I fly kites and I stack tins. But, I mainly fly kites. And, it’s all because I understand the true value of money.

I fly kites and I stack tins. But, I mainly fly kites. And, it’s all because I understand the true value of money.

Do you? Let’s find out …

The money that you save has a value today and a value in the future.

Aside from money that you save as a short-term buffer against emergencies, or to pay for a trip or other expense coming up soon, the real value of money that you save today is the value that it can provide tomorrow.

But, the ‘tomorrow’ that I am talking about is the one that comes on the day that you decide to begin Life After Work. Some call this retirement; others call it semi-retirement; I call it early retirement … but, that’s really up to you.

So, a dollar today is exactly that: One Today Dollar.

But, in the future, two things happen to that dollar:

1. Inflation erodes it – robbing it of roughly half its value every 20 years, and

2. Investment returns grows it – increasing it according to the annual compound growth rate of that asset class.

With inflation pulling one way (down), you need to find an investment that moves the value of your savings the other way (up); how fast you need to move depends on (a) how much money you need (your Number) and (b) when you need it (your Date).

So, how fast do different types of investments grow?

Well, according to Michael Masterson in his book Seven Years To Seven Figures:

[AJC: The greater the returns – that is, the lower down the table – the more ‘actively’ this table assumes you will manage the asset e.g. you may only be able to achieve 15% returns on stocks if you follow a system such as Rule #1 Investing. And, without active management – e.g. rehab’ing, flipping; leveraging; etc. – real-estate may only keep pace with inflation]

That’s why the Future Value of $1 could be $100, in just 10 years, if you invest it in a business.

But, that same $1 could be worth only $1.45 in 10 years, if left in CD’s. Now, that’s before inflation …

If inflation runs at its historical average of 4% $1 is only worth $1 in 10 years, 20 years, or 40 years!

So, when Brooke says:

create the proper mindset. then its time to move on to more advanced lessons.

I whole-heartedly agree.

EXCEPT that the “proper mindset” that she – and most others – talk about is saving, paying off debt, saving, living frugally, and … saving.

Which is great, if you value every Today Dollar exactly the same as a Future Dollar.

But, I don’t.

And, neither should you … and, here’s why:

The very first thing that you should do when you are thinking about saving is think about:

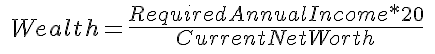

How many Future Dollars do you need, when you stop work / retire?

I’m guessing that Number’s at least 20 to 40 times your current expenses, doubled for every 20 years that you are prepared to wait.

[AJC: Ironically, the less you are willing to risk to grow each Future Dollar now, the higher the multiple that you will need e.g. if you are content to keep your savings in mutual funds, then you will need closer to 40 times your current expenses, doubled for every 20 years that you are prepared to wait. If you are prepared to actively invest in some mixture of stocks, real-estate, and/or businesses, then you may only need 20 times]

How much is that for you?

I’m guessing it’s much more that you previously thought.

Now, what has any of this got to do with either flying kites or stacking tins?!

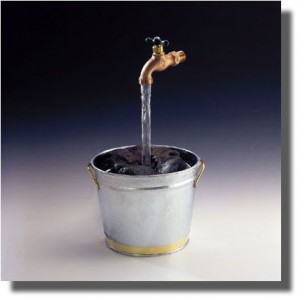

Well, when you save, is it going to be so that you can line each Today Dollar that you collect by saving into a nice Today Dollar Tin with all of the others that you get, until you have enough to oil, salt and close … putting it away, with all the other tins that you collect in your working life until – in 20 or 40 years time – you pull all of those tins out of the Tin Storage Bank, dust them off, and find …

Well, when you save, is it going to be so that you can line each Today Dollar that you collect by saving into a nice Today Dollar Tin with all of the others that you get, until you have enough to oil, salt and close … putting it away, with all the other tins that you collect in your working life until – in 20 or 40 years time – you pull all of those tins out of the Tin Storage Bank, dust them off, and find …

… exactly as many Future Dollars as you had Today Dollars, no more no less, and not enough?

Or, will you take each Today Dollar, and when you have enough, make a Future Dollar Kite (it can be a Business Kite, Real-Estate Kite, or possibly a Stock Kite) and let it soar?

And, if it crashes – when it crashes, because of storms and, well, kite-flying whilst you are learning is risky – will you then take a few more of your Today Dollars and make another, and another …

… until one flies, with each Today Dollar used in making it becoming 100 Future Dollars?

[AJC: Most likely, you will also be putting aside a few Today Dollar Tins of your own, for a rainy day – since it need not take many to make a few Kites, and you may as well save something whilst you are at it]

Tin Stacker or Kite Flyer? Which one you choose is up to you …

But, I must warn you – even though most of you are tin-stackers by nature, therefore, should not be surprised when your Future Dollar stock is well short of what I would consider a ‘nice retirement’ – I write solely for the kite-flyers out there!