into an asset (hence, creating Capital), and allowing that to sit for a long time, which has to be a good thing, right?

Of course it’s better than spending the money – perhaps literally eating your capital (fine dining, anyone?) …

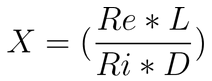

… but, is it optimal from a wealth-building perspective? For that, you need to turn to the third part of the formula – the X-Factor:

The two sub-sections of this part of the equation simply suggest that (Re)ward is offset by (Ri)sk; you have to rely on other studies (or common sense) to realize that Risk and Reward are related: as you increase Reward, so – to a greater/lesser degree, depending where you are on the Risk/Reward curve – so do you increase Risk.

In other words, Risk is a dampener for Reward – otherwise, we’d be traveling to work by jumping out of planes and playing the options market, as a matter of course!

But, the same cannot be said for (L)everage and (D)rag …

Leverage is the ‘big secret’ of building wealth: increase leverage and you MULTIPLY your wealth.

Using other people’s money is one way to increase leverage … but, by paying off your home mortgage, you are DECREASING leverage!

According to the formula, that’s bad 😉

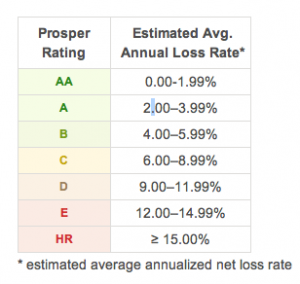

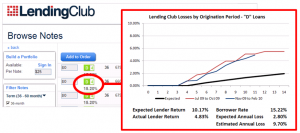

Interestingly, Peer to Peer lending also fails the leverage test.

You see, peer to peer lending, mortgage ‘wraps’, and other products where you are financing other people, reduces your Capital and increases their Leverage … the polar opposite of what you should be doing!

So, why do banks lend money, potentially reducing their leverage?

Simple!

They’re not lending their money; they are borrowing money as well. They are leveraged to the full extent allowed by their law and their board of directors.

Which brings us back to risk:

As the banks proved before the financial crisis, applying too much leverage can be bad for your financial health.

What about risk and your home mortgage?

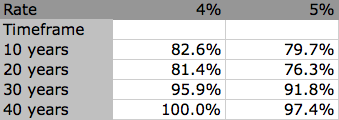

The argument often cited for paying down your home mortgage is one of decreasing risk. Yet, if you intend to live in the house for some extended period of time how is your risk increased / decreased by paying down debt?

How have you applied leverage to improve your wealth?