Marie (speaker, blogger, investor) agrees with my simple plan for wealth creation:

Marie (speaker, blogger, investor) agrees with my simple plan for wealth creation:

I have to go with your 2 step plan. All my years in PF it seem to work best than the cookie cutter approach.

The ‘cookie cutter’ approach that Marie refers to are the approaches that I was talking about in my provocatively titled guest post at Budgets Are $exy: “Why Most Personal Finance Blogs Are B.S.“, and includes: paying off all debt; maintaining an emergency fund; frugality and expense-cutting; paying yourself first via max’ing out your 401k; and, so on.

[AJC: To be fair, I was asked to write something ‘feisty’ so you should head on over and read the article (and the comments) now …]

To prove any personal finance strategy you need to have an objective against which you must measure the outcome.

To me, that goal must be: financial freedom.

But, what does ‘financial freedom’ mean?

That depends entirely on you …

If your goal is to simply replace your income, say, within 20 years, and you can train yourself – through frugality – to live on a lower income than your peers then it is possible to save your way to wealth (simply defined as financial freedom, or having enough passive income to replace your then-current income from employment).

For example, MB writes about her 12 year plan to replacing her and her husband’s dual working income:

After a couple years of full-time work I started to wonder, how can anyone possibly tolerate doing this for 40 whole years?!

[Now] our number is somewhere in the $1-2M range depending on how many kids we end up having (if any). But, then again, we are saving >50% of our salaries.

By ‘training’ themselves to live on only 50% of their salaries – or 1/4 to a 1/2 less than their peers – MB and her husband accomplish two purposes:

1. They save a lot more than most people,

2. They live on a lot less than most people

So … they need a much smaller Number than most people and they’ll be able to reach that number much, much sooner than most people.

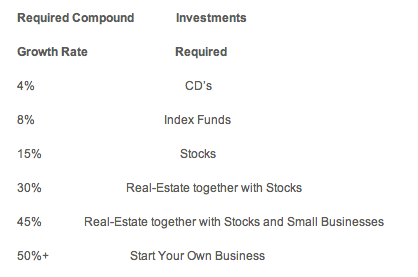

According to my calculations, if you start off earning, say, a combined $50k p.a. and are prepared to live off just $25k of that (assuming your combined salaries increase by 3% per year, and you get a very hefty 8% after-tax return on your savings) you will be able to retire on a combined $40k passive income in not the 12 years that MB is hoping for, but a still-healthy 17 years time.

The catch is that just 4% inflation would mean that you really have the earning power of a little less than $25k p.a. today.

In other words, to actually make this cookie cutter personal finance plan work, you need to be debt-free and be able to live on just half your current annual income for your whole life.

Is this you?

If not, I recommend that you spend a little time with an online retirement savings calculator and work out what income you would need in today’s dollars (i.e. assume you retire today) …

… then, leave a comment and – in my next post – I’ll explain what that means and what you need to do to get there.