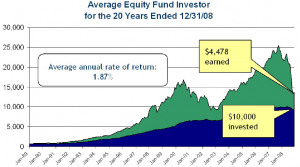

I have postulated before on the $5m5y Phenomenon: why is it that 80% of lottery winners, winning absolutely life-changing amounts such as $5 million (all the way up to $150 million) lose 100% of their winnings within 5 years?

I have postulated before on the $5m5y Phenomenon: why is it that 80% of lottery winners, winning absolutely life-changing amounts such as $5 million (all the way up to $150 million) lose 100% of their winnings within 5 years?

Think about it, it’s a staggering amount of money: how would you even go about spending $1m+ a year for 5 years, starting from an almost zero spending base?

Jake hits the nail on the head for at least one of those reasons:

When you hit your number or are well on your way toward it, how do you deal with family that are not making progress to their number (or likely ever will get there).

Specifically, how do you keep a cordial relationship – i.e avoiding acting like a heartless a-hole but also avoiding being the family patsy / sucker who pays for everything.

If you are making good progress toward your number, you are likely very hard working, talented and lucky. Chances are that family members lagging behind are lacking one or more of those traits, often the one associated with hard work.

Yes, after the houses, boats, vacations, girl/boy friends, and Ferraris come the financial-vacuum-cleaning carpet snakes:

Your friends and relatives 😉

Having had [AJC: too much] personal experience dealing with exactly this type of issue, let me try and give you some random pointers, which you will need as your journey progresses:

Stage 1 – When you are still on your journey towards your Number

– Lie about your financial circumstances; the corollary is to keep your spending under control, which has the side benefit of actually helping you to reach your Number

– Complain about everything: business is bad, your investments aren’t doing as well as you hoped, and so on

– Take a preemptive step: actually try and borrow money from those most likely to put the hard word on you [AJC: don’t try too hard though, you don’t actually want to owe your relatives anything]

Stage 2 – Just as you reach Number

– OK, it might be difficult to hide behind a veil of poverty (unless you are some sort of miser); so, you will need to rely on the old “can’t confirm/deny anything” … this is best done by attitude rather than words: in other words, when one of your friends says “Frank’s really loaded now”, just smile wryly or – if you have to say something – try “don’t believe everything you hear”

– You could still try and borrow money from your relatives to “help pay some back taxes that I owe … nothing serious”; this works best if you also put a For Sale sign on your Ferrari.

– At least try and keep your post-windfall spending spree in check; and, it’s likely – if you’ve been following the advice on this blog – that your Lifestyle isn’t going to to take a big jump, rather you will not have to work to maintain it.

Stage 3 – Making Money 301

You have your Number, but you forgot to build into your chosen lifestyle a certain amount for ‘paying off the friends and relatives’ [AJC: if you’re still calculating your Number, now’s your chance to put something in there], what to do?

– You will have no choice but to do certain ‘good deeds of kindness’; for example, we paid for two tickets for family members to fly to the US to see us. We flew them coach, provided no spending money, looked after them generously while they were with us (we paid for all meals, etc.), but they were grateful.

– Keep these ‘acts of generosity’ few and far between, or they will be soon seen as ‘rights’ and you will end up wearing all the cost with none of the benefit.

– Simply accept it as a ‘cost of doing [family] business’ that you will be the one footing the bill at all family events; we find ‘prior engagements’ for as many of those family functions as possible: out of sight, out of our pocket.

– Give 30% to 50% (only for family … friends get no more from you than anybody else) more generously for gifts than others; it will be expected and there’s not much you can do.

– Ditto for tips; if they know who you are, you had better be a little more generous if you want to avoid your food being spat in.

– Listen politely but offer little when friends and relatives come asking you for ‘advice’ … they are really sounding you out to ask you for money (they will call it a ‘loan’, but you know it for what it really is); your only protection is preemptive (see above).

– You are far better off to be seen doing ‘good works’ and giving to charity; the aim is to be seen as a good role model and something that your good-for-nothing-freeloading-ex-friends-and-still-relatives can aspire to when they make their own money.

Just remember, unless you built a huge Charity Case Buffer into the calculation of your Number, you have no choice but to let your friends/relatives do the right thing and work on their own Numbers … unless, you no longer want to be able to live your own Life Purpose?! 😉